From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Output Fluctuations & Regional Plant Activity Impact Prices

Asia’s steel market presents a mixed landscape, influenced by fluctuating Chinese production and varying regional plant activities. “China’s crude steel production and stocks rose 3.2% in early June“, yet this increase occurs amid a backdrop of overall production cuts as outlined in “China reduced steel production by 6.9% y/y in May“. Satellite data indicates fluctuations in plant activity that may or may not directly relate to these policy changes.

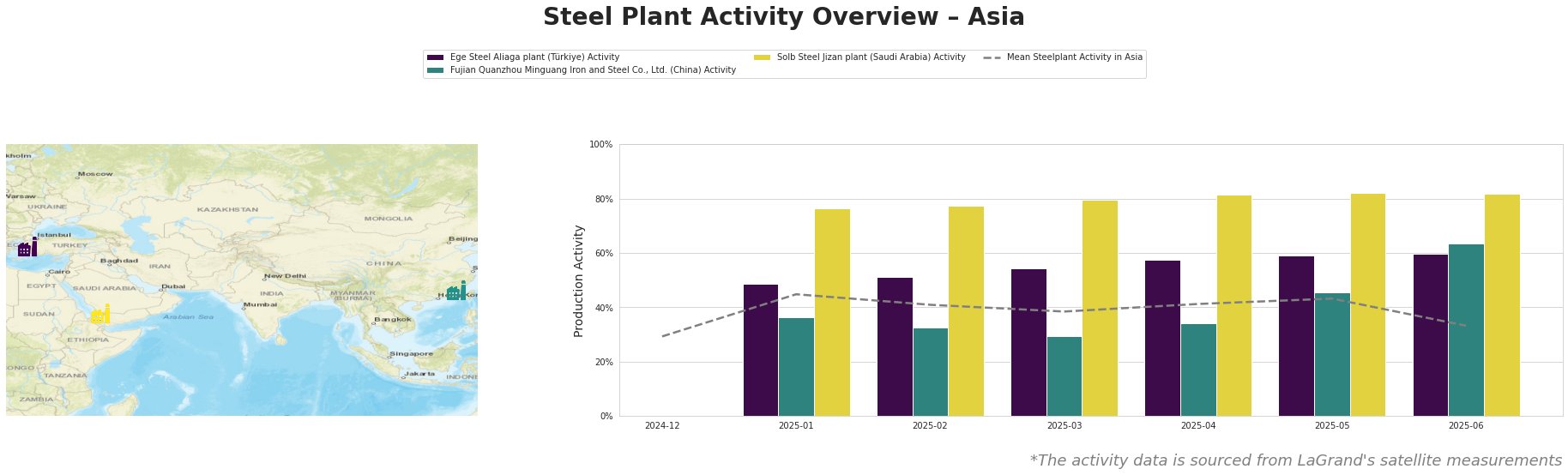

The mean steel plant activity across Asia reached a high of 45.0 in January 2025 before declining to 33.0 by June 2025. Ege Steel Aliaga plant consistently operated above the Asian average, climbing to 60.0 in June. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. experienced a significant activity increase from 45.0 in May to 64.0 in June. Solb Steel Jizan plant maintained a high and stable activity level around 80.0 throughout the monitored period.

Ege Steel Aliaga, a Türkiye-based EAF steel plant with a 2 million tonnes per annum (ttpa) crude steel capacity, primarily produces rebar and wire rod. Its activity has consistently remained above the Asian average, reaching 60.0 in June 2025. No direct connection can be established between its activity and the cited news articles concerning China’s market.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., a China-based integrated BF-BOF steel plant with a 2.55 million ttpa crude steel capacity, produces finished rolled products, including rebar and wire rod. The plant’s activity rose significantly to 64.0 in June. This increase in activity may be correlated with the news of “China’s crude steel production and stocks rose 3.2% in early June”, but it is contradictory to the fact that “China’s rebar output down 1.6 percent in January-May.”

Solb Steel Jizan plant, a Saudi Arabia-based EAF steel plant with a 1.2 million ttpa crude steel capacity, produces semi-finished (billets) and finished rolled products, including rebar and wire rod. Its activity has been consistently high throughout the observed period, hovering around 80.0. No direct link can be established between its activity and the cited news articles concerning China’s market.

The mixed signals from Chinese production data coupled with fluctuating plant activity present potential supply disruptions. The increase in activity observed at Fujian Quanzhou Minguang Iron and Steel Co., Ltd., alongside reports of increased crude steel production in China, may suggest a shift in regional supply dynamics. Given the reported decrease of rebar production in China, steel buyers focused on rebar should closely monitor output from plants outside of China, such as Ege Steel Aliaga and Solb Steel Jizan plant, to secure supply and mitigate potential price volatility as Chinese export volumes could fluctuate. Evaluate diversifying supply sources to include regions with stable or increasing production, such as Saudi Arabia, where the Solb Steel Jizan plant demonstrates consistent output.