From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market: Tariffs Impacted by Plant Activity Increase, Procurement Strategies Advised

North America’s steel market faces uncertainty due to rising US tariffs, as highlighted in “IREPAS: Uncertainty in the global long position market has increased after the increase in tariffs in the United States“. While this news points towards potential disruption, satellite data reveals mostly stable or increasing plant activity across North America, but with distinct regional variation, creating potential procurement opportunities.

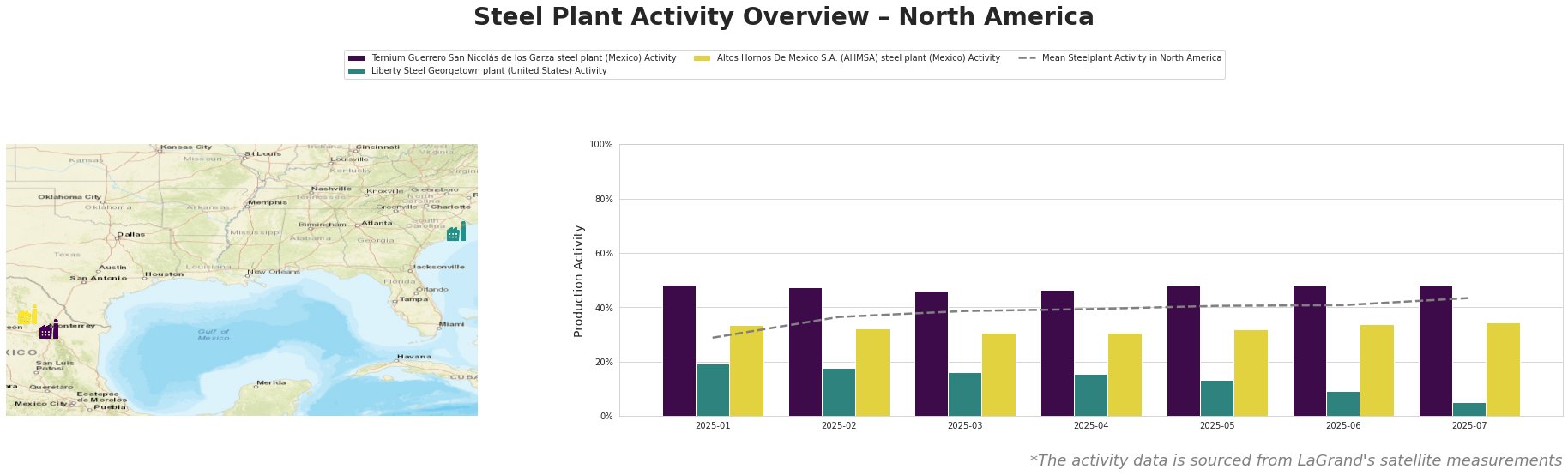

Here is the table of monthly activity for North America:

The mean steel plant activity in North America has steadily increased from 29.0% in January to 43.0% in July. This overall positive trend suggests a generally robust market. However, individual plant activity varies significantly. Ternium Guerrero consistently operates above the mean, while Liberty Steel Georgetown shows a concerning downward trend. Altos Hornos de Mexico S.A. (AHMSA) operates near the mean, with some fluctuations. The news “Stocks Set to Open Lower as Trump Ratchets Up Tariff Threats, U.S. Inflation Data and Big Bank Earnings Awaited” and “Stock Index Futures Climb on Nvidia Boost Ahead of U.S. Inflation Data and Big Bank Earnings” highlight the broader economic context, including tariff concerns and inflation pressures, but do not directly correlate with the individual plant activities observed.

The Ternium Guerrero San Nicolás de los Garza steel plant in Nuevo León, Mexico, an integrated (DRI) facility with a capacity of 2.4 million tonnes per annum (ttpa) of crude steel, consistently maintained activity above the North American average, fluctuating narrowly between 46% and 48% from March through July. Its production focuses on semi-finished and finished rolled products like hot- and cold-rolled coils and tubes, serving the building and infrastructure sectors. The steady activity, especially given its reliance on DRI and EAF technologies, potentially positions Ternium Guerrero as a reliable supplier despite tariff uncertainties.

The Liberty Steel Georgetown plant in South Carolina, a smaller EAF-based plant with a crude steel capacity of 908 ttpa, presents a contrasting picture. Its activity has declined steadily from 19% in January to a concerning 5% in July. This drop raises concerns about potential supply disruptions, particularly for its key products like billet, industrial wire, and wire rod, used in the automotive and construction sectors. There is no explicitly established connection between this decline and the news articles provided.

The Altos Hornos De Mexico S.A. (AHMSA) steel plant in Coahuila, Mexico, with a large crude steel capacity of 5.5 million ttpa, uses both BF/BOF and EAF technologies. Its activity levels have remained relatively stable, fluctuating between 31% and 35% from March to July. AHMSA produces a wide range of flat and long products, serving sectors like building, infrastructure, and steel packaging. Its relatively stable activity might offer some supply stability, but the facility is still running below capacity. No direct link to the news articles is evident.

Based on the observed plant activity and the news regarding tariffs, the following procurement actions are recommended:

- Steel Buyers: Given the significant activity drop at Liberty Steel Georgetown (US), immediately evaluate alternative suppliers for wire rod and billet. Consider shifting procurement towards Ternium Guerrero (Mexico) for hot- and cold-rolled coils as a potentially more stable supply source. The IREPAS article highlights the uncertainty caused by tariffs; therefore, securing supply from plants operating at high capacity is crucial.

- Market Analysts: Closely monitor Liberty Steel Georgetown’s activity in the coming weeks. A continued decline could signal significant production issues and warrant a re-evaluation of supply chain risk assessments. Compare spot prices for wire rod and billet in the Georgetown area with prices from alternative suppliers to quantify potential tariff-related cost increases. Further investigate potential capacity reduction in Georgetown, and publish a risk assessment.