From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market: Strong Activity Despite Global Trade Concerns – Procurement Opportunities Emerge

Asia’s steel market shows resilient activity levels, particularly in Iran and South Korea, even as global economic uncertainties mount. Activity levels are considered positive. The provided news article “Marktbericht: Setzt der DAX die Erholung fort?” notes mixed performance in Asian markets due to caution regarding US trade policy, but no direct connection to plant activity can be established.

Measured Activity Overview

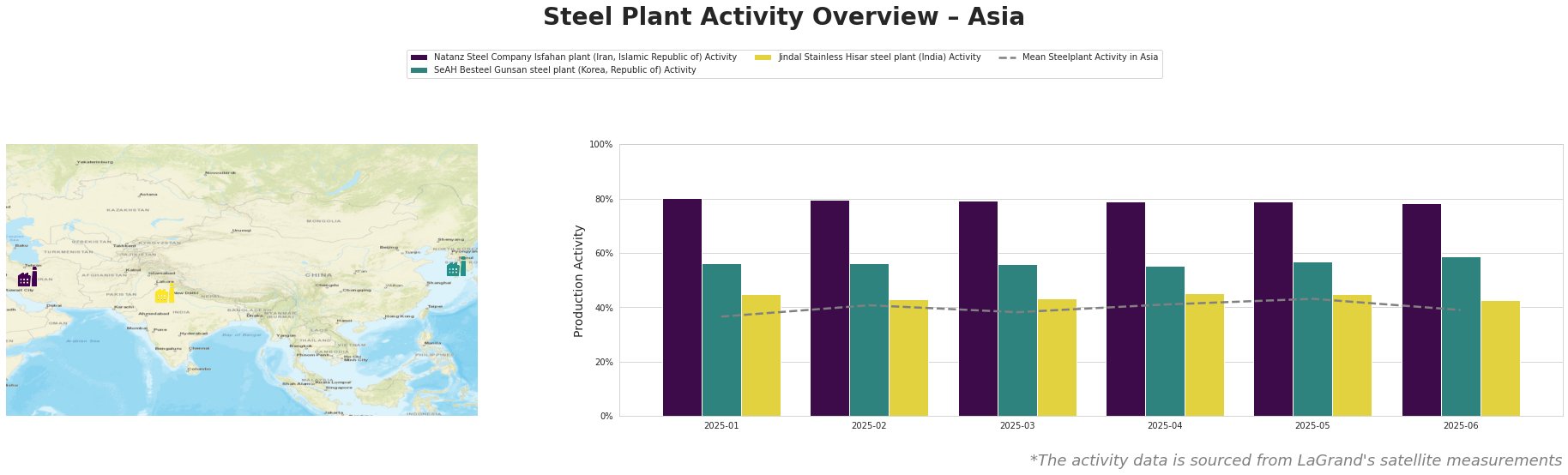

The mean steel plant activity in Asia fluctuated between 37% and 43% over the observed period, ending at 39% in June. Natanz Steel Company consistently exhibited the highest activity, around double the Asian mean. SeAH Besteel Gunsan steel plant showed a slight upward trend, reaching 59% in June. Jindal Stainless Hisar steel plant activity remained relatively stable, fluctuating between 43% and 45%.

Natanz Steel Company Isfahan plant

The Natanz Steel Company Isfahan plant, an integrated DRI-EAF operation with a crude steel capacity of 1000 ttpa, maintained a consistently high activity level (around 80%), significantly above the Asian average. A slight decrease to 78% in June was observed. Given its focus on rebar production, high activity may indicate sustained regional demand for construction materials. The news articles provide no direct insights into the drivers of this plant’s activity.

SeAH Besteel Gunsan steel plant

SeAH Besteel Gunsan steel plant, primarily an EAF-based special steel producer for automotive and other industries, experienced a gradual increase in activity, reaching 59% in June. This increase may be linked to regional automotive or infrastructure demand, however no articles discussed specifics to the automotive industry, or the South Korean economy. The news articles provide no direct insights into the drivers of this plant’s activity.

Jindal Stainless Hisar steel plant

Jindal Stainless Hisar steel plant, an EAF-based stainless steel producer, maintained a relatively stable activity level between 43% and 45%. As the plant produces stainless products for automotive, building, energy and steel packaging, it is subject to a multitude of markets. Activity is slightly above the mean. The news articles provide no direct insights into the drivers of this plant’s activity.

Evaluated Market Implications

The sustained high activity at Natanz Steel suggests a stable regional demand for its products, such as rebar and other long products. While broader economic uncertainties stemming from US trade policy as highlighted in “Marktbericht: Setzt der DAX die Erholung fort?” could impact future demand, the current operational tempo indicates minimal immediate disruption. The news articles “Stock Index Futures Slip With Focus on Trump’s Tax Bill and Trade Deals, U.S. JOLTs Report and Powell’s Remarks on Tap” and “Foreign stocks are crushing US shares, even with the new record high” indicate possible trade changes, however due to the number of countries involved, and plant’s reliance on the local market, we cannot establish any direct links.

Recommended Procurement Actions:

* Monitor Natanz Steel supply chains closely. While current activity is high, track regional construction indicators to anticipate potential future demand shifts.

* Diversify sources. Given global trade uncertainties as emphasized in “Foreign stocks are crushing US shares, even with the new record high,” steel buyers should seek diverse supply sources, especially for specialized steels like those produced by SeAH Besteel and Jindal Stainless.

* Negotiate long-term contracts strategically. Capitalize on any temporary dips in international pricing due to the uncertainty described in “Stock Index Futures Slip With Focus on Trump’s Tax Bill and Trade Deals, U.S. JOLTs Report and Powell’s Remarks on Tap“, but factor in potential longer-term trade impacts.