From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Strong Exports Offset Weak China Demand, Driving Regional Production

Asia’s steel market presents a mixed picture, with robust exports partially mitigating the impact of declining domestic demand in China. As highlighted in “Domestic demand for steel in China continues to fall,” China’s steel demand experienced a significant year-on-year drop, while exports surged due to favorable US tariff policies. These trends are juxtaposed against satellite-observed activity levels across the region. Despite decreasing exports in the region (Japan’s steel exports down 2.8 percent in January-May 2025), overall Asian activity remained positive, suggesting that the regional market is being supported by alternatives to Japanese exports.

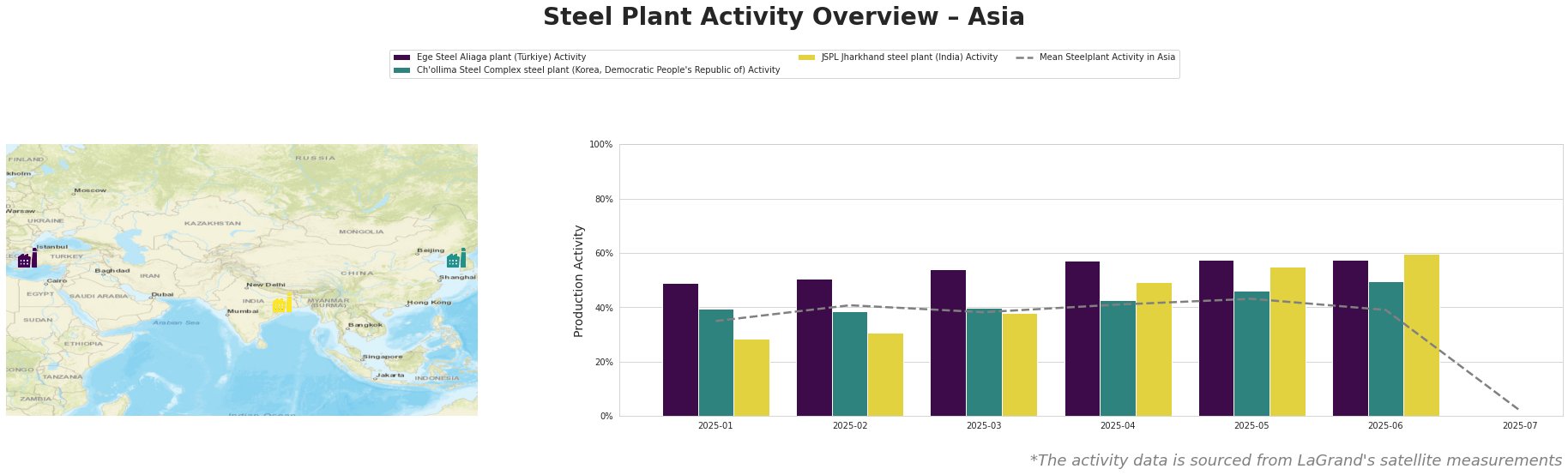

Monthly aggregated activities in % (0% = lowest ever measured, 100% = all time high):

Mean steel plant activity in Asia shows an increase from 35.0% in January to a peak of 43.0% in May, before decreasing to 39.0% in June. Note the drop in regional mean activity to just 2.0% in July. Ege Steel Aliaga plant consistently shows activity levels significantly above the Asian average, remaining between 49% and 58% throughout the observed period. Ch’ollima Steel Complex also shows above-average activity. JSPL Jharkhand steel plant activity consistently lags the other plants, but shows the largest relative increase from January to June.

Ege Steel Aliaga plant, an electric arc furnace (EAF) facility located in İzmir, maintains a consistently high activity level, reaching 58% in both May and June, significantly exceeding the regional average. This plant focuses on semi-finished and finished rolled products like rebar and wire rod. There is no direct link to the provided news articles that can explain its performance.

The Ch’ollima Steel Complex steel plant in South Pyongan demonstrates relatively stable activity, ranging from 40% in January to 50% in June, consistently above the mean activity level across Asia. The plant produces plates and wire rod but production details and processes remain unknown. There is no direct link to the provided news articles that can explain its performance.

JSPL Jharkhand steel plant, an EAF-based facility in Jharkhand producing semi-finished products like wire rod and bar, shows a marked increase in activity from 28% in January to 60% in June. This increase is notable considering the reported decline in China’s domestic demand outlined in “Domestic demand for steel in China continues to fall“, but no direct causal connection can be established based on the available information.

The continued decline in China’s steel sector PMI, as indicated in “China’s steel sector PMI declines to 45.9 percent in June” coupled with increasing steel exports documented in “Domestic demand for steel in China continues to fall“, may signal a shift in steel flow dynamics within Asia.

Evaluated Market Implications:

The weak domestic demand in China coupled with decreased Japanese exports may open opportunities for other regional suppliers. The high activity level at Ege Steel Aliaga plant suggests a stable supply source for rebar and wire rod, warranting consideration for steel buyers in regions experiencing supply constraints from China. Steel buyers should closely monitor JSPL Jharkhand steel plant’s increasing activity as it could indicate a growing supply source for semi-finished products within Asia, however buyers should keep in mind the drastic drop in July mean activity across the region.