From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: ArcelorMittal Sale Amid Stable Activity; Procurement Alert

ArcelorMittal’s strategic shift in Bosnia impacts regional dynamics, but overall European steel plant activity remains largely stable. The sale of ArcelorMittal Zenica, as reported in “ArcelorMittal sells plants in Bosnia and Herzegovina to Pavgord Group“, “ArcelorMittal Sells Operations in Bosnia and Herzegovina“, and “ArcelorMittal to sell steelmaking business in Bosnia amid falling production“, has no immediately observable relationship with the satellite-observed activity levels of the selected steel plants.

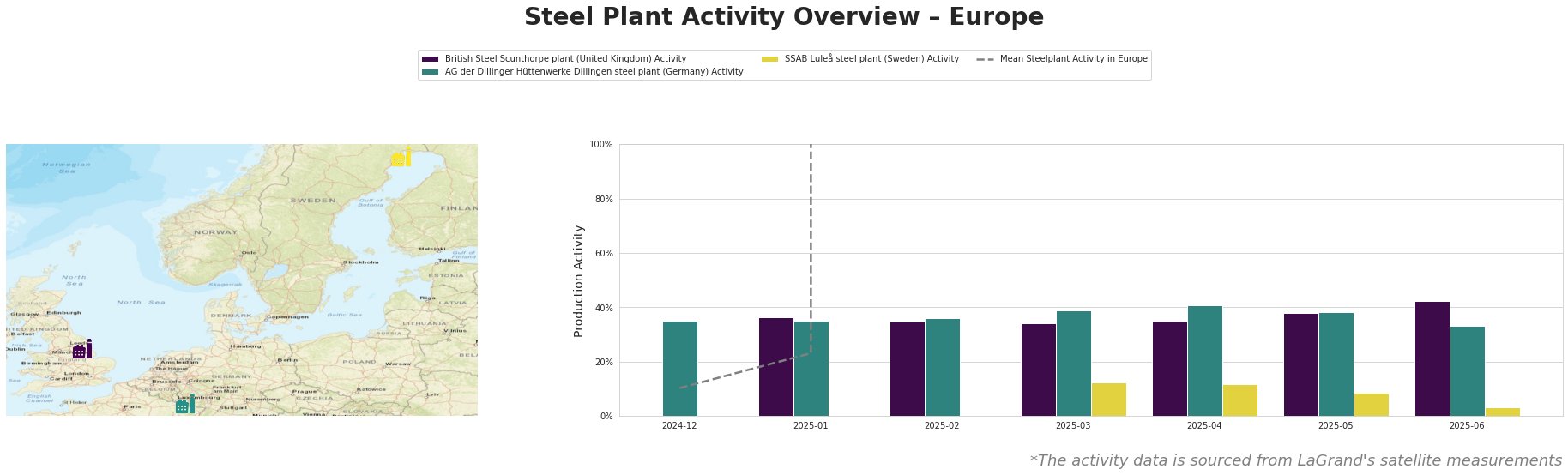

The average European steel plant activity shows significant fluctuations across the observed months, peaking in May 2025. Activity at the British Steel Scunthorpe plant remained relatively stable, showing an increase to 42% in June 2025. AG der Dillinger Hüttenwerke saw a peak activity of 41% in April 2025 and a decrease to 33% in June 2025. SSAB Luleå plant activity significantly decreased to 3% in June 2025. The overall trend suggests volatile production, with large changes in the monthly average.

The British Steel Scunthorpe plant, an integrated BF-BOF facility with a crude steel capacity of 3.2 million tonnes, produces semi-finished and finished rolled products. Satellite data shows a stable activity level throughout the observed period, increasing to 42% in June 2025. This stability does not directly reflect any of the provided news articles.

AG der Dillinger Hüttenwerke Dillingen, another integrated BF-BOF plant with a crude steel capacity of 2.76 million tonnes, manufactures heavy-plate products for various sectors. The plant’s activity levels peaked at 41% in April 2025 but declined to 33% by June 2025. This fluctuation cannot be directly attributed to the ArcelorMittal sale mentioned in the news articles.

SSAB Luleå, an integrated BF-BOF plant with a crude steel capacity of 2.3 million tonnes focused on slabs and crude iron, experienced a significant drop in activity, falling to 3% in June 2025. This decrease does not directly reflect any of the provided news articles.

The sale of ArcelorMittal’s Bosnian operations, while strategically important, doesn’t appear to be immediately impacting activity at the observed major European steel plants. However, the observed decrease in activity at SSAB Luleå plant to 3% in June 2025 warrants close monitoring for potential future supply chain effects.

Evaluated Market Implications:

The sale of ArcelorMittal Zenica (Bosnia) raises concerns about potential supply disruptions in the Balkan region. While not directly impacting the larger European plants monitored, the news highlights ArcelorMittal’s restructuring and potential impact on regional steel supply dynamics. Specifically, steel buyers who source from, or compete with, ArcelorMittal in the Balkans should actively seek alternative suppliers and closely monitor the transition of ownership to Pavgord Group.

Recommended Procurement Action: Steel buyers should diversify their sourcing strategies to mitigate potential disruptions related to ArcelorMittal’s sale in Bosnia. Focus on establishing relationships with alternative suppliers, particularly for product categories previously sourced from ArcelorMittal Zenica. Further, monitor the activity of the SSAB Luleå plant for consistent low activity in July which could further impact supply dynamics.