From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Shows Strong Activity Amid Tata’s UK Green Steel Investments

Ukraine’s steel market demonstrates positive momentum, with increasing plant activity observed across key producers. While no direct link can be established between this activity and the UK-based initiatives, news articles like “Tata Steel UK Celebrates New EAF Groundbreaking” and “Tata’s green transformation begins today” signal a broader industry shift towards low-carbon steel production, potentially influencing future demand and supply dynamics.

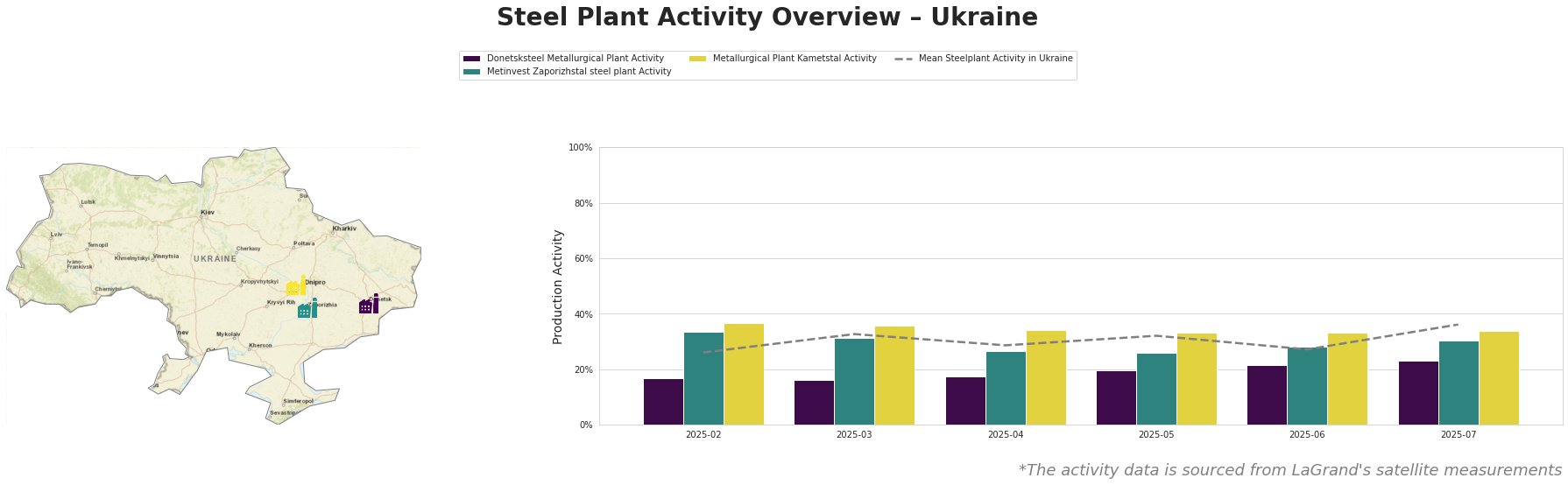

Monthly aggregated activities in % (0% = lowest ever measured, 100% = all time high):

The mean steel plant activity in Ukraine reached 36.0% in July, marking the highest level in the observed period. Donetsksteel Metallurgical Plant shows the lowest activity levels of the plants, but also the biggest monthly rise of 1% over the same period. Metinvest Zaporizhstal steel plant activity peaked at 33.0% in February, followed by a subsequent decrease and gradual recovery to 30.0% in July. Metallurgical Plant Kametstal exhibited the most stable activity, hovering between 33.0% and 37.0% throughout the observed months.

Donetsksteel Metallurgical Plant

Donetsksteel, located in Donetsk, primarily produces pig iron using BF and EAF technologies, with a BF iron capacity of 1500 ttpa. Despite ResponsibleSteelCertification, its activity has been consistently below the national average, reaching 23.0% in July after a low of 16% in March. No direct connection can be established between Donetsksteel’s activity levels and the developments outlined in the provided news articles regarding Tata Steel UK’s investments in EAF technology.

Metinvest Zaporizhstal steel plant

Metinvest Zaporizhstal, situated in Zaporizhzhia, is an integrated BF-OHF plant with a crude steel capacity of 4100 ttpa, specializing in finished rolled products like hot-rolled and cold-rolled sheets. While also ResponsibleSteelCertified, its activity has fluctuated, reaching 30.0% in July. The plant’s product range targeting the automotive and packaging sectors could benefit from the research into low-carbon automotive steel, as reported in “Tata Steel UK launches research initiative to develop AI-driven low-carbon auto steel“, although no direct impact can be confirmed yet.

Metallurgical Plant Kametstal

Kametstal, based in Dnipropetrovsk, is an integrated BF-BOF plant with a crude steel capacity of 4200 ttpa, producing semi-finished and finished rolled products, including billets, wire rods, and rails. It maintains ISO14001 certification. Its activity has remained relatively stable, reaching 34.0% in July. As the plant uses BOF technology, no immediate impact from the EAF technology highlighted in “Tata Steel UK Celebrates New EAF Groundbreaking” is anticipated.

Evaluated Market Implications

The satellite data indicates robust activity levels at Ukrainian steel plants, yet no news articles relate to the plants directly. The provided news focuses on Tata Steel’s UK operations, highlighting a global trend towards low-carbon steel production using EAF technology.

Recommended Procurement Actions:

- Monitor technological shifts: Steel buyers should closely monitor the progress of EAF technology adoption globally, as highlighted by the news articles on Tata Steel UK. While these developments are not directly impacting Ukrainian steel production currently, they signal a future shift in the availability and demand for low-carbon steel.

- Engage suppliers: Steel buyers should initiate discussions with their Ukrainian suppliers, particularly Metinvest Zaporizhstal due to their product focus. Inquire about their plans to adopt EAF technology or other methods to reduce carbon emissions. This engagement can help buyers anticipate future supply chain adjustments and ensure access to increasingly demanded low-carbon steel options.

- Assess supply chain vulnerability: Buyers relying on Donetsksteel should develop contingency plans due to its consistently lower activity levels.