From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Tumbles: Production Cuts Deepen Amid Export Surge, June Output Hits 2025 Low

China’s steel market faces mounting pressure, evidenced by a 9.2% year-over-year decrease in steel production in June, as reported in “China reduced steel production by 9.2% y/y in June“, “China reduced steel output by 9.2% in June%” and “China’s crude steel output in June lowest so far this year, down 3% in H1“. Simultaneously, exports surged by 9.2% in the first half of 2025, according to “China increased steel exports by 9.2% y/y in 1H2025“. While production is decreasing, no direct link can be established between these news articles and the observed activity trends in the selected plants via satellite.

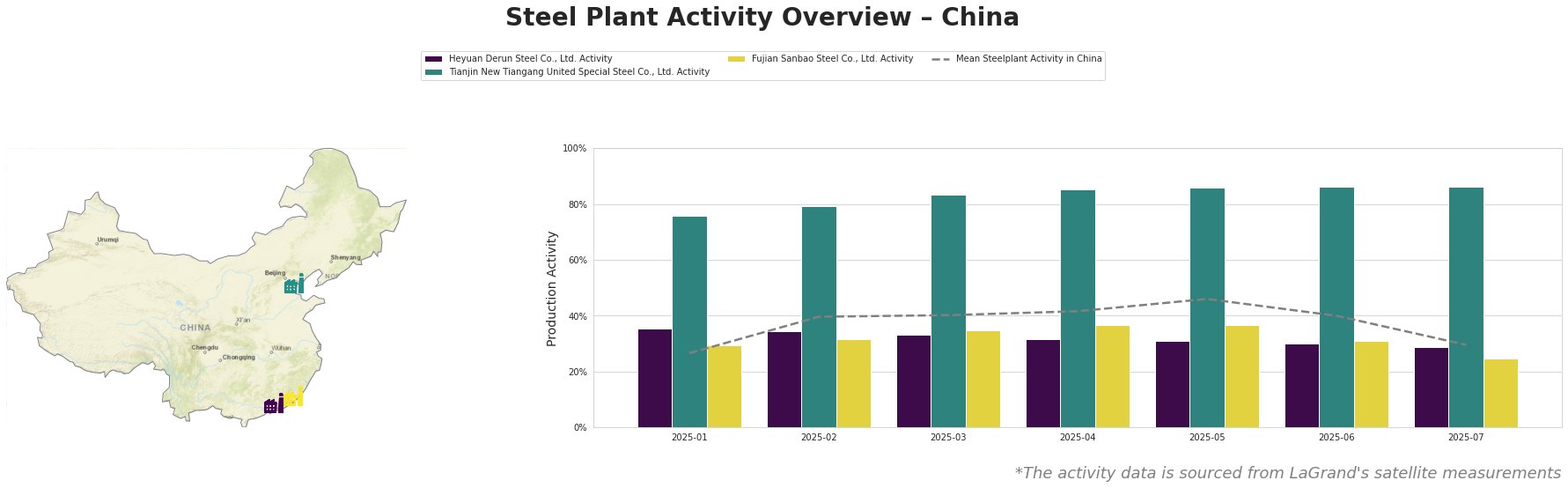

Overall, average steel plant activity in China peaked in May at 46% and then dropped significantly to 30% in July.

Heyuan Derun Steel Co., Ltd., located in Guangdong, operates exclusively with EAF technology and has a crude steel capacity of 1.2 million tons. Satellite data shows a consistent decline in activity throughout the observed period, dropping from 35% in January to 29% in July. This downward trend in activity aligns with the general production cuts across China reported in “China reduced steel production by 9.2% y/y in June“, however, no direct link can be firmly established.

Tianjin New Tiangang United Special Steel Co., Ltd., an integrated BF-BOF plant in Tianjin with a capacity of 4.5 million tons of crude steel, has maintained a consistently high activity level. Activity held steady at 86% between May and July, significantly above the national average. This sustained high activity contrasts with the reported nationwide production cuts, as reported in “China reduced steel production by 9.2% y/y in June“.

Fujian Sanbao Steel Co., Ltd., located in Fujian, is an integrated steel plant with both BF-BOF and EAF technologies, possessing a crude steel capacity of 4.62 million tons. Activity peaked at 37% in April and May, followed by a sharp drop to 25% in July. This decline is more pronounced than the overall average decline and might correlate with the general trend of production reduction as discussed in “China reduced steel production by 9.2% y/y in June“, but a direct link cannot be confirmed.

Given the reported production cuts and the observed decline in overall plant activity, coupled with increasing exports reported in “China increased steel exports by 9.2% y/y in 1H2025“, steel buyers should anticipate potential supply constraints and volatile pricing. Procurement professionals should proactively:

- Secure supply contracts immediately for H2 2025, particularly if relying on regions showing production declines, such as Guangdong (where Heyuan Derun Steel Co., Ltd. is located).

- Closely monitor export data, as further increases could exacerbate domestic supply issues. Analyze whether the semi-finished products in exports align with your raw material needs.

- Assess alternative sourcing options outside of China, considering that increased export activity, as reported in “China increased steel exports by 9.2% y/y in 1H2025“, may continue for the remainder of the year.

- Prioritize integrated BF-BOF plants such as Tianjin New Tiangang United Special Steel Co., Ltd. as they maintain stable production outputs. However, consider that supply from those plants could be prioritized for export and be less available in the domestic market.