From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Kametstal Stays Strong Despite Overall Dip, UK Energy Initiatives Signal Long-Term Boost

Ukraine’s steel sector shows mixed signals. While overall activity dipped in June, Kametstal maintains relatively stable production. The potential long-term impact of the UK’s energy initiatives, as highlighted in “The UK will reduce electricity costs for industry,” “UK set to boost clean energy investments by £30bn/yr,” and “The UK will increase investment in clean energy to over £30 billion per year,” may benefit specific Ukrainian steel exporters supplying the UK market. However, there is currently no direct observable impact of the UK energy initiatives on the current activity levels of the Ukrainian steel plants.

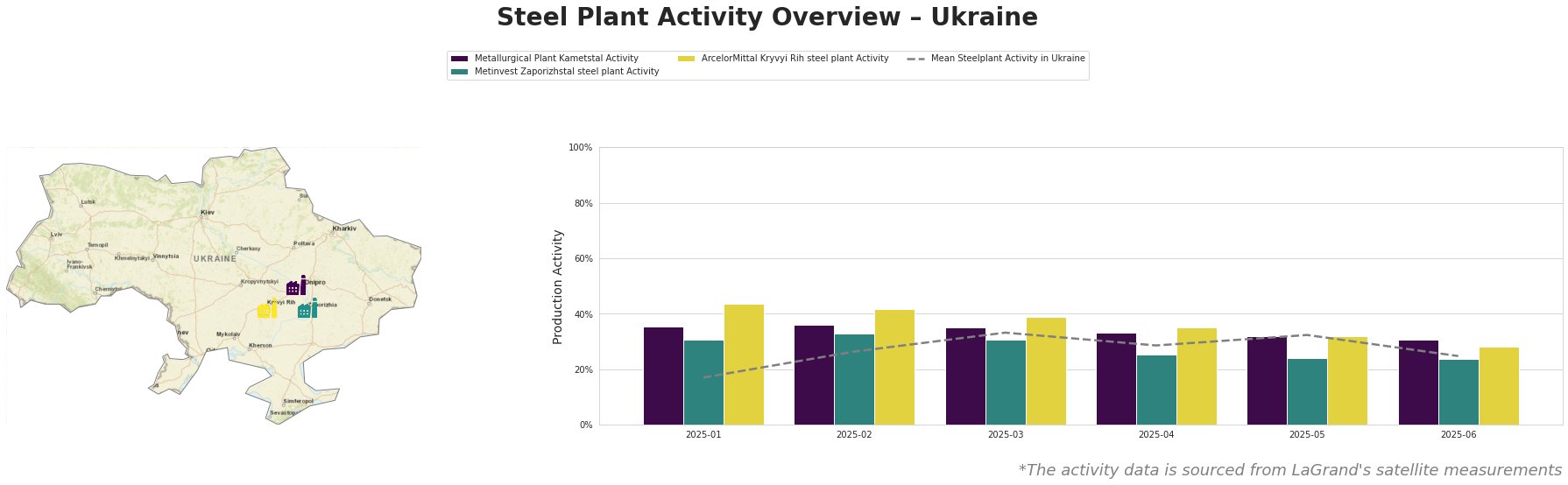

The mean steel plant activity in Ukraine shows a general upward trend from January (17%) to March (33%), followed by a decline to 25% in June. Metallurgical Plant Kametstal shows a more stable trend, hovering around 31-36%, indicating resilience compared to the other plants. Metinvest Zaporizhstal shows a decrease from 31% in January to 24% in both May and June. ArcelorMittal Kryvyi Rih experienced the highest activity in January (44%) but has steadily decreased to 28% by June.

Metallurgical Plant Kametstal, located in Dnipropetrovsk, utilizes integrated BF-BOF processes and boasts a crude steel capacity of 4.2 million tonnes per annum. The plant focuses on semi-finished and finished rolled products, including square billets, wire rods, and rails, primarily serving the energy and transport sectors. While the average Ukrainian steel plant activity experienced a decline in June, Kametstal’s activity only slightly decreased from 32% to 31%. This relative stability suggests consistent production despite broader market fluctuations. No direct link to provided news articles can be established.

Metinvest Zaporizhstal, situated in Zaporizhzhia, operates with integrated BF-OHF processes and has a crude steel capacity of 4.1 million tonnes annually. Its primary output is finished rolled products such as hot-rolled coil and cold-rolled sheets, targeting the automotive, steel packaging, and transport industries. Activity at Metinvest Zaporizhstal has declined steadily from 31% in January to 24% in June, a significant drop compared to the overall Ukrainian average. There is no clear link of this slow down to provided news articles.

ArcelorMittal Kryvyi Rih, based in Dnipropetrovsk, is an integrated BF-BOF-OHF plant with a substantial crude steel capacity of 8 million tonnes per year. The plant produces both semi-finished and finished rolled products, including billet, rebar, and wire rod, serving the building and infrastructure sectors. The plant’s activity decreased significantly from 44% in January to 28% in June. There is no clear correlation between this activity reduction and the provided news.

Given the overall market decline in Ukraine coupled with the potential benefits for certain sectors from the UK’s energy initiatives, steel buyers and market analysts should:

- Monitor Kametstal: Closely track Kametstal’s production and pricing, as its relative stability could make it a more reliable supplier than other plants experiencing more significant activity declines.

- Assess UK Export Opportunities: Investigate the potential for Ukrainian steel products, particularly from plants like Kametstal, to capitalize on the UK’s reduced electricity costs for energy-intensive industries, as outlined in “The UK will reduce electricity costs for industry,” once these incentives are implemented.

- Diversify Procurement: Mitigate risks associated with fluctuating activity levels at Metinvest Zaporizhstal and ArcelorMittal Kryvyi Rih by diversifying procurement sources.

- Negotiate Contracts: Use the market downturn as leverage to negotiate favorable contract terms with Ukrainian steel producers.