From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIran Steel Market: Nuclear Setbacks Impact Production; Procurement Risks Emerge

Recent developments in Iran’s geopolitical landscape are impacting its steel industry. Specifically, the activity levels at key steel plants may be affected by recent geopolitical events reported in the news articles: “Iran’s nuclear programme set back ‘significantly’: IAEA“ and “Trump says Iran will not restart enrichment“. These articles highlight the damage inflicted on Iranian nuclear facilities, although it is unclear if there is a direct link between the disruption of the nuclear program and changes in activity at specific steel plants.

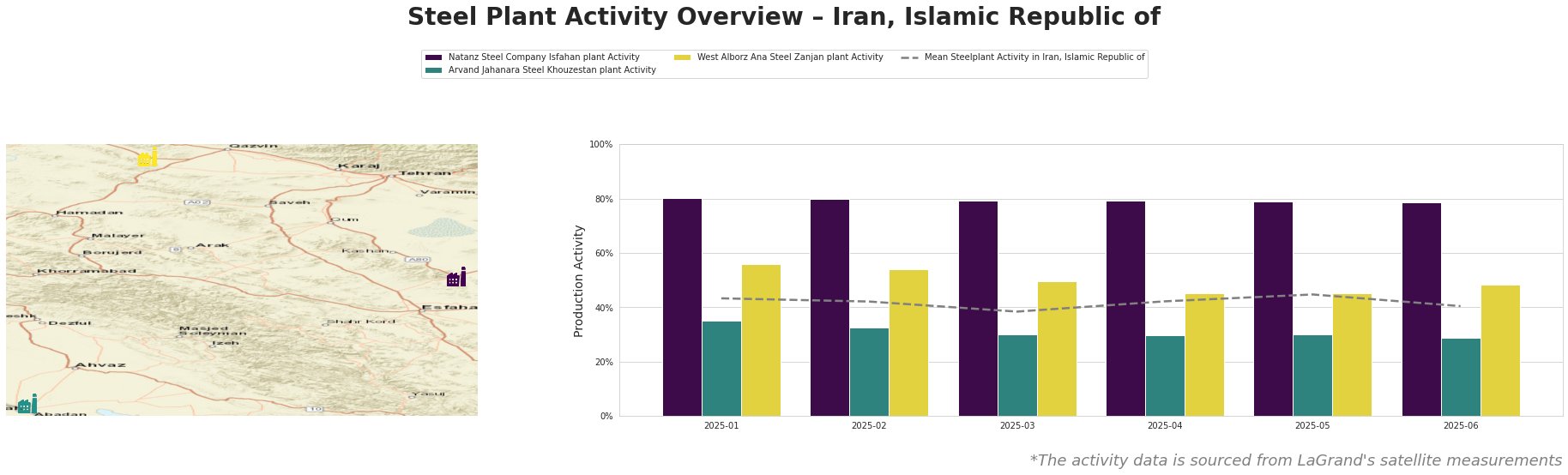

The data shows a relatively stable activity level at the Natanz Steel Company Isfahan plant, contrasting with fluctuations at other plants. The mean steel plant activity across Iran, Islamic Republic of, has fluctuated between 38% and 45% over the period.

Natanz Steel Company Isfahan plant, located in Isfahan, is an integrated steel plant with a capacity of 1 million tonnes per annum (ttpa) of crude steel produced via EAF, utilizing 1.5 million ttpa of DRI. The plant produces semi-finished and finished rolled products, including bar and rebar. The plant’s activity remained consistently high at around 80% throughout the monitored period, well above the national average. There is no evident connection between the stable observed activity level at this plant and the geopolitical news outlined in articles such as “Morning Glory: Trump’s signature quote on Iran cements a decisive success“ or “Trump navigates the most complex foreign policy crisis of his presidency, one ‘Truth’ at a time“.

Arvand Jahanara Steel Khouzestan plant, situated in Khouzestan, has a crude steel capacity of 1.5 million ttpa produced via EAF. The plant’s activity has been consistently below the national average. Activity has declined slightly, from 35% in January 2025 to 29% in June 2025. There is no clear link between this observed decrease and the specific news articles provided.

West Alborz Ana Steel Zanjan plant, located in Zanjan, has a crude steel capacity of 1.5 million ttpa produced via EAF, utilizing 1.2 million ttpa of DRI. It also features significant sintering (2 million ttpa) and pelletizing (1.8 million ttpa) capacity. The plant’s activity declined from 56% in January 2025 to 45% by April and May before increasing slightly to 48% in June. The plant produces semi-finished products, specifically billets. There is no explicit connection between the fluctuations in plant activity and the provided news articles.

The IAEA’s report, as per the article “Iran’s nuclear programme set back ‘significantly’: IAEA,” implies potential disruptions to Iran’s industrial capabilities, but without further information about the interdependencies between the steel industry and the nuclear program no explicit recommendations can be given.

Procurement Recommendations:

- Monitor Regional Supply Chains: Steel buyers should closely monitor supply chains originating from or passing through the Khouzestan region, given the lower activity levels observed at Arvand Jahanara Steel Khouzestan plant.

- Evaluate Alternative Sourcing: Procurement professionals relying on billet from West Alborz Ana Steel Zanjan plant, should develop contingency plans or evaluate alternative sourcing options due to the observed activity fluctuations.

- Maintain Buffer Stock: Given the geopolitical instability, steel buyers are advised to maintain a reasonable buffer stock of critical steel products to mitigate potential supply disruptions.

- Closely monitor Natanz Steel company: The consistently high utilization of the plant may indicate the importance of this particular plant for Iranian steel making. Closely observe any future disturbances of operations.