From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Faces Uncertainty Amidst Trump’s Tariff Threats and Fluctuating Plant Activity

North America’s steel market sentiment is negative due to potential disruptions caused by new tariffs. The announced tariffs, as reported in “Trump announces 35% tariff on imports from Canada,” “Trump threatens Mexico, EU with 30pc tariffs,” and “Trump imposes 35 percent tariffs on Canadian imports starting August 1,” raise concerns about increased manufacturing costs and supply chain disruptions. While these tariffs are significant news events, direct impacts on recent plant activity observed through satellite data remain unclear based on the provided information.

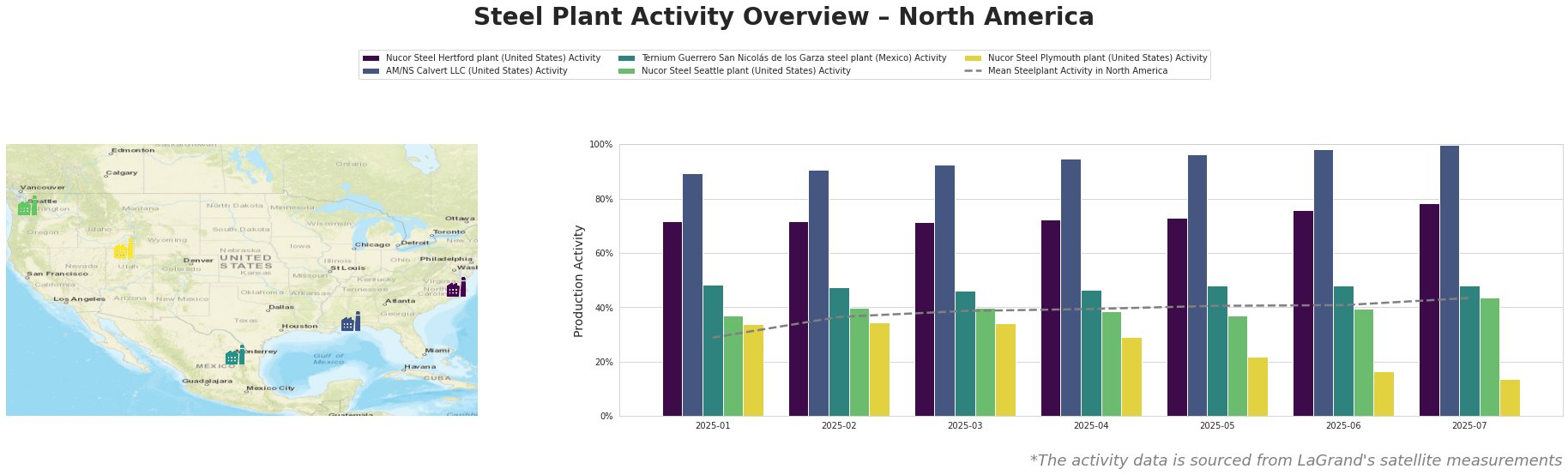

The mean steel plant activity in North America has shown a steady increase from 29% in January to 43% in July. The AM/NS Calvert LLC plant in Alabama consistently operated at high levels, reaching 100% activity in July. In contrast, the Nucor Steel Plymouth plant in Utah experienced a significant decline in activity, dropping from 34% in January to just 14% in July.

Nucor Steel Hertford, located in North Carolina, is an EAF steel plant with a crude steel capacity of 1542 ttpa, producing semi-finished plate products for various sectors. The plant has shown relatively stable activity, increasing gradually from 72% in January to 78% in July. No direct impact from the tariff news can be established based on this activity data.

AM/NS Calvert LLC, situated in Alabama, is another EAF steel plant, boasting a 1500 ttpa capacity and focusing on finished rolled products. It demonstrated consistently high activity, reaching 100% in July. This plant’s output may be affected if tariffs increase the cost of imported raw materials, but no evidence of this is reflected in the provided activity data.

Ternium Guerrero San Nicolás de los Garza steel plant in Mexico utilizes integrated (DRI) processes with a crude steel capacity of 2400 ttpa, producing both semi-finished and finished rolled products. The plant maintained relatively stable activity around 47-48% throughout the observed period. While the news articles “Trump threatens Mexico, EU with 30pc tariffs” mentions potential tariffs on Mexico, the plant’s activity level did not change considerably.

Nucor Steel Seattle plant, an EAF plant in Washington with 855 ttpa capacity, produces finished rolled bar products. Its activity fluctuated slightly, ending at 44% in July. No direct link to the announced tariffs can be established based on the provided information.

Nucor Steel Plymouth plant, located in Utah, is an EAF steel plant with a 908 ttpa capacity focused on finished rolled bar products. This plant saw a notable decline in activity, falling from 34% in January to 14% in July. No direct link to the announced tariffs can be established based on the provided information.

The announced tariffs on Canada and potential tariffs on Mexico and the EU, as highlighted in “Trump announces 35% tariff on imports from Canada,” “Trump threatens Mexico, EU with 30pc tariffs,” and “Trump imposes 35 percent tariffs on Canadian imports starting August 1” pose potential supply disruptions for steel buyers.

Based on the current information, specifically the potential for tariffs on Canadian imports buyers should:

- Consider diversifying sources: Given the 35% tariff on Canadian imports, buyers heavily reliant on Canadian steel should explore alternative sources to mitigate price increases. This action is directly supported by the news article “Trump announces 35% tariff on imports from Canada“.

- Monitor AM/NS Calvert: While currently operating at full capacity, keep close watch on AM/NS Calvert, given its heavy reliance on raw material imports. Changes could quickly ripple through prices and availability.