From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Resilient Despite Summer Lull: Rising HRC Prices and Increased Plant Activity

The Italian steel market exhibits resilience despite the seasonal slowdown, with hot-rolled coil (HRC) prices showing an upward trend. The “Prices are rising in the European HRC market amid a lull” article highlights this increase, despite weak demand. While the article “EU plate, slab spot liquidity drops amid summer lull” indicates stable prices but quieter activity in plate and slab, the “Stainless steel prices in Europe continue to fall amid summer lull” highlights continued price decline for stainless steel due to low demand and increased imports. While these articles describe the trends in the market, there is no direct relationship established with observed activity levels.

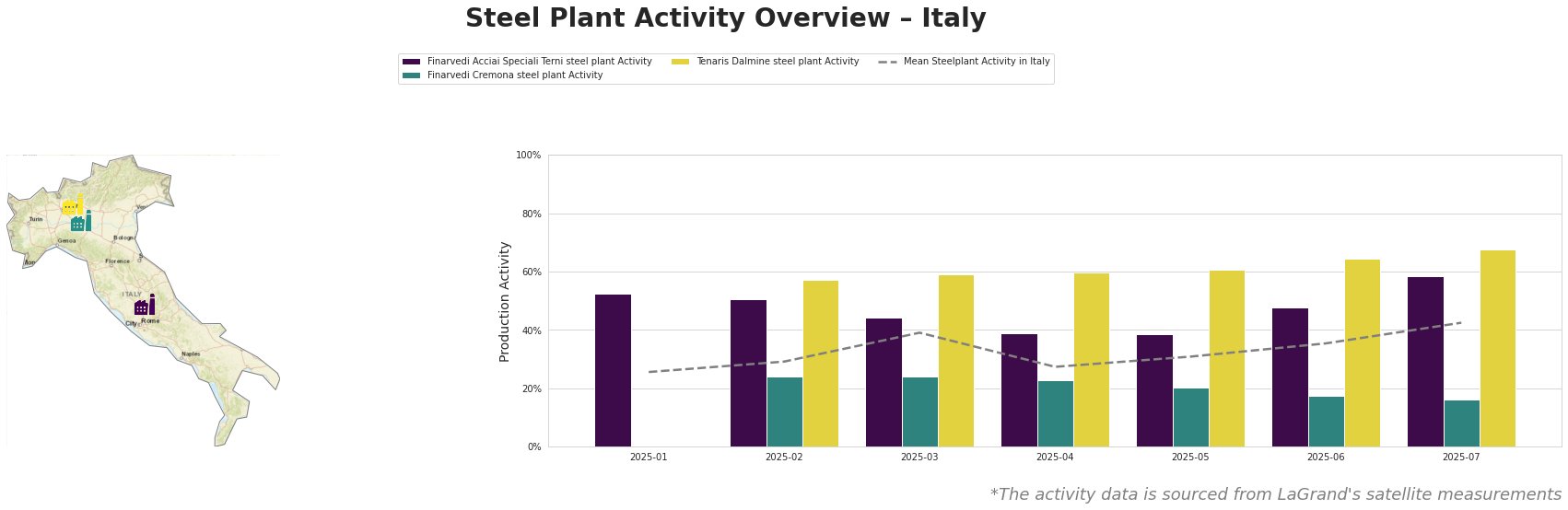

The mean steel plant activity in Italy has steadily increased throughout the observed period, reaching 42.0% in July, up from 26.0% in January. Finarvedi Acciai Speciali Terni steel plant experienced fluctuations, decreasing from 52.0% in January to 38.0% in May, before rebounding to 58.0% in July. Finarvedi Cremona steel plant saw a continuous decline, dropping from 24.0% in February to 16.0% in July. Tenaris Dalmine steel plant showed a consistent upward trend, increasing from 57.0% in February to 68.0% in July, significantly exceeding the mean activity level. While the news articles indicate a summer lull, this does not directly correlate with decreasing production activity in Terni and Dalmine. Cremona decreased however, but without a direct connection to any particular news article.

Finarvedi Acciai Speciali Terni, located in the Province of Terni, operates two electric arc furnaces (EAFs) with a crude steel capacity of 1.45 million tonnes per annum (ttpa). The plant produces semi-finished and finished rolled products, including stainless steels, serving sectors such as automotive and construction. The observed activity at Finarvedi Acciai Speciali Terni shows a recovery to 58% in July after a low of 38% in May, indicating potential adjustments in production to meet anticipated post-summer demand. Although there’s an increase, a direct connection to the articles isn’t explicitly established.

Finarvedi Cremona, located in the Province of Cremona, operates two EAFs with a larger crude steel capacity of 3.85 million ttpa, specializing in hot-rolled coil and galvanized products primarily for the automotive sector. The activity level at Finarvedi Cremona continuously decreased during the observed period, reaching 16.0% in July. This decrease may reflect reduced demand in the automotive sector during the summer lull, but no explicit link can be made to the provided news articles.

Tenaris Dalmine, situated in the Province of Bergamo, operates a single 95-tonne EAF with a crude steel capacity of 0.7 million ttpa. The plant produces tubes and pipes for the energy and automotive sectors, supported by a 120 MW captive power plant. Tenaris Dalmine exhibits the highest activity level among the observed plants, reaching 68.0% in July, reflecting sustained demand for its products, independent of the general market trends. No explicit link to the provided news articles can be established.

Evaluated Market Implications:

Based on the rising HRC prices reported in “Prices are rising in the European HRC market amid a lull” and the increased activity at Finarvedi Acciai Speciali Terni and Tenaris Dalmine, steel buyers should anticipate potential price increases for HRC and tube products in the coming months. The increased activity at Finarvedi Acciai Speciali Terni may suggest a strategic adjustment to the rise in HRC prices in anticipation of higher demand post summer. The summer slowdown may provide a temporary window of opportunity to secure orders before prices potentially rise further. Given the steady activity levels at Tenaris Dalmine, securing long-term contracts for tubular products may be a prudent strategy to mitigate future price volatility. For stainless steel, procurement managers can benefit from the current downward price trend but should monitor import competition and potential shifts in currency exchange rates as highlighted in the “Stainless steel prices in Europe continue to fall amid summer lull” article.