From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market Braces for Potential Supply Disruptions Amidst Weakening Global Prices

Oceania’s steel market faces potential disruptions as global steel prices decline, although a direct connection between these price drops and plant activity in Oceania cannot be definitively established based on the provided news and data. The European market is currently experiencing downward pressure, as highlighted in “European HRC prices close to cost line after aggressive sales push,” “European steel CRC, HDG prices fall on seasonal slowdown, import competition,” and “European HRC prices continue falling.” There is no explicit indication in the news or activity data that the steel market developments in Europe are reflected in Oceania.

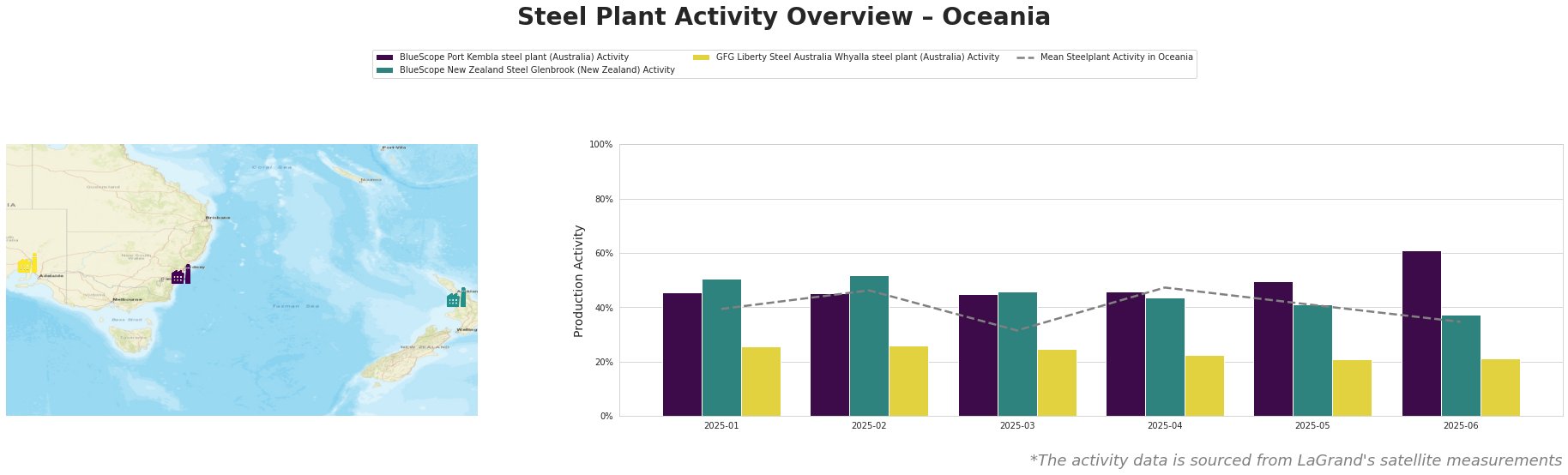

Overall, the mean steel plant activity in Oceania has fluctuated. It peaked in April at 47.0%, but saw a decline to 35.0% in June. BlueScope Port Kembla shows a notable increase in activity, reaching 61.0% in June. In contrast, GFG Liberty Steel Australia Whyalla steel plant consistently exhibits the lowest activity levels, remaining near 20% throughout the observed period.

BlueScope Port Kembla, an integrated BF/BOF steel plant in New South Wales, Australia, with a crude steel capacity of 3.2 million tonnes per annum, produces slabs, hot rolled coil, and plate primarily for the building and infrastructure sectors. Activity at this plant has generally been above the Oceania average, with a significant increase to 61.0% in June. No direct link to the cited news articles can be established, as the price declines in Europe do not appear to have impacted the company’s activity.

BlueScope New Zealand Steel Glenbrook, an integrated DRI/BOF steel plant in South Auckland, New Zealand, has a crude steel capacity of 650,000 tonnes per annum, producing slabs, hot rolled products, and cold rolled products for various sectors. Its activity levels were highest in February (52.0%), before declining steadily to 37.0% in June. Again, there’s no explicit connection to the price decreases reported in Europe, so the cause of the reduced activity is unknown.

GFG Liberty Steel Australia Whyalla steel plant, an integrated BF/BOF steel plant in South Australia with a crude steel capacity of 1.2 million tonnes per annum, produces long products for building, infrastructure, and other sectors. Activity at this plant has been consistently low, with a slight decline to 21.0% in both May and June. No direct link to the European price trends can be inferred from the provided data.

Evaluated Market Implications:

While European HRC, CRC and HDG prices have weakened due to factors like seasonal slowdowns and increased import competition from Asia as stated in “European steel CRC, HDG prices fall on seasonal slowdown, import competition“, this has not manifestly impacted Oceania steel production. Nonetheless, the consistent low activity at GFG Liberty Steel Australia Whyalla warrants monitoring, as it could potentially lead to localized supply constraints for long steel products within Australia.

Recommended Procurement Action:

- Steel buyers who rely on GFG Liberty Steel Australia Whyalla for the supply of long steel products (rod, bar, wire, tube) should closely monitor the plant’s production output and consider diversifying their sources to mitigate potential supply disruptions.