From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Hit by Middle East Tensions, Plant Activity Declines

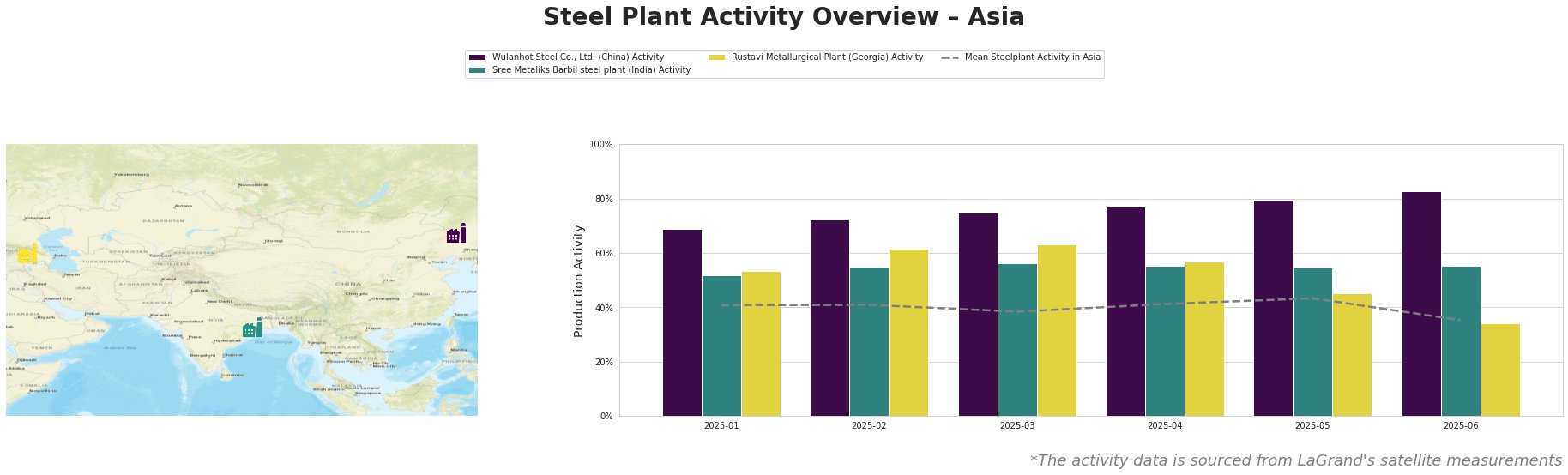

Asia’s steel market faces downward pressure amid recent geopolitical instability and fluctuating energy prices. The drop in mean steel plant activity can be linked to news articles such as “Potential closure of Hormuz strait by Iran to trigger higher oil prices, inflation and shipping route disruptions” which suggests a potential impact on production costs and disruptions to shipping routes. Furthermore, the resumption of Israeli gas fields after the Israel-Iran truce, as reported in “Israeli gas fields to restart after Israel-Iran truce,” could alleviate some energy cost pressures, but the overall outlook remains uncertain.

The mean steel plant activity in Asia decreased from 43.0% in May to 35.0% in June. Wulanhot Steel Co., Ltd. shows a continuous increasing trend and reaches an activity level of 83.0% in June, significantly above the Asian mean. Sree Metaliks Barbil steel plant maintains a relatively stable activity level around 55%. The Rustavi Metallurgical Plant experienced a significant drop in activity, from 57.0% in April to 34.0% in June, falling significantly below the Asian mean. The oil price volatility mentioned in “Morning Bid: Oil, rates and the dollar tumble” may have contributed to the overall decline.

Wulanhot Steel Co., Ltd., located in Inner Mongolia, China, operates primarily through the BF-BOF integrated process with a crude steel capacity of 1,050 thousand tonnes per annum (ttpa) and iron capacity of 1,300 ttpa. The plant’s activity has consistently increased over the months, reaching 83.0% in June. This increase contrasts with the overall decline in the Asian mean and may be related to domestic demand factors not directly addressed in the provided news articles.

Sree Metaliks Barbil steel plant, located in Odisha, India, uses both BF and DRI processes and has a crude steel capacity of 700 ttpa. Its activity level remained relatively stable at around 55% throughout the period. No direct link can be established between this stability and the provided news articles.

Rustavi Metallurgical Plant, located in Kvemo Kartli, Georgia, utilizes an integrated BF process along with EAF technology, with a crude steel capacity of 120 ttpa and iron capacity of 725 ttpa. Activity significantly declined from 57.0% in April to 34.0% in June. This decline, combined with potential oil price spikes mentioned in “US producers rushed to hedge on Israel-Iran oil spike,” could be linked to increased energy costs, as the plant uses a captive power plant built in 1946.

Given the decreased mean steel plant activity in Asia, particularly the notable drop in activity at Rustavi Metallurgical Plant, potentially linked to energy cost fluctuations stemming from Middle East tensions, steel buyers should:

- Prioritize diversification of steel sources: Reduce reliance on regions potentially affected by geopolitical instability.

- Closely monitor energy price developments: Track how oil price volatility impacts steel production costs, especially for plants like Rustavi reliant on older energy infrastructure. The trends reported in “Mideast Gulf VLCC rates halve as ceasefire holds” provide useful real-time insights.

- Engage in short-term procurement strategies: Given market uncertainties, focus on securing supply for immediate needs rather than long-term contracts.