From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market: HRC Prices Rise Amidst Stainless Steel Slump & Summer Slowdown

European steel markets present a mixed picture as summer lull impacts liquidity and pricing. Recent shifts in HRC and stainless steel prices are juxtaposed against stable plate and slab markets, while plant activity data reveals varied production trends. The price increase in the “Prices are rising in the European HRC market amid a lull” article contrasts with the falling prices reported in “Stainless steel prices in Europe continue to fall amid summer lull“, highlighting diverging dynamics across different steel product categories. A relationship between news articles reporting of reduced spot liquidity can be expected to be related to satellite data on plant activity due to decreased production, although there is no one-to-one quantifiable relationship.

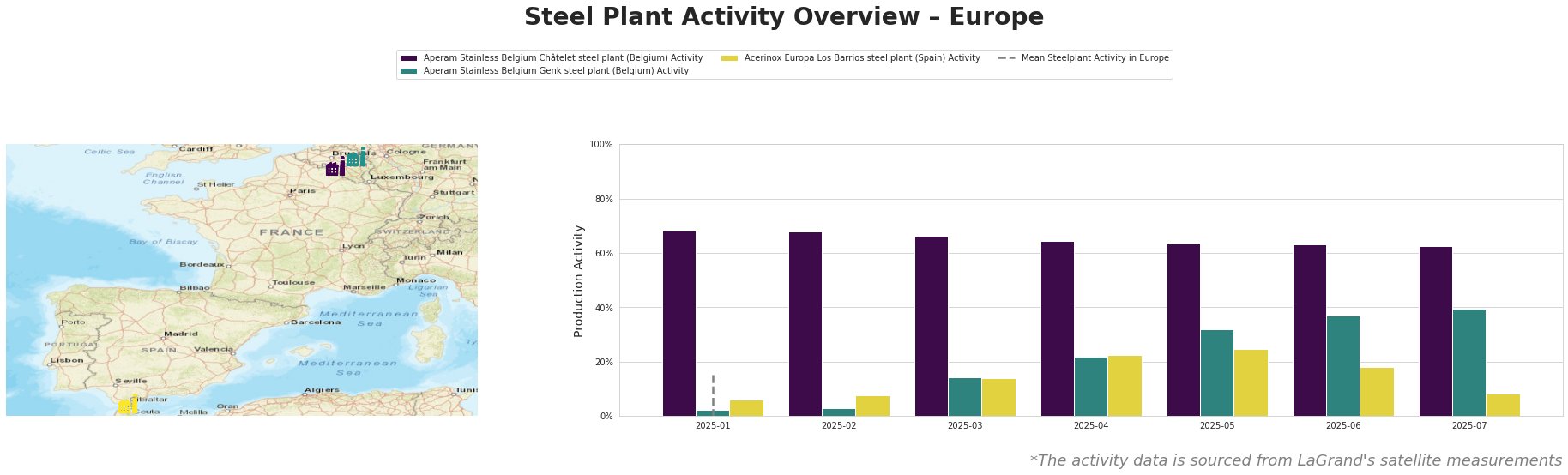

The Mean Steelplant Activity in Europe column contains extremely negative values for February through July, invalidating its use as a reference value for describing overall market activity relative to specific plants.

Aperam Stainless Belgium Châtelet, an EAF-based plant focused on stainless steel slabs and cold-rolled products, showed a consistently high activity level, ranging from 63% to 68% throughout the observed period. This relative stability does not appear to be directly linked to the market sentiments described in “EU plate, slab spot liquidity drops amid summer lull” or “Stainless steel prices in Europe continue to fall amid summer lull”.

Aperam Stainless Belgium Genk, also an EAF-based stainless steel producer of slabs and cold-rolled products, exhibited a steady increase in activity from 2% in January to 39% in July. This upward trend occurs during a period when “Stainless steel prices in Europe continue to fall amid summer lull”, however, no direct relationship can be derived from the provided information.

Acerinox Europa Los Barrios, a stainless steel plant producing a wide range of products including slabs, plates, and coils via EAF, showed a decrease in activity from 25% in May to 8% in July. This reduction might be indirectly connected to the slowdown mentioned in “EU plate, slab spot liquidity drops amid summer lull” as it covers similar products, but no direct link can be established.

Based on the news articles and satellite data, potential localized supply tightness can be expected in the HRC market, specifically related to the Northern European market, and for plate and slab products from Italian producers, whereas ample availability and price pressure can be expected for stainless steel. Steel buyers should:

- Prioritize HRC Procurement: Given the rising prices in the “Prices are rising in the European HRC market amid a lull” news article, buyers requiring HRC should secure supply promptly to avoid further price increases, potentially focusing on forward contracts where possible.

- Evaluate Stainless Steel Options: With “Stainless steel prices in Europe continue to fall amid summer lull”, buyers should explore opportunities to negotiate more favorable terms with stainless steel suppliers, especially given that plant activity at Aperam Stainless Belgium Genk is increasing while prices decline.

- Monitor Plate and Slab Market Closely: While “EU plate, slab spot liquidity drops amid summer lull” indicates a stable market, the anticipation of rising prices after summer warrants close monitoring and potentially securing supply before prices potentially increase.