From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Shows Strong Production Despite EU Quota Exhaustion

Asia’s steel market maintains positive momentum amid shifts in global trade dynamics. Recent reports such as “Most EU steel import quotas are almost exhausted by the end of the second quarter” and “EU steel quotas reflect shifting trade dynamics after US tariffs” highlight significant quota utilization by Asian exporters to the EU, potentially impacting regional supply-demand balances. The satellite-observed activity levels at key Asian steel plants provide further insight into regional production trends. However, a direct relationship between the EU quota news and Asian steel plant activities cannot be explicitly established with the provided data.

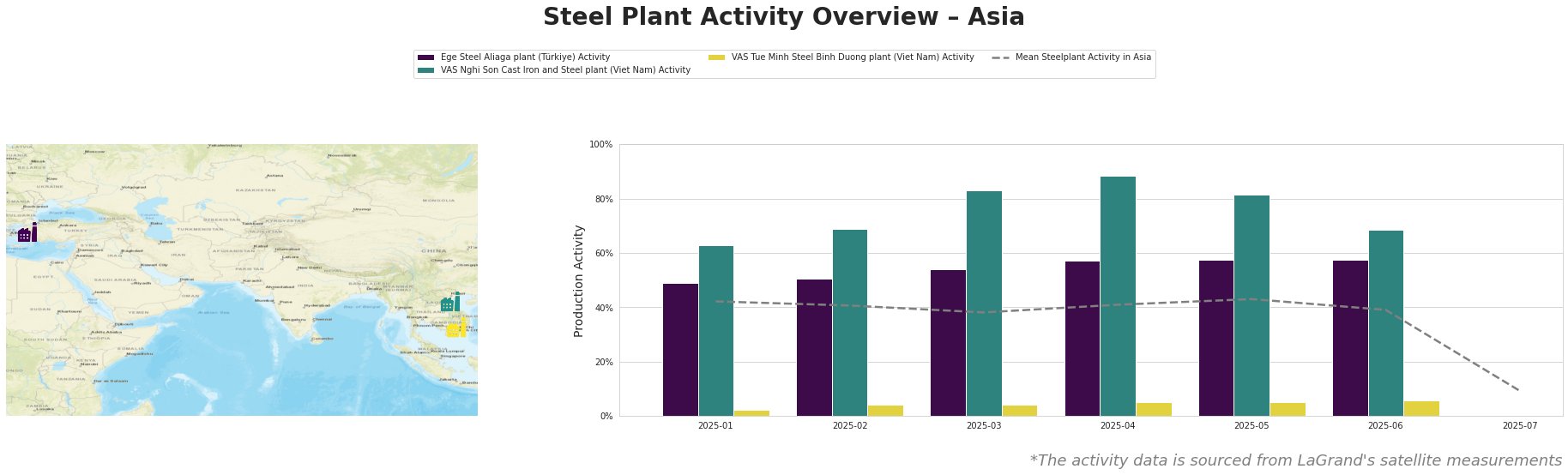

The mean steel plant activity in Asia experienced fluctuations from January to June 2025, ranging from a low of 38.0 in March to a high of 43.0 in May, before dropping significantly to 9.0 in July.

Ege Steel Aliaga plant, located in İzmir, Türkiye, operates with a 2000 ttpa EAF capacity, producing rebar and wire rod. The plant’s activity consistently remained above the Asian average, peaking at 58.0 in May and June before the general drop in July. Ege Steel is a ResponsibleSteel certified Plant. Given that articles like “Most EU steel import quotas are almost exhausted by the end of the second quarter” indicate Turkey has nearly exhausted quotas for HRC, cold-rolled stainless steel, gas pipes, other welded pipes and metal-coated sheets, it’s plausible that Ege Steel’s observed high activity in the first half of the year was partially driven by EU demand, though a direct connection cannot be definitively established.

VAS Nghi Son Cast Iron and Steel plant, situated in Thanh Hoa, Viet Nam, boasts a 3150 ttpa EAF capacity, producing billet, rebar, and wire rod. The plant consistently operated well above the Asian average. Its activity peaked at 88.0 in April and remained strong until June, before the measured drop in overall steel plant activity in Asia. VAS Nghi Son is a ResponsibleSteel certified Plant. Articles like “EU steel quotas reflect shifting trade dynamics after US tariffs” suggest that Vietnam has exceeded quotas for steel products like HRC, CRC, and coated sheets, potentially reflecting strong production, although no direct connection can be established for this specific plant based on the provided data.

VAS Tue Minh Steel Binh Duong plant, located in Binh Duong, Viet Nam, is a smaller EAF-based plant with a 500 ttpa capacity, focusing on billet, rebar, and wire rod for the building and infrastructure sectors. Its activity remained relatively low throughout the observed period, peaking at 6.0 in June. VAS Tue Minh is a ResponsibleSteel certified Plant. A specific link between its activity levels and the EU quota news cannot be explicitly established.

The significant drop in overall activity in July across Asia’s steel plants cannot be explicitly linked to the news articles provided, especially given the focus of the articles on quota exhaustion in the EU market.

Based on the news articles indicating quota exhaustion, potential shifts in trade dynamics, and plant-specific activity:

- Supply Disruptions: While plants are operating, the EU quota exhaustion may lead to regional supply adjustments as exporters redirect volumes. Monitor Turkish exports to the EU given the high utilization of their steel quotas, specifically concerning their HRC exports.

- Procurement Actions: Steel buyers should explore alternative sourcing options, particularly from regions with lower EU quota utilization. Consider increasing inventory levels of wire rod and rebar from Vietnamese suppliers given the potential impact on supply chains due to possible trade redirection in light of the information in the article “EU steel quotas reflect shifting trade dynamics after US tariffs“.