From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSaudi Steel Market: Output Trends Mixed Amid OPEC+ Production Hikes

Saudi Arabia’s steel market presents a mixed outlook. While OPEC+ is accelerating crude oil production increases as detailed in “Opec+ 8 speeds up output hike to 548,000 b/d for August” and “Opec+ 8 likely to speed up output hike for August,” which could stimulate economic activity, observed steel plant activity shows a recent decline. The relationship between increased oil production and steel plant activity isn’t directly established but warrants monitoring for future impact.

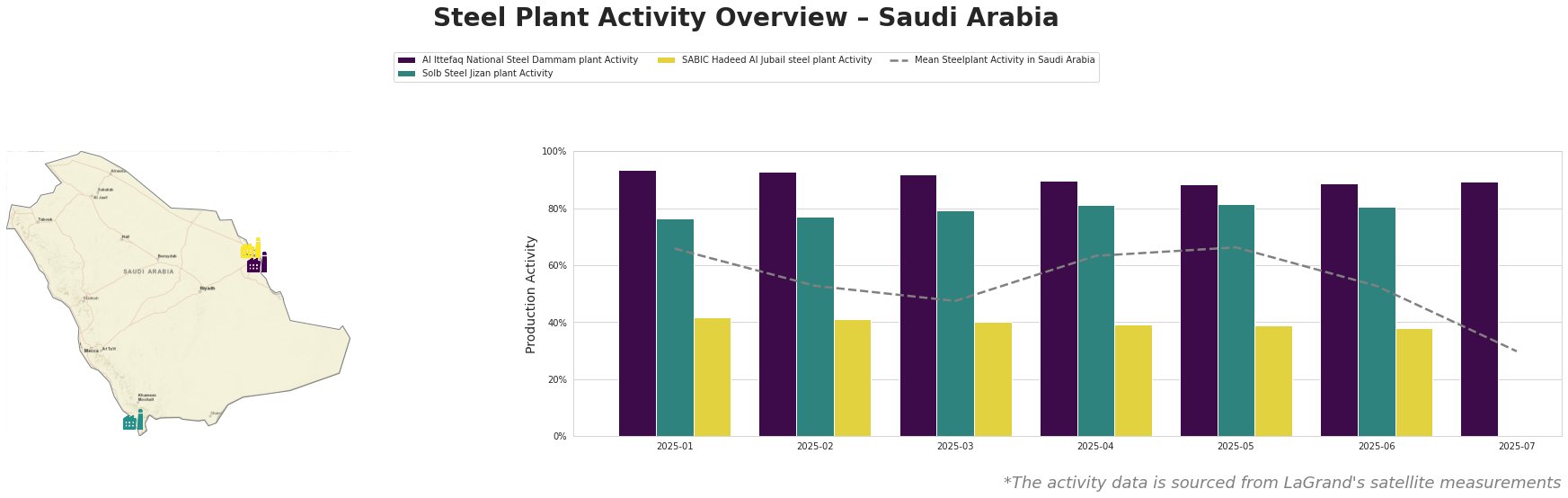

Overall mean steel plant activity in Saudi Arabia has fluctuated significantly throughout the year, declining sharply to 30% in July. Al Ittefaq National Steel in Dammam shows consistently high activity (88-93%), declining only slightly over the period. Solb Steel Jizan maintained relatively stable activity between 76% and 81% until July, where data is unavailable. SABIC Hadeed Al Jubail has exhibited consistently low activity, ranging from 38% to 42%.

Al Ittefaq National Steel, a Dammam-based plant with a 1000 thousand tonnes per annum (ttpa) EAF capacity and DRI-integrated process, has shown robust activity, consistently operating near peak capacity with a slight decline to 89% in July. This high level of output, in contrast to the broader market decline, may signal a strategic focus on semi-finished products like billets. There is no discernible link between this activity and the OPEC+ announcements outlined in the provided articles.

Solb Steel Jizan, with its 1200 ttpa EAF-based capacity producing both semi-finished (billets) and finished rolled products (rebar, wire rod), maintained stable activity until July, where data is missing. Its focus on finished products caters to local construction, but without July data, recent trends cannot be assessed. No direct connection to the OPEC+ news can be established.

SABIC Hadeed Al Jubail, a major integrated plant with 6000 ttpa crude steel capacity, DRI facilities, and diverse product portfolio (including rebar, coils, and sheets), consistently showed the lowest activity levels. The significantly lower activity, around 40%, suggests potential operational adjustments or market-driven production cuts. No direct relationship can be established between the OPEC+ production increases and observed activity, although increased oil revenues could eventually stimulate downstream demand for SABIC’s finished steel products.

Evaluated Market Implications:

The sharp decline in mean steel plant activity for July, driven by data unavailability from Solb Steel and uncharacteristic lack of data from SABIC Hadeed indicates a potential short-term supply disruption. However, Al Ittefaq’s consistent high activity may partially offset this.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor price fluctuations, particularly for rebar and wire rod, given the uncertainty around Solb Steel’s Jizan plant activity. Diversify suppliers to mitigate potential delays and shortages.

- Market Analysts: Investigate the reasons behind the drop in mean activity and the data unavailability from Solb Steel and SABIC, particularly focusing on potential maintenance shutdowns or supply chain bottlenecks. Analyze the long-term impact of OPEC+ production increases on domestic steel demand.