From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: US Tariff Threats Loom Amidst Diverging Plant Activity

Asia’s steel market faces uncertainty due to potential US tariff hikes, detailed in articles such as “US to lay out tariff demands in coming days: Trump,” “Marktbericht: Anleger warten auf Neues in Sachen Zollkonflikt,” and “Briefe an Handelspartner: Höhere US-Zölle drohen ab August.” These announcements coincide with varied steel plant activity levels across the region, although a direct causal relationship between the tariff news and observed production levels cannot be definitively established for all plants. The overall market sentiment remains neutral, pending further clarification on the specific tariffs and their impact on trade flows.

Measured Activity Overview

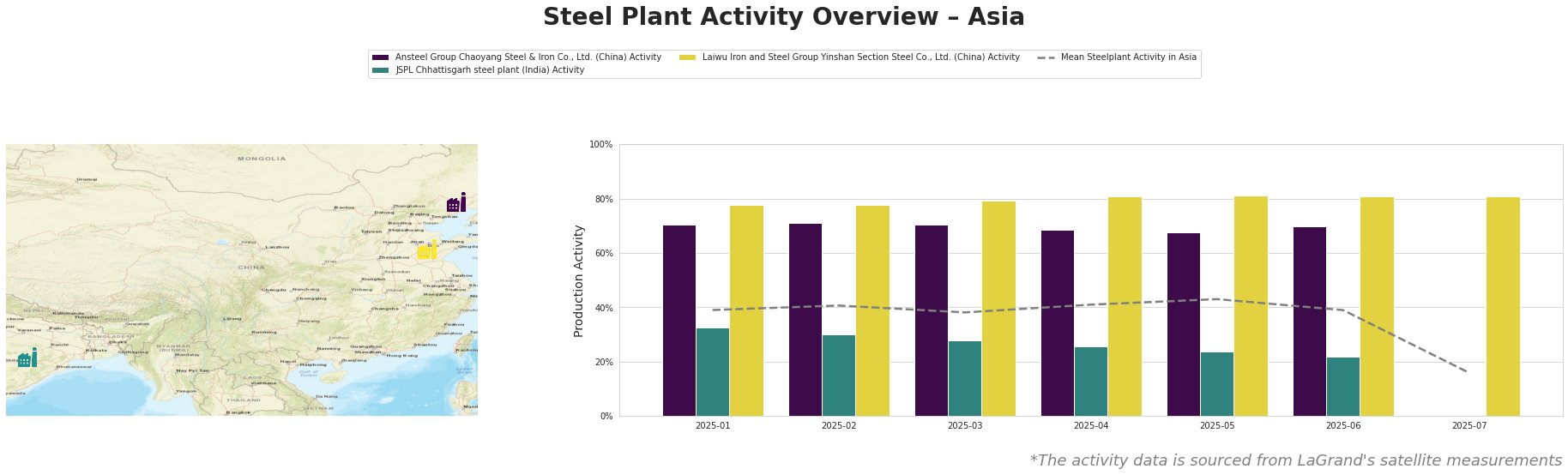

The mean steel plant activity in Asia experienced fluctuations from January to June 2025, ranging from 38% to 43%, before dropping sharply to 16% in July. Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd. showed consistently high activity levels around 80% throughout the period. Ansteel Group Chaoyang Steel & Iron Co., Ltd. maintained activity levels between 68% and 71% until data becomes unavailable in July. JSPL Chhattisgarh steel plant experienced a continuous decline in activity from 33% in January to 22% in June before data becomes unavailable in July.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning, China, is an integrated steel plant with a crude steel capacity of 2.1 million tonnes per annum (mtpa), utilizing basic oxygen furnace (BOF) technology. Satellite data indicates relatively stable activity levels between 68% and 71% from January to June 2025. The absence of data for July 2025 coincides with President Trump’s announcements of potential tariff impositions (“US to lay out tariff demands in coming days: Trump”) but a causal relationship cannot be explicitly established.

JSPL Chhattisgarh steel plant, situated in Chhattisgarh, India, has a crude steel capacity of 3.6 mtpa, utilizing both blast furnace (BF) and direct reduced iron (DRI) processes, followed by electric arc furnace (EAF) steelmaking. The plant’s activity levels steadily decreased from 33% in January 2025 to 22% in June 2025. This downward trend does not have a directly identifiable link to the mentioned news articles on US tariff policies, suggesting that plant-specific or local market factors might be the primary drivers.

Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd., located in Shandong, China, operates as an integrated steel plant with a crude steel capacity of 5.4 mtpa, relying on BOF technology. The plant has consistently demonstrated high activity levels, remaining around 80% from January to July 2025. This stable activity level, despite the overall market uncertainties related to US tariffs, as reported in “Marktbericht: Anleger warten auf Neues in Sachen Zollkonflikt,” suggests strong domestic or regional demand for its section and strip steel products, or pre-emptive production in light of expected tariffs discussed in “Briefe an Handelspartner: Höhere US-Zölle drohen ab August”, however, a direct causal relationship cannot be established.

Evaluated Market Implications

The potential imposition of US tariffs, particularly as highlighted in “US to lay out tariff demands in coming days: Trump,” introduces a degree of uncertainty into the Asian steel market. While specific impacts remain unclear, the news articles “Trump’s Vietnam trade deal to keep US tariffs” and “Briefe an Handelspartner: Höhere US-Zölle drohen ab August” indicate the potential for targeted tariffs on specific countries. The observed sharp drop in overall mean steel plant activity in Asia in July may reflect anticipation of these tariffs, though supporting data from individual plants is unavailable.

- Supply Disruption Risks: Given the potential for tariffs, particularly on Chinese steel products, there is a risk of supply disruptions, which could lead to price volatility. While Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd. has maintained high production levels, broader market uncertainty could impact its future output and export strategies. The potential supply disruption risk due to geopolitical reasons in the region must be considered.

- Recommended Procurement Actions: Steel buyers should closely monitor announcements regarding specific tariff rates and affected countries. Diversifying sourcing options, particularly exploring suppliers in regions less likely to be impacted by US tariffs, is advisable. Negotiating contract clauses that allow for price adjustments based on tariff changes can help mitigate financial risks. Furthermore, buyers should evaluate their inventory levels and consider strategic stockpiling of critical steel products if tariffs are expected to significantly increase prices, based on information from articles such as “Trumps US-Zölle im Liveticker: USA wollen Zoll-Verhandlungen bis 1. August ausdehnen | FAZ“.