From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Strong Plant Activity Despite EU Import Concerns

Asia’s steel market demonstrates robust production despite the EU’s anxieties over low-cost steel imports, as highlighted in articles such as “EU steel industry calls for policy clarity amid weak demand, CBAM uncertainty” and “EUROMETAL’s 75th Anniversary conference focuses on protectionism/autarky“. Satellite data confirms high activity at key Asian steel plants, though direct correlations to EU policy concerns are not explicitly evident at this time.

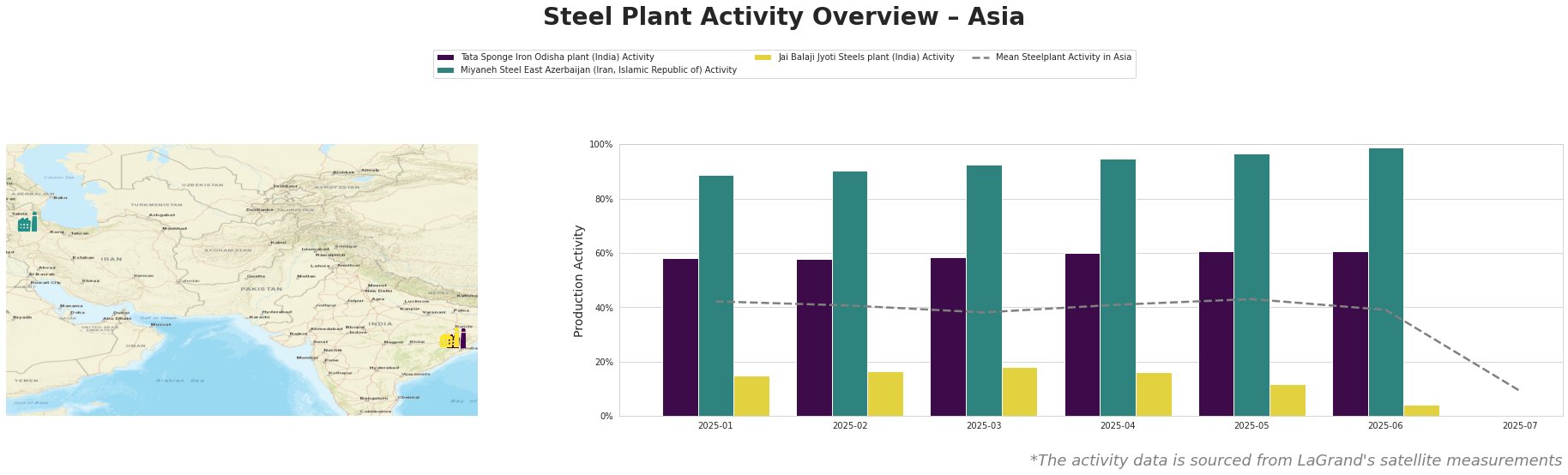

The mean steel plant activity in Asia shows a significant drop to 9.0% in July, following a period of fluctuation.

The Tata Sponge Iron Odisha plant in India, with a 400 ttpa DRI capacity and ResponsibleSteel Certification, maintained a relatively stable activity level between 58% and 61% from January to June. Activity for July is missing. This stable trend does not show any immediate impact from the concerns expressed in the articles “Steel market participants warn of risks in the new EU state aid program” or “Uneven national implementation risks undermining EU state aid framework, metal markets warn“, although these articles do not specifically address Indian DRI production.

The Miyaneh Steel East Azerbaijan plant in Iran, an integrated DRI/EAF facility with 800 ttpa capacity, displayed consistently high activity, steadily increasing from 89% in January to 99% in June. Activity for July is missing. This plant’s high activity could potentially contribute to the concerns raised in “Eurometal has started collecting information from EU associations, national federations and steel consumers regarding imports of low-cost steel derivatives into the EU. The Association analyzes the increase in imports compared to the continued decline in“, though a direct link cannot be definitively established.

The Jai Balaji Jyoti Steels plant in Odisha, India, possessing a 120 ttpa DRI and 92 ttpa EAF capacity, showed a fluctuating activity trend, starting at 15% in January, peaking at 18% in March, and then declining to 4% in June. Activity for July is missing. The decline in activity could be a consequence of factors discussed in “Alexander Julius: Industry must utilize political problem-solving momentum“, such as geopolitical instability or production adjustments. However, a direct, demonstrable causal link cannot be proven from the provided information.

Evaluated Market Implications

The substantial drop in mean steel plant activity in Asia during July suggests a potential overall decrease in Asian steel production. The consistently high activity at the Miyaneh Steel plant, coupled with EU concerns over import levels, warrants careful monitoring of Iranian steel export trends. However, as the Mean activity in Asia is so low in July, further observation is needed before any procurement actions can be recommended.

Procurement teams should be aware of the potential for supply disruptions stemming from broader market factors and consider diversifying their sourcing to mitigate risks.