From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJapan Steel Output Declines Amid Import Shifts: A Buyer’s Guide

Japan’s steel market faces challenges as evidenced by the recent news. “Japanese crude steel output down 4.7 percent in May” reports a decrease in production, a trend further confirmed by “Japan’s crude steel output extends fall on year in May.” While these reports highlight production declines, it is not possible to directly relate these to specific satellite-observed activity changes at individual plants based on the current data. However, a significant shift in raw material sourcing is highlighted by “Japan’s Australian iron ore imports fall on year in May,” indicating a potential restructuring of supply chains. “Japan’s steel scrap exports up 25.7 percent in January-May 2025” points to increased scrap availability for domestic producers or a potential shift in export strategy.

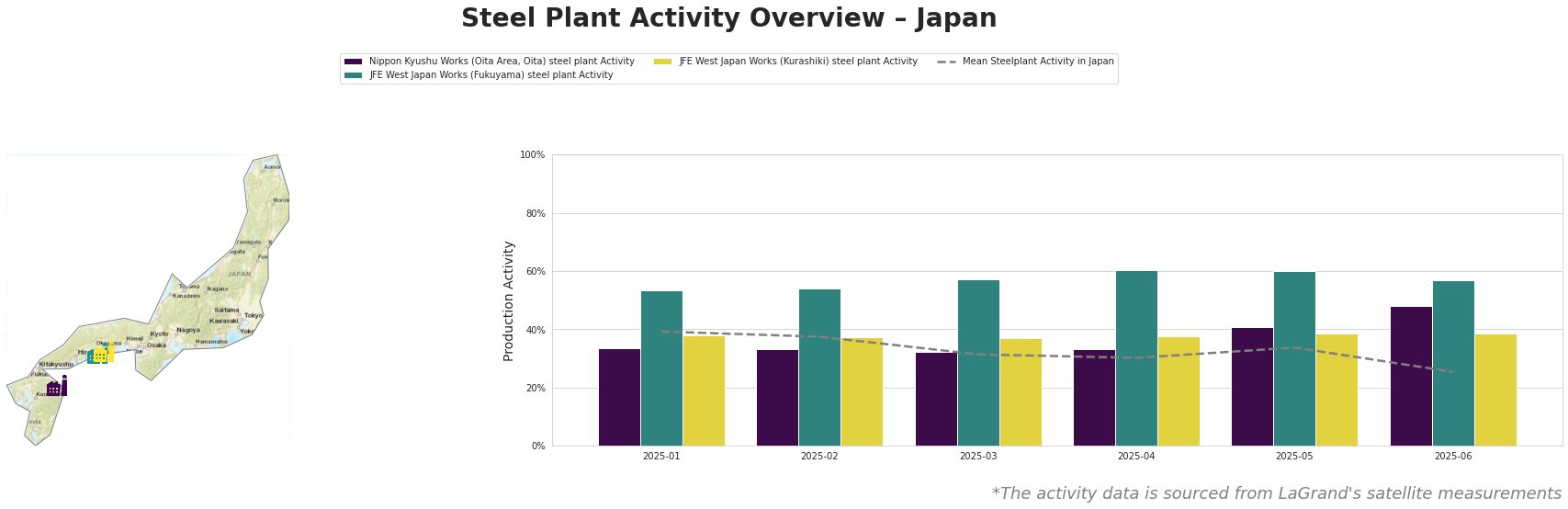

The mean steel plant activity in Japan shows a downward trend, decreasing from 39.0% in January to 25.0% in June. Nippon Kyushu Works initially showed a low activity of 33.0% and is now showing a positive increase in activity ending on 48.0% in June. JFE West Japan Works (Fukuyama) steel plant consistently operated above the national average, with activity peaking at 60.0% in April and May, but decreasing to 57.0% in June. JFE West Japan Works (Kurashiki) steel plant showed relatively stable activity, fluctuating only slightly between 37.0% and 39.0%. It is not possible to directly correlate the satellite-observed activity levels with the specific output declines reported in the news articles “Japanese crude steel output down 4.7 percent in May” and “Japan’s crude steel output extends fall on year in May” based on the provided information.

Nippon Kyushu Works (Oita Area, Oita) is an integrated steel plant with a crude steel capacity of 10 million tons per annum, primarily utilizing basic oxygen furnaces (BOF). It focuses on producing hot-rolled steel sheets and steel plates for the automotive, building, and machinery sectors. The plant’s activity level has increased from 33.0% in January to 48.0% in June, showing a substantial recovery. It is not possible to directly link this increase to specific news events based on the current data.

JFE West Japan Works (Fukuyama) is also an integrated steel plant with a crude steel capacity of 13 million tons per annum, relying on blast furnaces (BF) and BOF. Its diverse product range includes hot-rolled, cold-rolled, and coated sheets, plates, and structural sections for various industries. The plant’s activity remained high at 60% from April to May, then decreased to 57.0%. It is not possible to directly link this decrease to the production decline reported in the news based on the current data.

JFE West Japan Works (Kurashiki) is an integrated steel plant. Its activity remained relatively stable. It is not possible to directly link the production volume to the news.

The decrease in iron ore imports from Australia, as reported in “Japan’s Australian iron ore imports fall on year in May,” coupled with increased steel scrap exports (“Japan’s steel scrap exports up 25.7 percent in January-May 2025”), suggests a potential shift towards greater reliance on scrap-based steel production.

Procurement Action Recommendations:

- Monitor scrap prices: Given the increased steel scrap exports and potential shift towards scrap-based production, procurement professionals should closely monitor domestic and international scrap prices to anticipate potential cost fluctuations.

- Diversify iron ore suppliers: In light of the reduced iron ore imports from Australia, explore alternative sourcing options from Canada or other regions to mitigate supply chain risks. Buyers should consider negotiating long-term contracts with diversified suppliers to ensure stable material supply.

- Assess impact of domestic demand: Considering the weakness in domestic demand, steel buyers should carefully assess their inventory levels and adjust procurement strategies to avoid overstocking. Negotiating flexible delivery schedules with suppliers can help mitigate risks associated with fluctuating demand.

- Stay informed on facility closures: Considering JFE Steel postponed a planned facility closure, it is important to monitor closely the equipment status to prevent disruption in supply. Contacting JFE for transparency can help.