From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism Amidst Oil Surge: Plant Activity Trends and Procurement Strategies

Asia’s steel market exhibits a generally positive sentiment despite evolving dynamics in the energy sector. Increased OPEC+ oil production, as reported in “Opec+ 8 speeds up output hike to 548,000 b/d for August” and “Opec+ 8 likely to speed up output hike for August“, has the potential to affect energy costs for steel production, however the precise correlation with steel plant activity cannot be directly established from provided data. No named article explains the activity trend of any specific steel plant observed.

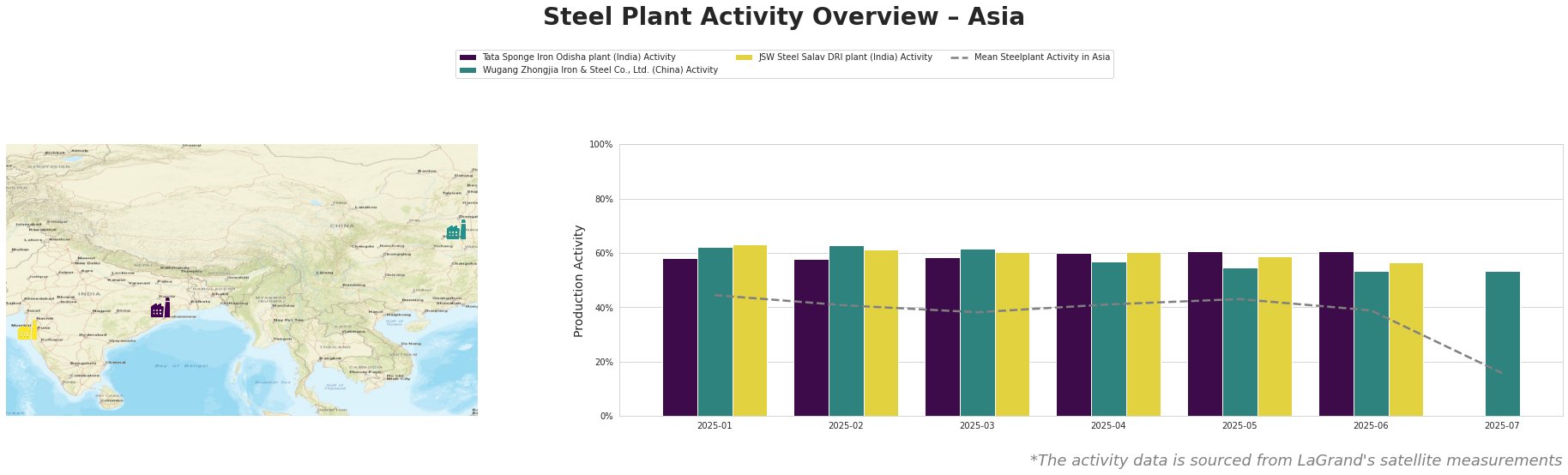

The mean steel plant activity in Asia shows a general decline throughout the observed months, hitting a low of 16.0% in July. Tata Sponge Iron Odisha plant in India, producing 400 ttpa of DRI, maintained a consistently high activity level between 58% and 61% from January to June, significantly above the mean Asian activity. Wugang Zhongjia Iron & Steel Co., Ltd. in Henan, China, with a 1220 ttpa BF-based iron production capacity, demonstrated stable activity from January to March around 62-63%, followed by a gradual decrease to 53% by July. JSW Steel Salav DRI plant in Maharashtra, India, another DRI producer with a 1000 ttpa capacity, mirrored this trend, dropping from 63% in January to 57% in June. Notably, both Tata Sponge Iron and JSW Steel Salav were not measured in July.

Tata Sponge Iron Odisha plant is a DRI-based plant located in Odisha, India, with a production capacity of 400 ttpa. The plant maintained a high activity level between January and June, consistently outperforming the average Asian steel plant activity. There is no direct connection between the plant’s activity and the provided news articles. The lack of data for July prevents identifying any recent changes.

Wugang Zhongjia Iron & Steel Co., Ltd., based in Henan, China, utilizes blast furnace (BF) technology for its 1220 ttpa iron production. The activity level gradually decreased from 63% in February to 53% in July. While “Mideast NOCs, majors upbeat on near-term oil demand” indicates potential overall demand growth, its direct impact on Wugang Zhongjia’s production levels cannot be established.

JSW Steel Salav DRI plant, situated in Maharashtra, India, is a DRI plant with a 1000 ttpa capacity. Like Tata Sponge Iron, it produces DRI and HBI. Its activity decreased from 63% in January to 57% in June. No direct connection can be established between this activity trend and the provided news articles regarding oil production increases. The plant activity level was not measured in July.

While the provided news articles highlight an optimistic view on near-term oil demand and increased oil production, the provided data and articles do not allow establishing direct causality with steel plant activity.

The significant drop in overall mean plant activity across Asia (to 16% in July) warrants close monitoring.

Given the stable performance of Tata Sponge Iron Odisha through June, steel buyers should investigate potential supply opportunities from this plant, assuming activity levels are maintained. Buyers dependent on Wugang Zhongjia Iron & Steel should monitor its production levels closely for potential delays resulting from the observed activity decline, particularly if confirmed in subsequent activity measurements.