From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineArcelorMittal Bosnia Sale: Activity Surge Amidst Ownership Transfer

Bosnia and Herzegovina’s steel market faces transition as ArcelorMittal exits. Recent shifts in activity at key plants may influence near-term supply dynamics. This report analyzes these changes in light of the pending sale reported in “ArcelorMittal sells plants in Bosnia and Herzegovina to Pavgord Group” and “ArcelorMittal to sell steelmaking business in Bosnia amid falling production.” While the articles detail the strategic shift, direct correlations between these announcements and observed satellite-observed activity changes are not explicitly stated in the news, necessitating careful interpretation.

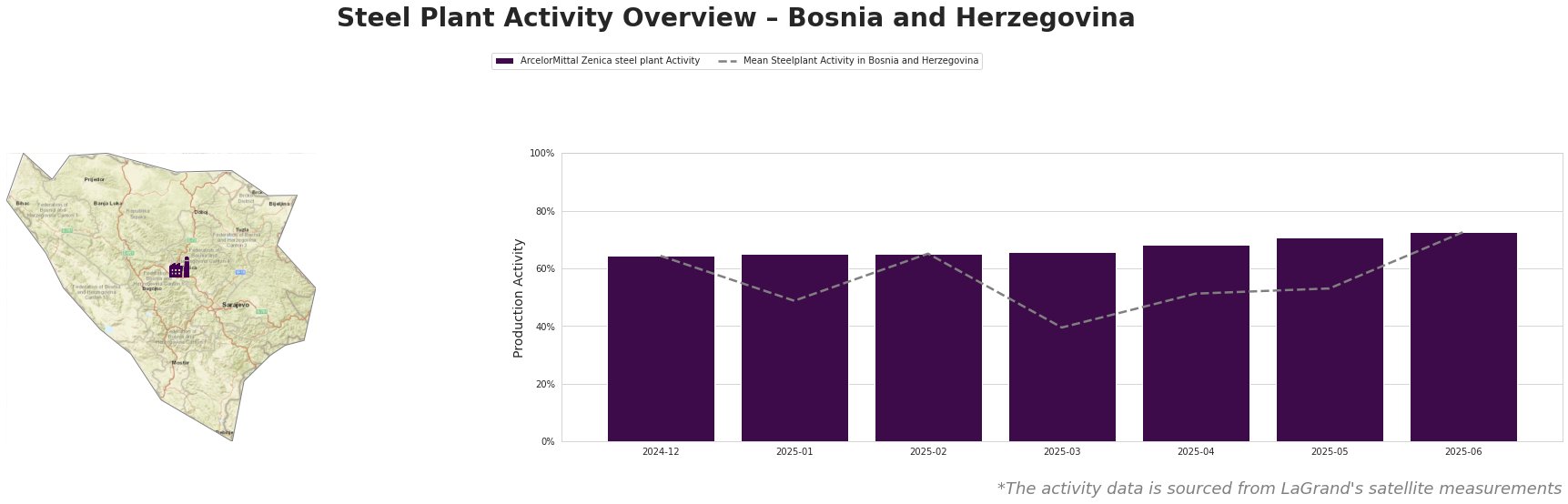

Here’s a breakdown of monthly activity:

The mean activity level across Bosnian steel plants showed fluctuations between December 2024 and June 2025, with a notable dip in March 2025 (40%) and a peak in June 2025 (73%). ArcelorMittal Zenica steel plant generally maintained activity levels above the average during this period, reaching 73% in June 2025 which mirrored the observed mean steel plant activity.

ArcelorMittal Zenica, an integrated steel plant with a 1.14 million tonne BOF and an 800,000 tonne EAF capacity, produces semi-finished and finished rolled products for the building and infrastructure sectors. Despite the pending sale to Pavgord Group, as reported in “ArcelorMittal Sells Operations in Bosnia and Herzegovina,” the plant’s activity has steadily increased from 64% in December 2024 to 73% in June 2025. This increasing production trend does not obviously reflect the narrative in “ArcelorMittal to sell steelmaking business in Bosnia amid falling production.” However, despite the news article, there has been rising plant activity, so there is no current drop in production that would influence steel procurement.

Given the imminent ownership change and ArcelorMittal Zenica’s continued high activity levels, steel buyers should:

- Closely monitor communications from ArcelorMittal and Pavgord regarding production plans during the transition. Although current activity is high, the change in ownership introduces uncertainty.

- Review existing contracts with ArcelorMittal Zenica to understand potential clauses related to change of control and supply continuity.

- Consider diversifying supply sources in the medium term to mitigate potential disruptions related to the ownership transfer.