From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Headwinds: Protectionism, Policy Uncertainty, and Production Cuts

Europe’s steel sector grapples with mounting challenges as evidenced by observed production slowdowns and concerns raised in recent industry events. News articles such as “Eurometal conference focuses on protectionism/autarky” and “EU steel industry demands policy clarity amid weak demand and CBAM uncertainty” highlight the industry’s anxieties over import pressures, policy ambiguities, and the impact of the Carbon Border Adjustment Mechanism (CBAM). The satellite-observed changes in plant activity levels could be related to these issues.

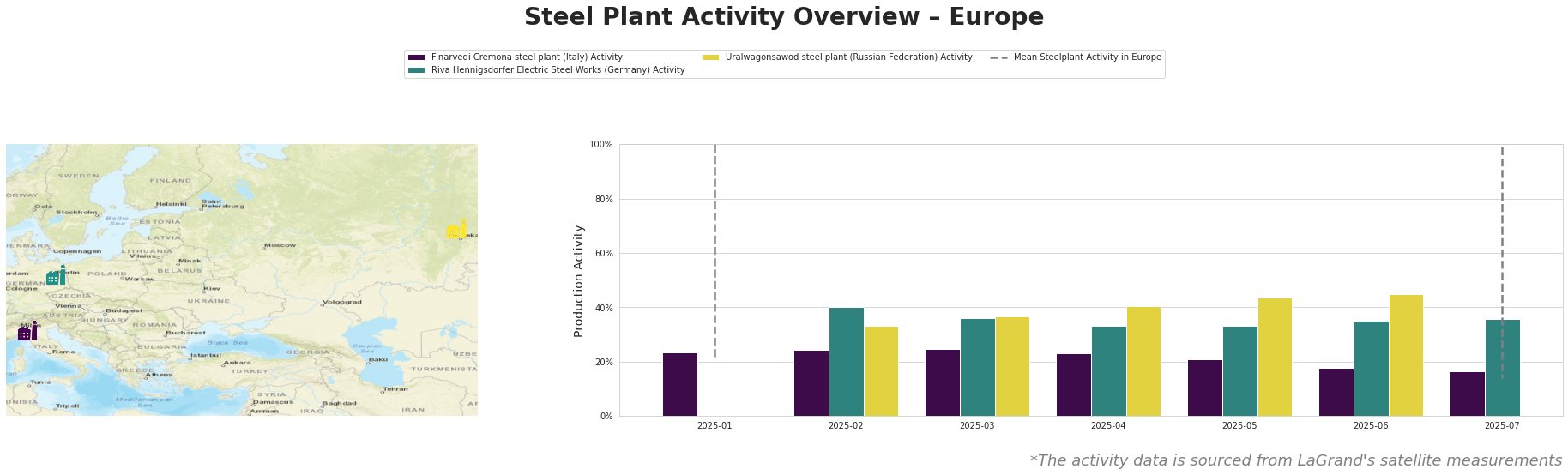

The mean steel plant activity in Europe has fluctuated significantly, peaking in May before dropping to 14% in July, indicating a sharp decline. The activity levels for individual plants display varying trends.

Finarvedi Cremona, an EAF-based steel plant in Italy producing hot-rolled coil and galvanized products for the automotive sector, showed activity declining from 25% in March to 16% in July. This recent decrease may align with the automotive sector concerns over competition from cheaper Asian imports, as highlighted in “Eurometal conference focuses on protectionism/autarky“.

Riva Hennigsdorfer, a German EAF-based steel works producing steel billets and rebar, showed activity fluctuating, dropping to 33% in April and May and then steadily rising again to 36% in July. Despite the slight recovery, the overall trend remains uncertain. No direct connection to the provided news articles could be explicitly established for this trend.

Activity at the Uralwagonsawod steel plant remained relatively stable, increasing to 45% in June, although it’s based in the Russian Federation and primarily serves the defense sector and is therefore less influenced by the European market dynamics discussed in the news articles.

Evaluated Market Implications

The observed decline in activity at Finarvedi Cremona, coupled with the broader industry concerns about import pressures and policy uncertainty as noted in “Eurometal conference focuses on protectionism/autarky” and “EU steel industry demands policy clarity amid weak demand and CBAM uncertainty,” suggests potential supply disruptions specifically for hot-rolled coil and galvanized products within the European automotive sector. The article “Uncertainty continues to put pressure on the UK steel sector” underlines similar conditions in the UK.

Recommended Procurement Actions:

- Diversify Supplier Base: Steel buyers, particularly those in the automotive sector relying on hot-rolled coil and galvanized products, should proactively diversify their supplier base to mitigate potential disruptions stemming from reduced European production and increased import competition.

- Monitor CBAM Policy: Closely monitor the evolving CBAM policy and its impact on steel prices, as highlighted in “EU steel industry demands policy clarity amid weak demand and CBAM uncertainty“. Factor potential price volatility of up to 100 euros per ton into financial planning.

- Assess Import Options: Evaluate the feasibility of sourcing steel from non-European suppliers, considering potential tariff changes and protective measures, to ensure supply continuity amidst domestic production cuts.