From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Faces Headwinds: Activity Declines Amidst Global Trade Tensions

Asia’s steel market is showing signs of weakness, with decreasing plant activity observed across the region. While no direct link can be established, the recent trade tensions highlighted in the article “Europe needs effective protective measures for steel in light of US tariffs – EUROFER” and “EUROFER calls for emergency measures as US Tariffs crush EU steel exports” raise concerns about global steel trade flows, which could indirectly influence Asian steel production.

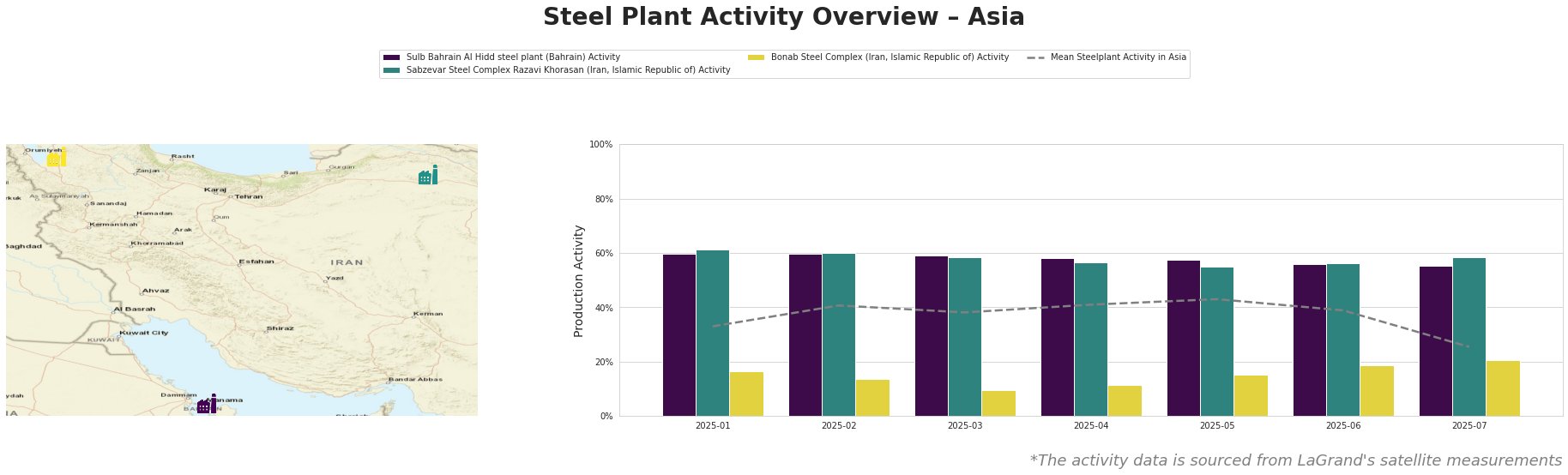

The mean steel plant activity in Asia experienced a significant drop in July, falling to 25% after hovering around 33-43% in the preceding months.

The Sulb Bahrain Al Hidd steel plant, an integrated DRI-EAF facility with a crude steel capacity of 1.1 MTPA and a DRI capacity of 1.6 MTPA, has shown a gradual decrease in activity from 60% in January to 55% in July. No direct connection between this decline and the news articles “Europe needs effective protective measures for steel in light of US tariffs – EUROFER” or “EUROFER calls for emergency measures as US Tariffs crush EU steel exports” can be explicitly established.

The Sabzevar Steel Complex in Razavi Khorasan, Iran, a smaller EAF-based plant with a crude steel capacity of 800,000 tons, saw its activity decrease from 61% in January to 55% in May, before recovering to 58% in July. There is no directly established link between this development and the provided news articles.

The Bonab Steel Complex in East Azerbaijan, Iran, another EAF-based plant with a 1.4 MTPA crude steel capacity, displayed a fluctuating activity pattern, hitting a low of 10% in March and peaking at 20% in July. There is no direct connection between this activity and the provided news articles.

Evaluated Market Implications:

The observed decrease in overall Asian steel plant activity, particularly the sharp drop in the regional mean, suggests potential downward pressure on steel supply in the coming months. While the provided news focuses on the EU and US markets, the global interconnectedness of steel trade means that disruptions in one region can have ripple effects elsewhere. The article “EU tariffs threaten US EAF prime scrap imports” illustrates how tariffs in one region can influence the supply of essential resources in other markets.

Recommended Procurement Actions:

Given the potential for supply disruptions and the overall negative market sentiment, steel buyers and market analysts should take the following actions:

- Monitor Regional Price Volatility: Closely track price movements in Asian steel markets. The declining activity levels, combined with global trade uncertainties, could lead to increased price volatility.

- Diversify Sourcing: Evaluate alternative steel supply sources within and outside Asia. The observed production cuts could strain existing supply chains, making diversification a prudent risk mitigation strategy.

- Assess Scrap Supply Chains: Given the impact of tariffs on scrap flows as highlighted in “EU tariffs threaten US EAF prime scrap imports“, carefully assess the stability and cost of scrap-based steel supplies, especially for buyers reliant on EAF steel production.

- Evaluate Contractual Terms: Review existing steel supply contracts, paying close attention to force majeure clauses and pricing mechanisms, to prepare for potential supply chain disruptions or price increases.

These actions, while not directly tied to specific plant outages, are recommended in response to the general market uncertainty indicated by the declining activity and the global trade tensions.