From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Exports Surge Amidst Production Shifts: An Asian Steel Market Update

Asia’s steel market presents a complex picture of shifting production and export dynamics. The key drivers are: China’s increasing exports coupled with decreasing domestic demand, Japan’s decreasing output, and global production adjustments. According to “China’s semis exports up 75% in May from April, surge 306% in Jan-May, 2025” and “Exports of semi-finished products from China increased by 75% in May“, Chinese semi-finished steel exports have surged, suggesting increased activity at some Chinese mills. Simultaneously, the article “China reduced iron ore production by 10.1% y/y in January-May” indicates reduced iron ore production, which doesn’t directly align with the increased steel exports without further analysis of inventory and import levels.

Observed Steel Plant Activity:

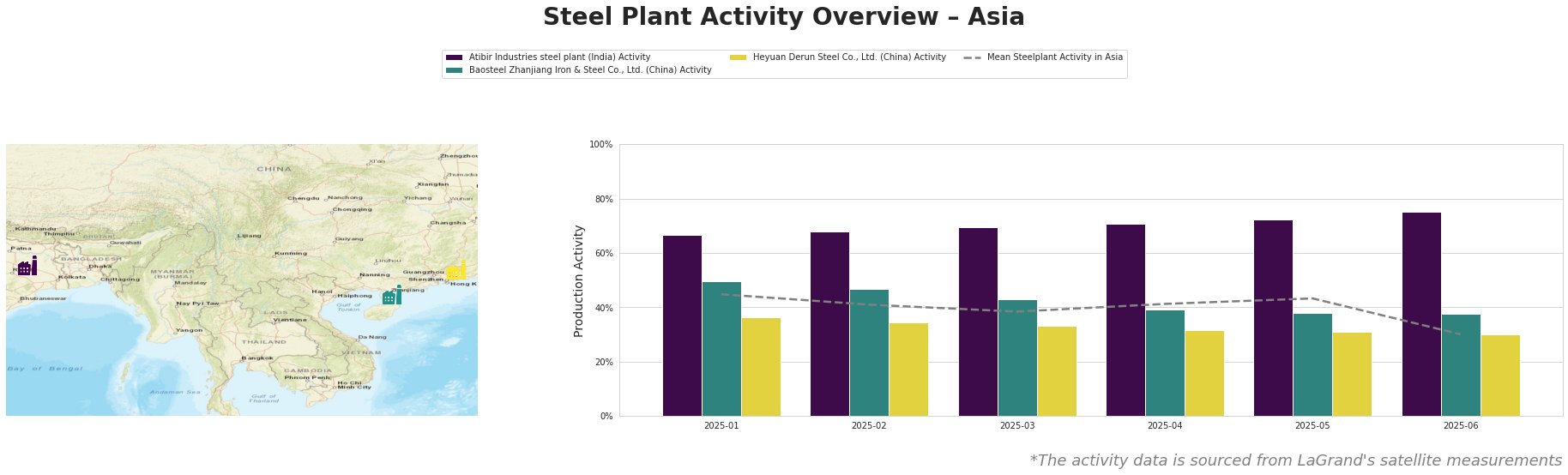

The mean steel plant activity in Asia shows a fluctuating trend with a sharp drop to 30% in June. Atibir Industries in India shows a consistent increase, reaching 75% in June. Baosteel Zhanjiang in China shows a gradual decline, stabilizing at 38% in May and June. Heyuan Derun Steel in China shows a consistent downward trend, reaching 30% in June. Atibir Industries’ activity is consistently above the Asian average, while Baosteel Zhanjiang’s and Heyuan Derun’s are consistently below.

Atibir Industries steel plant in Jharkhand, India, is an integrated steel plant using BF/BOF technology with a crude steel capacity of 600 ttpa. The plant’s activity has steadily increased from 67% in January to 75% in June. This upward trend doesn’t directly correlate with the news articles focusing on China and global production declines, suggesting regional or company-specific factors are at play.

Baosteel Zhanjiang Iron & Steel Co., Ltd., located in Guangdong, China, possesses a significant crude steel capacity of 12,528 ttpa, relying on integrated BF/BOF processes. The plant’s activity has gradually decreased from 50% in January to 38% in May, remaining stable in June. Although it’s possible that Baosteel Zhanjiang’s reduction contributes to the overall decrease in Chinese steel production mentioned in “China reduced iron ore production by 10.1% y/y in January-May“, no direct connection can be explicitly made based on the provided information.

Heyuan Derun Steel Co., Ltd., also in Guangdong, China, is an EAF-based steel plant with a crude steel capacity of 1200 ttpa. Its activity has consistently declined from 36% in January to 30% in June. No direct connection can be established between Heyuan Derun’s declining activity and the news articles, even though the overall activity decrease would match with the overall decrease in Chinese domestic demand according to the article “Domestic demand for steel in China continues to fall“.

Given the surge in Chinese semi-finished steel exports reported in “China’s semis exports up 75% in May from April, surge 306% in Jan-May, 2025” and “Exports of semi-finished products from China increased by 75% in May“, alongside declining domestic demand described in “Domestic demand for steel in China continues to fall“, steel buyers should anticipate increased availability of semi-finished steel from Chinese suppliers in the short term. Therefore, procurement strategies should be adapted to capitalize on potential price advantages in semi-finished steel. Steel buyers should also closely monitor potential trade policy changes that may impact export dynamics.