From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Resilient Despite IEA Outlook Revision; Saudi Oil Boost Fuels Production

Asia’s steel market shows resilience as oil demand sustains activity, despite a revised IEA outlook. Saudi Arabia’s increased oil production, as reported in “Saudi Arabia leads June Opec+ production increase“, supports energy-intensive steelmaking processes, while the news articles “Mideast NOCs, majors upbeat on near-term oil demand“ and “IEA trims oil demand outlook on 2Q weakness: Resend“ highlight both the optimism in sustained demand and the acknowledged slowdown in specific regions.

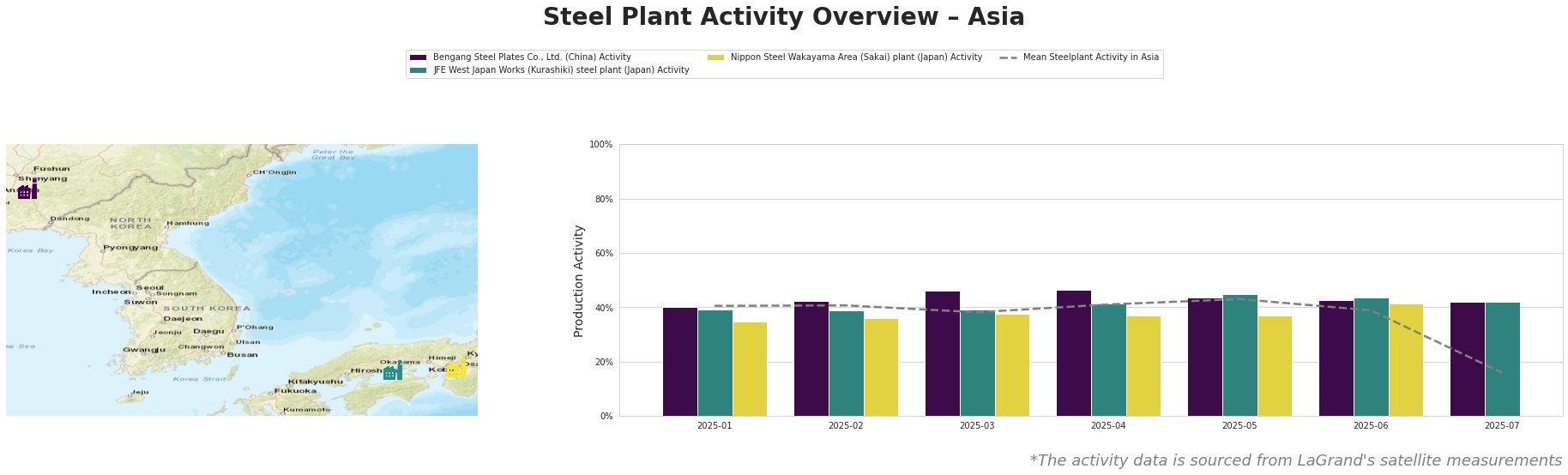

The mean steel plant activity in Asia saw fluctuations, peaking at 43% in May before dropping to 16% in July. Bengang Steel Plates Co., Ltd. showed increased activity from January to April, peaking at 47% before stabilizing around 42-44%. JFE West Japan Works (Kurashiki) showed a similar trend, with activity peaking at 45% in May before settling at 42%. Nippon Steel Wakayama Area (Sakai) maintained a relatively stable activity level, fluctuating between 35% and 42%. The sharp drop in mean activity in July does not appear to be reflected in the observed activity of the individual plants, potentially indicating decreased production at other plants within the region, or a data collection anomaly. No direct connections between the observed plant activity levels and the named news articles could be established.

Bengang Steel Plates Co., Ltd., located in Liaoning, China, is an integrated steel plant utilizing BF/BOF processes with a crude steel capacity of 12.8 million tonnes. Its main products include automotive, home appliance, and oil pipeline steel. The plant’s activity increased from 40% in January to 47% in April before decreasing to 42% in July. While Saudi Arabia’s increased crude output reported in “Saudi Arabia leads June Opec+ production increase” indirectly supports energy-intensive BF/BOF processes, a direct connection to Bengang’s activity levels cannot be definitively established based on available information.

JFE West Japan Works (Kurashiki) is an integrated steel plant in the Chūgoku region of Japan, producing 10 million tonnes of crude steel via BF/BOF processes. It manufactures a wide range of products, including hot/cold rolled sheets, coated sheets, and pipes. The plant’s activity showed a similar pattern, rising from 39% in January to 45% in May, and settling at 42% in July. The “Mideast NOCs, majors upbeat on near-term oil demand” article suggests continued demand which can indirectly support the plant’s output, but no explicit causal link is evident.

Nippon Steel Wakayama Area (Sakai) plant, situated in the Kansai region of Japan, operates an electric arc furnace (EAF) with a capacity of 3.45 million tonnes of crude steel, producing long products such as angles, rails, and rebar. Its activity remained relatively stable compared to the other two plants. The “IEA trims oil demand outlook on 2Q weakness: Resend” article highlights a potential slowdown in specific Asian economies. However, a direct connection between this broader trend and specific activity shifts at the Nippon Steel Wakayama plant cannot be established based on the provided data.

Given the overall sustained activity at the individual plant level, despite the observed drop in the mean Asian steelplant activity in July (which could signal broader, less granular trends elsewhere, or even a data collection anomaly), and considering Saudi Arabia’s increased crude production boosting overall supply as per “Saudi Arabia leads June Opec+ production increase,” steel buyers should leverage this stable supply to negotiate favorable contract terms. Specifically, focus on securing medium-term contracts (3-6 months) to mitigate potential future price volatility highlighted by the contrasting demand outlooks of the OPEC majors (in “Mideast NOCs, majors upbeat on near-term oil demand“) and the IEA (in “IEA trims oil demand outlook on 2Q weakness: Resend“).