From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUS-China Trade Deal Boosts Asian Steel: Production Surge Anticipated

The Asian steel market shows positive signs following a new trade agreement between the US and China, as indicated by the news articles “Handelskonflikt: Neue Einigung zwischen Trump und China” and “USA und China unterschreiben Handelsvereinbarung“. While a direct link between these news events and observed plant activity cannot be definitively established, the overall market sentiment is positive, potentially influencing future production levels.

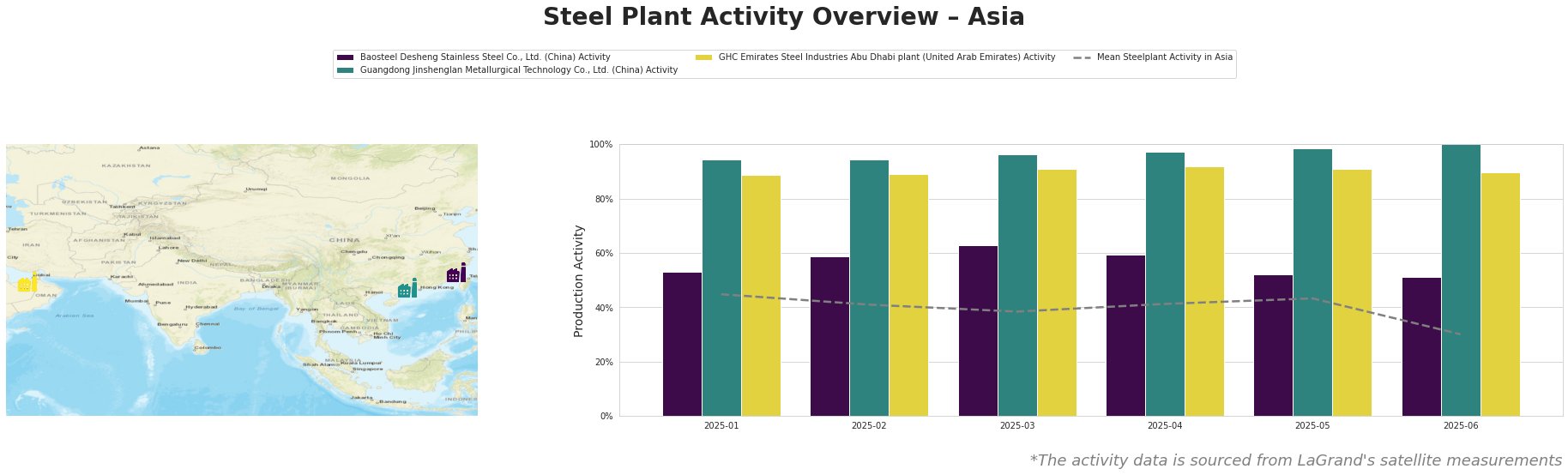

The mean steel plant activity in Asia experienced a decline over the observed period, hitting a low of 30% in June. Baosteel Desheng saw its activity fluctuate, peaking in March at 63% and then decreasing to 51% by June. Guangdong Jinshenglan consistently operated at very high activity levels, reaching 100% in June. GHC Emirates Steel Industries maintained a relatively stable, high activity level throughout the period, hovering around 90%.

Baosteel Desheng Stainless Steel Co., Ltd., located in Fujian, China, operates as an integrated steel plant with a crude steel capacity of 3.41 million tonnes, primarily utilizing BF and BOF technologies for stainless steel production. The plant’s activity decreased from 63% in March to 51% in June. While the recent trade agreement could influence future production, no direct link can be established at this time.

Guangdong Jinshenglan Metallurgical Technology Co., Ltd., located in Guangdong, China, focuses on excellent special steel production using EAF technology with a capacity of 1.2 million tonnes. The plant exhibited consistently high activity, reaching 100% in June, suggesting strong demand for its specialized steel products. While the ” Handelskonflikt: Neue Einigung zwischen Trump und China” article describes a trade agreement that could benefit the steel industry, no direct link can be explicitly established between the agreement and the plant’s maximum production output.

GHC Emirates Steel Industries Abu Dhabi plant, with a 3.5 million tonne crude steel capacity, uses DRI and EAF technologies to produce rebar, wire rod, and other products. Its activity remained consistently high, around 90%, throughout the period. There is no direct relationship that can be established between plant output and the trade deal.

The new trade agreement between the US and China, reported in “Handelskonflikt: Neue Einigung zwischen Trump und China” and “USA und China unterschreiben Handelsvereinbarung“, could alleviate some trade tensions and potentially increase demand for steel, particularly benefiting plants like Guangdong Jinshenglan specializing in special steel. However, steel buyers should monitor closely how the trade agreement specifically impacts tariffs on steel and raw materials. Given the consistently high activity at Guangdong Jinshenglan, procurement professionals should attempt to secure supply contracts early to avoid potential shortages of specialized steel. If tariffs are reduced or eliminated as a result of the deal, consider diversifying suppliers to take advantage of potentially lower prices. Buyers should remain aware of the developments reported in “Handelskonflikt: „Lieber schnell als kompliziert“ – Merz will Turbo-Deal mit Trump“, as it suggests potential for further trade negotiations and shifts in the market landscape.