From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndonesian Steel Exports Face Pressure as European Demand Dwindles: Plant Activity Stable

Indonesia’s steel industry faces increased headwinds as European demand weakens due to oversupply and anticipation of further price declines. The articles “HRC buyers in Europe hold back from trading; slow demand, competitive imports weigh down on expectations,” “European HRC prices decline on weak demand, import interest stays low despite more price cuts,” and “European prices for HRC are declining due to weak demand, while interest in imports remains low despite further price declines” highlight the challenges. These articles directly mention Indonesian HRC offers into Europe, which are now encountering resistance, even with price cuts. While the articles highlight Indonesian offers, a direct, immediate link between these factors and changes in satellite-observed Indonesian plant activity could not be established based on available data.

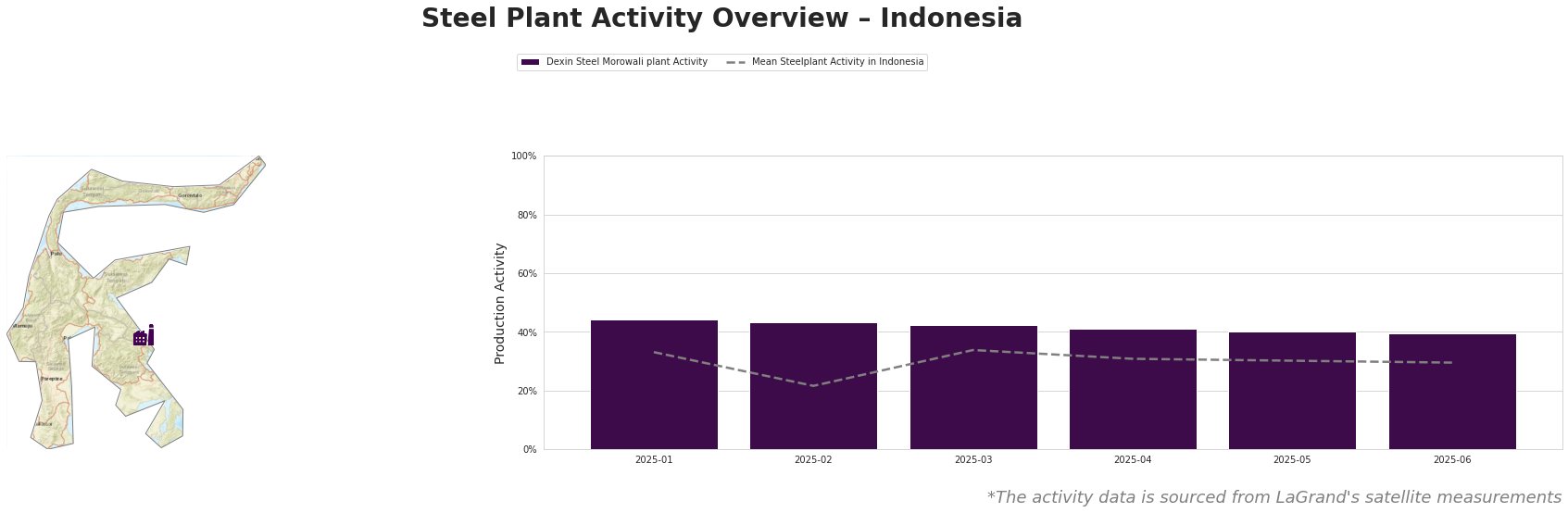

The mean steel plant activity in Indonesia has fluctuated over the past six months. Starting at 33% in January 2025, it decreased to a low of 22% in February before rising to 34% in March. Since then, activity has remained relatively stable at around 30% between April and June. Dexin Steel Morowali plant’s activity has followed a similar trend, starting at 44% in January and gradually decreasing to 39% by June. The Dexin Steel Morowali plant has consistently shown higher activity levels than the average across all Indonesian steel plants, exceeding the mean activity by 9-21%. However, no immediate connection between these activity trends and the specific European market news could be established based on the information provided.

Dexin Steel Morowali plant, located in Central Sulawesi, is an integrated steel plant with a crude steel capacity of 3.5 million tonnes per annum (mtpa), utilizing blast furnace (BF) and basic oxygen furnace (BOF) technology. The plant primarily produces finished rolled and semi-finished products like wire rod, slab, bar, and billet, catering to the building, infrastructure, and automotive sectors. Satellite data shows the plant’s activity decreased from 44% in January 2025 to 39% in June 2025, however, given the context of stable average plant activity this is not necessarily indicative of market shifts. No explicit connection between this specific decline and the European market news can be established based on the provided information.

European HRC prices are falling due to weak demand and bearish market sentiment. Buyers are hesitant to purchase, expecting further price decreases and citing sufficient inventories. Trading activity is low, with Northern European prices around €590/tonne and Italian prices at €550-555/tonne from factories. Import interest remains low, with offers from Indonesia at €470-490/tonne CFR and India at around €520-530/tonne CFR. Buyers are pushing for even lower prices, and the market anticipates further declines before a possible rebound later in the year.

Given the weak European demand and Indonesian steel export pressure, steel buyers should:

- Short-Term Procurement Strategy: Prioritize short-term contracts and delay large-volume purchases, anticipating further price drops in the European market.

- Negotiate Aggressively: Leverage the oversupply situation and competitive import offers (including those from Indonesia mentioned in “European prices for HRC are declining due to weak demand, while interest in imports remains low despite further price declines”) to negotiate lower prices with suppliers.

- Monitor Activity: Watch for changes in Indonesian plant activity. Although the Dexin Steel Morowali plant’s recent activity decline cannot be directly attributed to the European situation, continued monitoring is crucial to understand potential supply-side responses to reduced export demand.