From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals in European Steel: Production Gains in Poland & Austria Amidst German Decline

Europe’s steel market presents a mixed landscape as of late June 2025. While Poland and Austria show signs of growth, Germany faces continued production declines. According to “German crude steel output down 10.8 percent in Jan-May 2025“, Germany’s crude steel production is down, while “Poland increased steel production by 3.7% y/y in January-May” indicates growth in Poland. The article “Austria increased steel production by 12.2% m/m in May” highlights a monthly increase in Austria’s steel production, although year-to-date figures show a decrease. There is no directly reported correlation between these news articles and the observed satellite activity data, with only regional aggregate data being provided.

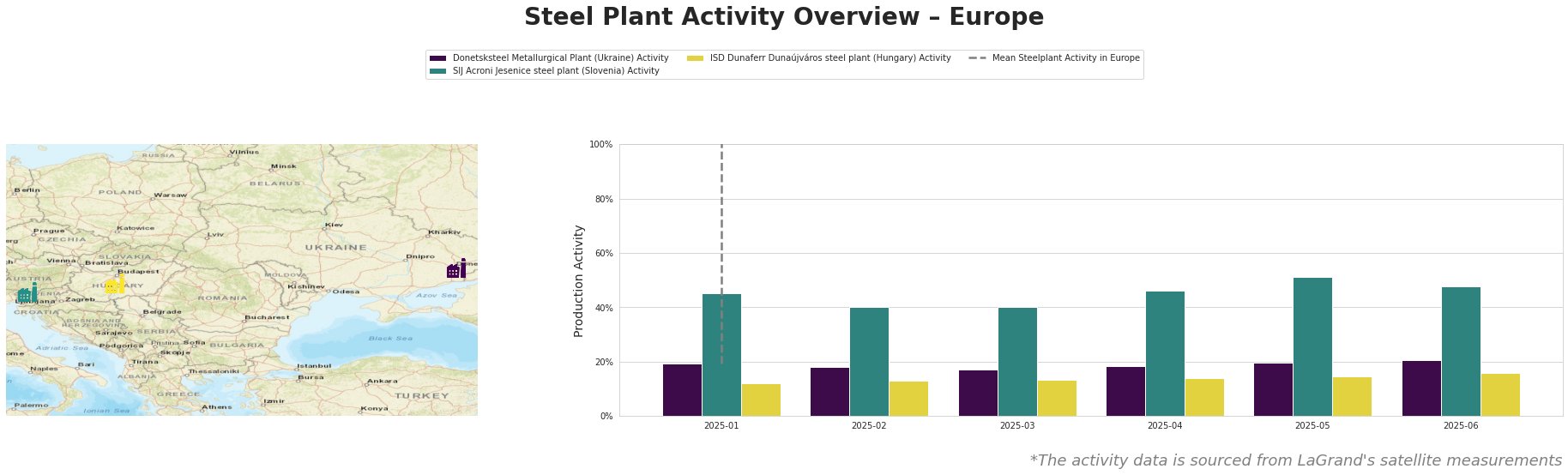

Overall, activity levels based on satellite measurements show fluctuations across all observed plants. Donetsksteel shows a gradual increase from January (19%) to June (21%). SIJ Acroni shows initial stability at 40% from February to March, then increased activity to 51% in May, followed by a slight decrease to 48% in June. ISD Dunaferr displays a consistent gradual increase from 12% in January to 16% in June. It is very important to note that the “Mean Steelplant Activity in Europe” values are significantly higher than individual plants and are, therefore, considered anomalous values in the dataset (most likely an artifact of data processing or sensor error).

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, primarily produces pig iron using integrated (BF) processes. Its activity has seen a slight but consistent increase from 19% in January to 21% in June. Given the lack of direct news linking to this plant, these changes cannot be directly correlated with specific market events or reported production changes.

SIJ Acroni Jesenice steel plant in Slovenia, relies on EAF technology for its production of semi-finished and finished rolled steel products. The plant’s activity peaked at 51% in May after staying steady at 40% in February and March, indicating increased output, although decreasing back to 48% in June. Again, there’s no directly correlating news data to tie this increased plant activity to any recent market development explicitly, but its increase does coincide with the increase in “Austria increased steel production by 12.2% m/m in May”.

ISD Dunaferr Dunaújváros steel plant in Hungary, an integrated plant using BF and BOF processes, saw a gradual rise in activity from 12% in January to 16% in June. As with the other plants, no direct news specifically mentions ISD Dunaferr or relates to its production shifts that would explain the steady increase in activity levels.

The news “German crude steel output down 10.8 percent in Jan-May 2025” implies potential supply constraints within the German market. The “Poland increased steel production by 3.7% y/y in January-May” indicates the potential to offset supply shortages elsewhere in Europe, given logistical proximity. While Austria had a strong month in May with “Austria increased steel production by 12.2% m/m in May”, the overall trend for Jan-May is still down by 4.5%.

Given the decline in German steel production and the rise in Polish production, buyers focused on the German market should proactively:

- Diversify Sourcing: Explore Polish steel suppliers, especially those highlighted in the “Poland increased steel production by 3.7% y/y in January-May” article (ArcelorMittal, Celsa Huta Ostrowiec, Huta Czestochowa, CMC Zawiercie, ArcelorMittal Dąbrowa Górnicza, and Ferrostal Labedy Gliwice), to mitigate potential supply disruptions stemming from reduced German output.

- Negotiate Contracts: Given the potential for increased demand on Polish steelmakers as German output falls, initiate contract negotiations early to secure favorable pricing and volumes.