From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Pig Iron Exports Surge, Impacting European Steel Supply: A Data-Driven Analysis

Europe’s steel market shows a mixed picture with rising Ukrainian pig iron exports potentially influencing regional supply dynamics. The increase in pig iron production reported in “pig iron smelting in Ukraine increased by 6% in the first half of the year” and “Ukraine reports 5.8 percent rise in pig iron output for H1 2025“, coupled with the surge in exports detailed in “Ukraine increased pig iron exports by 47.5% y/y in 1H2025“, especially to the US and Italy, could redirect supply flows within Europe. However, “Ukraine reduced iron ore exports by 11.9% y/y in 1H2025” and “Turkey reduced imports of raw materials from Ukraine by 65% y/y in January-May” suggest potential constraints on future Ukrainian steel production. We examine these trends in combination with satellite-observed plant activity.

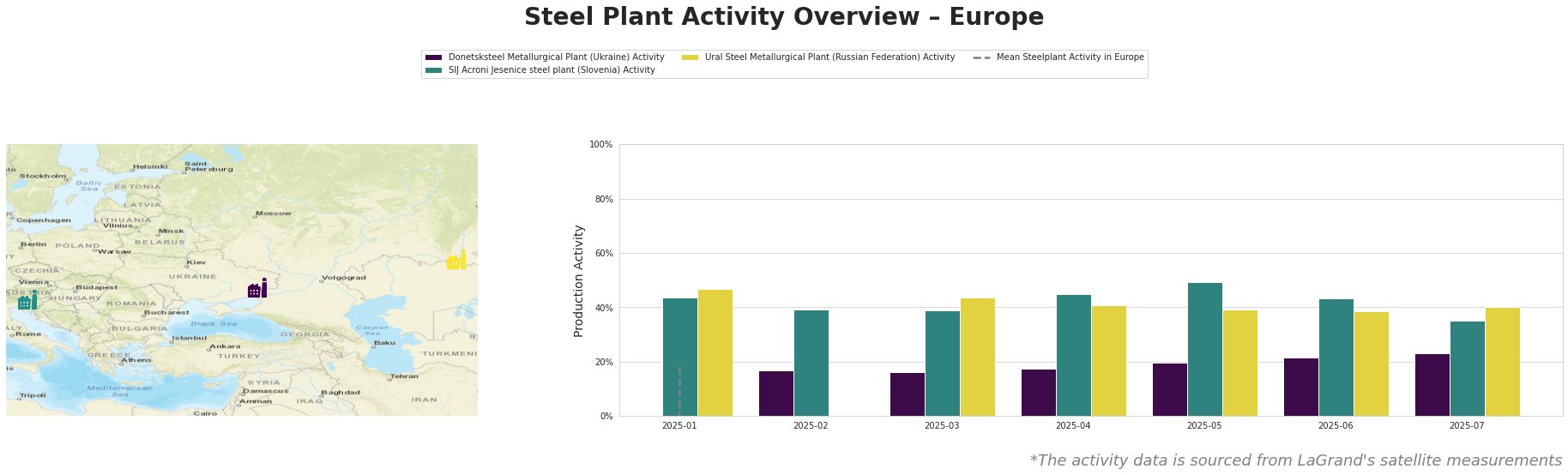

Observed plant activity data shows that the Donetsksteel Metallurgical Plant in Ukraine demonstrates a consistent upward trend in activity throughout the observed period, reaching 23% in July, up from 17% in February. This aligns with the reported increases in Ukrainian pig iron production and exports. SIJ Acroni Jesenice steel plant in Slovenia shows fluctuating activity, peaking at 49% in May before declining to 35% in July. Ural Steel Metallurgical Plant in Russia experienced relatively stable activity between 39% and 47%. The mean steel plant activity in Europe is statistically not useful, as the negative numbers indicate the data’s corruption or that the values are being used as placeholders.

Donetsksteel Metallurgical Plant: This Ukrainian plant, with a capacity of 1.5 million tons of iron via BF, specializes in pig iron production. The satellite data shows a steady increase in activity from 17% in February to 23% in July. This increase directly correlates with news of increased pig iron production and exports from Ukraine, as mentioned in “pig iron smelting in Ukraine increased by 6% in the first half of the year” and “Ukraine increased pig iron exports by 47.5% y/y in 1H2025“. This increase in activity is despite the fact that BOF production has been dismantled or mothballed since 2021.

SIJ Acroni Jesenice steel plant: This Slovenian plant has a crude steel production capacity of 726,000 tons using EAF technology and focuses on flat rolled steel products. Its activity peaked at 49% in May but fell to 35% in July. No direct connection between this drop and any of the provided news articles can be established.

Ural Steel Metallurgical Plant: Located in Russia, this plant has an integrated BF/EAF production route with a capacity of 2.7 million tons of iron and 1.6 million tons of crude steel. Its activity remained relatively stable between 39% and 47%. No direct connection between these activity levels and the provided news articles can be established.

Based on the provided data, the increase in Ukrainian pig iron production and exports may have a downward pressure on European steel prices, particularly for pig iron.

* Procurement Action: Steel buyers should closely monitor pig iron price trends, especially from Ukrainian sources. Given the increase of pig iron production in “pig iron smelting in Ukraine increased by 6% in the first half of the year“, buyers should explore potential opportunities to secure pig iron supplies from Ukraine, as highlighted in “Ukraine increased pig iron exports by 47.5% y/y in 1H2025“. However, the reduction of iron ore exports in “Ukraine reduced iron ore exports by 11.9% y/y in 1H2025“, coupled with reduced raw materials import to Turkey in “Turkey reduced imports of raw materials from Ukraine by 65% y/y in January-May“, signals potential future supply constraints and buyers should secure alternate sources.