From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mideast Ceasefire Impacts VLCC Rates, Plant Activity Shows Mixed Signals

Asia’s steel market reflects a neutral sentiment, influenced by fluctuating geopolitical tensions and shifting economic factors. Recent changes in plant activity, while present, cannot be conclusively linked to specific news events related to the Israel-Iran conflict, highlighting underlying market dynamics. This is despite the fact that fluctuations in energy markets as reported in “Morning Bid: Oil, rates and the dollar tumble” and “US producers rushed to hedge on Israel-Iran oil spike” might be anticipated to impact energy-intensive steel production.

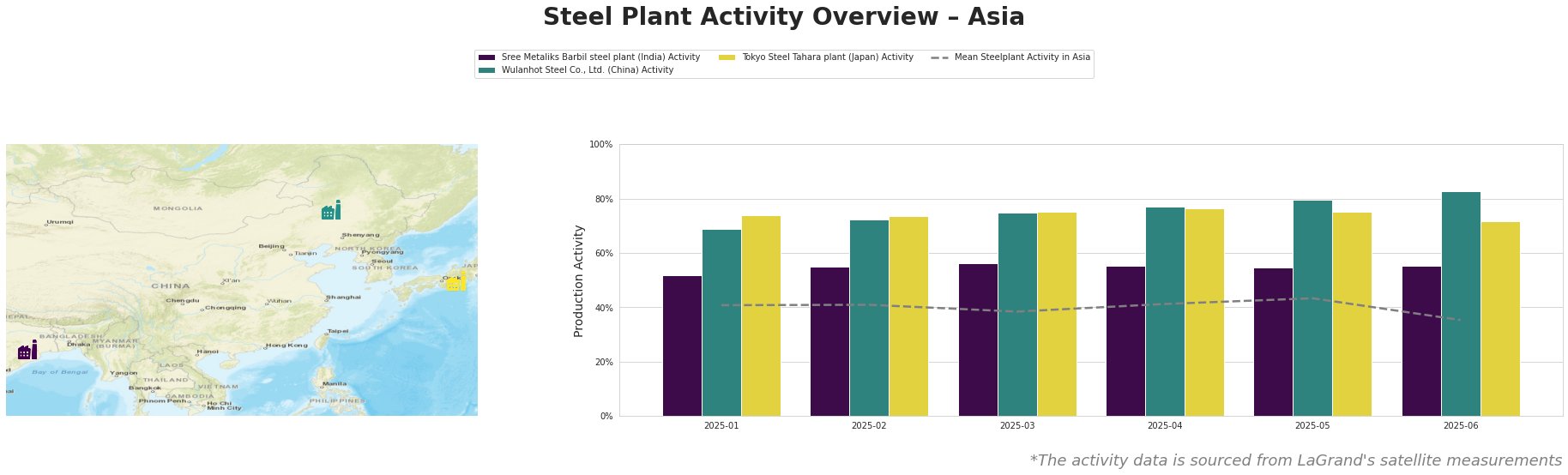

Here’s an overview of the observed plant activities in the last six months:

The mean steel plant activity in Asia peaked in May at 43.0% and then significantly dropped to 35.0% in June.

-

Sree Metaliks Barbil steel plant (India): Activity has remained relatively stable, hovering around 55%, consistently above the Asian mean except for the month of May. This stability occurs despite the disruptions referenced in “Israeli gas fields to restart after Israel-Iran truce” where gas exports to Egypt and Jordan were halted which led those countries to curb industrial activity. No direct connection to the news events can be established. The plant has a capacity of 700 ttpa of crude steel, using both BF and DRI processes, producing primarily DRI, pig iron, billets, and TMT bars.

-

Wulanhot Steel Co., Ltd. (China): The plant demonstrates a continuous increase in activity, reaching a peak of 83% in June, significantly exceeding the Asian average. This upward trend, though notable, cannot be directly correlated with any of the provided news articles. The plant’s 1050 ttpa crude steel capacity relies on BOF technology integrated with BF, focusing on finished rolled products for the building and infrastructure sectors.

-

Tokyo Steel Tahara plant (Japan): Activity has been consistently high, remaining above the Asian mean, but saw a drop from 75% to 72% in June. This decline, while modest, might reflect broader economic adjustments, but no direct link to the ceasefire or associated events can be confirmed based on the provided information. With a 2500 ttpa crude steel capacity based on EAF technology, the plant produces semi-finished and finished rolled products.

Evaluated Market Implications:

The significant decrease in VLCC rates reported in “Mideast Gulf VLCC rates halve as ceasefire holds” indicates a potential easing of transportation costs for raw materials to Asia. Given that Sree Metaliks Barbil and Wulanhot Steel have been maintaining or increasing their production, buyers in India and China might expect that those plants may be able to access inputs at lower costs.

- Procurement Action: Steel buyers should monitor freight rates for further declines, and potentially negotiate for better prices as production is stable in key regions. Buyers should watch for opportunities to optimize inventory levels given the relative stability and the potential price benefits from reduced VLCC freight rates. Buyers need to remain vigilant as markets adjust to the post-conflict environment.