From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Rebar Production Dips, Semis Exports Surge Amidst Fluctuating Iron Ore Prices

China’s steel market presents a mixed picture. According to “China’s rebar output down 1.6 percent in January-May,” rebar production decreased, while “China’s semis exports up 75% in May from April, surge 306% in Jan-May, 2025” reports a significant rise in semi-finished steel exports. These trends may be influenced by reduced iron ore production, as highlighted in “China’s iron ore output down 10.1 percent in January-May,” although a direct relationship cannot be definitively established at this time.

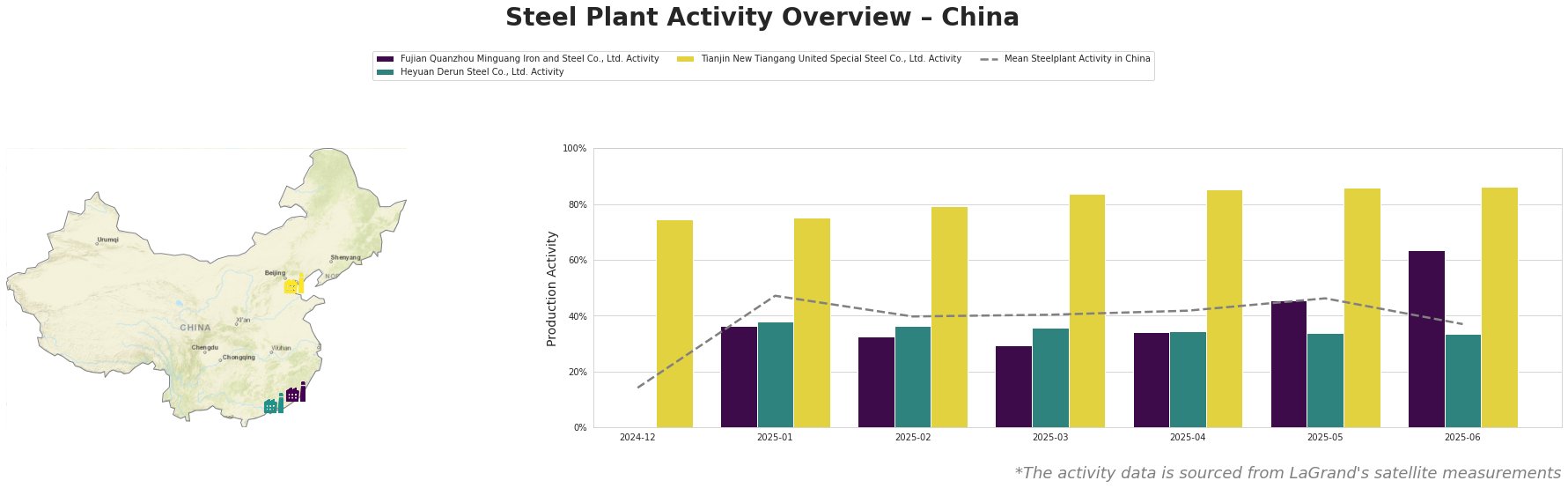

The mean steel plant activity in China fluctuated throughout the period, with a peak in January 2025 (47%) and a drop to 37% in June. Tianjin New Tiangang United Special Steel Co., Ltd. consistently showed high activity, ranging from 75% to 86%, significantly above the mean. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. saw a low of 29% activity in March, followed by a sharp increase to 64% in June. Heyuan Derun Steel Co., Ltd. exhibited relatively stable activity around 34-38% throughout the observed period. No direct links between these observed activity variations and the provided news articles can be explicitly established.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF steel plant in Fujian with a 2,550ktpa BOF crude steel capacity, produces finished rolled products like rebar and wire rod. After a low of 29% activity in March 2025, the plant experienced a notable increase to 64% by June. While “China’s rebar output down 1.6 percent in January-May” indicates an overall decrease in rebar production, the plant’s increasing activity in June suggests a possible shift in production strategy, potentially capitalizing on export opportunities as described in “China’s steel bar exports increase by 49.3 percent in Jan-May“.

Heyuan Derun Steel Co., Ltd., an electric arc furnace (EAF) steel plant in Guangdong with a 1,200ktpa crude steel capacity, produces finished rolled products like hot rolled rebar and semi-finished products like billets. The plant’s activity remained stable around 34-38% throughout the observed period. “China quadrupled its exports of semi-finished steel products in January-May” suggests increased exports of semi-finished products. However, it is not possible from the available data to determine if this plant directly contributed to this export surge.

Tianjin New Tiangang United Special Steel Co., Ltd., an integrated BF steel plant in Tianjin with a 4,500ktpa BOF crude steel capacity, produces finished rolled products like angle steel and semi-finished products like continuous casting billets. The plant maintained consistently high activity levels, ranging from 75% to 86%, throughout the observed period. While “China’s semis exports up 75% in May from April, surge 306% in Jan-May, 2025” highlights a general increase in semis exports, it’s impossible to confirm whether the sustained high activity at Tianjin New Tiangang directly correlates to increased billet exports.

Based on “China’s rebar output down 1.6 percent in January-May,” steel buyers focused on rebar should monitor price fluctuations closely, particularly given the volatility observed in May. Given the surge in semi-finished steel exports reported in “China’s semis exports up 75% in May from April, surge 306% in Jan-May, 2025”, procurement professionals should explore opportunities to diversify their supply sources. Steel buyers in regions reliant on Chinese semi-finished steel should anticipate potential price increases due to higher export demand.