From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Braces for Further Weakness: Plant Activity Declines Signal Continued Downward Pressure

The Asian steel market faces growing headwinds, evidenced by declining plant activity amidst weak global demand and import pressures, particularly in Europe. European steel prices continue to decline due to weak demand, as reported in “European CRC and HDG steel prices continue to decline due to weak demand” and “European HRC prices decline on weak demand, import interest stays low despite more price cuts“, yet no direct correlation to specific activity changes at Asian steel plants could be explicitly established.

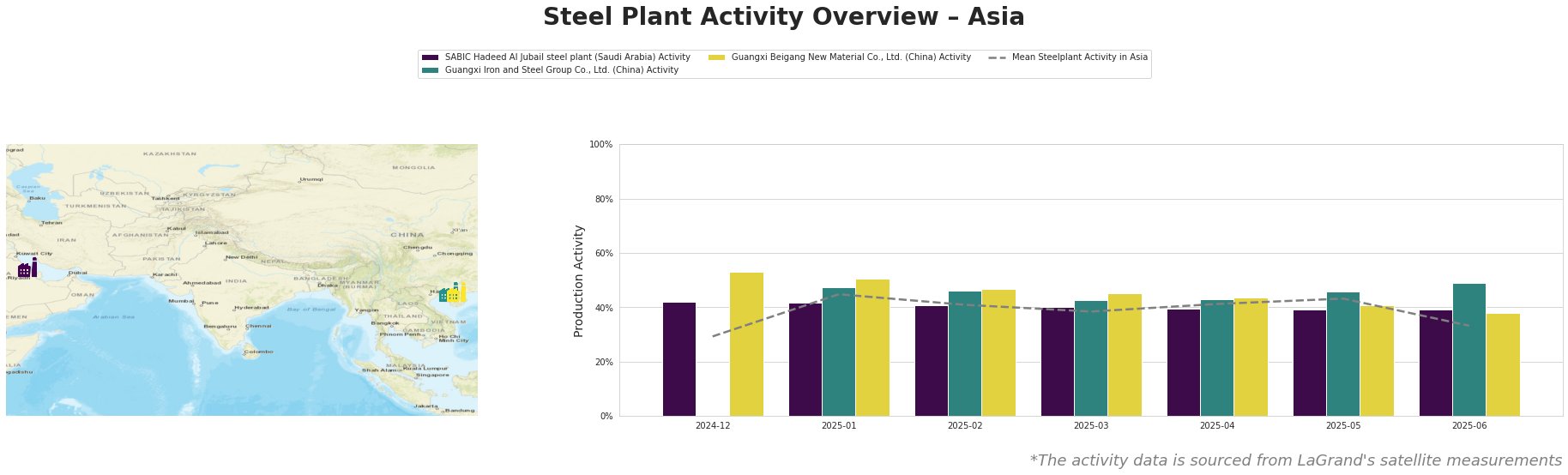

The mean steel plant activity in Asia has decreased significantly from 43.0% in May to 33.0% in June, indicating an overall production slowdown. Notably, Guangxi Iron and Steel Group Co., Ltd. observed a peak in activity at 49.0% in June, bucking the overall downtrend. The activity levels at SABIC Hadeed Al Jubail steel plant remained relatively stable, fluctuating only slightly between 39.0% and 42.0% over the observed period. Guangxi Beigang New Material Co., Ltd. experienced a notable drop in activity in June, from 41.0% to 38.0%.

SABIC Hadeed Al Jubail steel plant, located in Saudi Arabia, operates with a 6000 ttpa crude steel capacity, utilizing DRI and EAF technologies. Specializing in semi-finished and finished rolled products, including HRC, HDG, and pre-painted galvanized coil, its stable activity levels around 40% do not reflect the overall declining trend in Asia. No direct correlation could be established between its stable activity and the news articles.

Guangxi Iron and Steel Group Co., Ltd., based in China, has a 9200 ttpa crude steel capacity and relies on BF and BOF processes. The plant produces finished rolled products, including cold-rolled coil and hot-dip galvanized coil. Activity at this plant reached 49% in June, standing out in contrast to the overall Asian downturn. The reasons for this divergence could not be explicitly established from the news articles provided, and further investigation is needed.

Guangxi Beigang New Material Co., Ltd., also in China, has a 3400 ttpa crude steel capacity, using both BF and EAF technologies, alongside ferronickel production. Their product portfolio includes HRC and cold-rolled coil. A decrease to 38% activity in June from 41% in May indicates a possible slowdown. However, no explicit links could be established to the news articles regarding weakening demand or import pressures.

Based on the overall decline in Asian steel plant activity and reports of weakening demand from “European prices for HRC are declining due to weak demand, while interest in imports remains low despite further price declines“, steel buyers should anticipate continued downward pressure on prices in the short term. Delaying large-volume purchases may allow for securing more favorable prices. Furthermore, monitor closely the activity of Guangxi Iron and Steel Group Co., Ltd., as its increased production might impact regional supply dynamics. Given European buyers’ hesitancy due to CBAM regulations as noted in “European HRC prices decline on weak demand, import interest stays low despite more price cuts,” explore alternative sourcing options within Asia.