From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market: Mixed Signals Amid Stable Production; Focus on European Import Dynamics

Asia’s steel market presents a neutral outlook with stable production levels despite global market volatility. European heavy plate and HRC prices are declining due to weak demand and competitive imports, as highlighted in “European heavy plate prices slip further amid slow spot activity, mill pressure,” “HRC buyers in Europe hold back from trading; slow demand, competitive imports weigh down on expectations,” and “European HRC prices decline on weak demand, import interest stays low despite more price cuts.” The impact of these European market conditions on Asian steel producers is currently uncertain and not directly reflected in observed Asian steel plant activity.

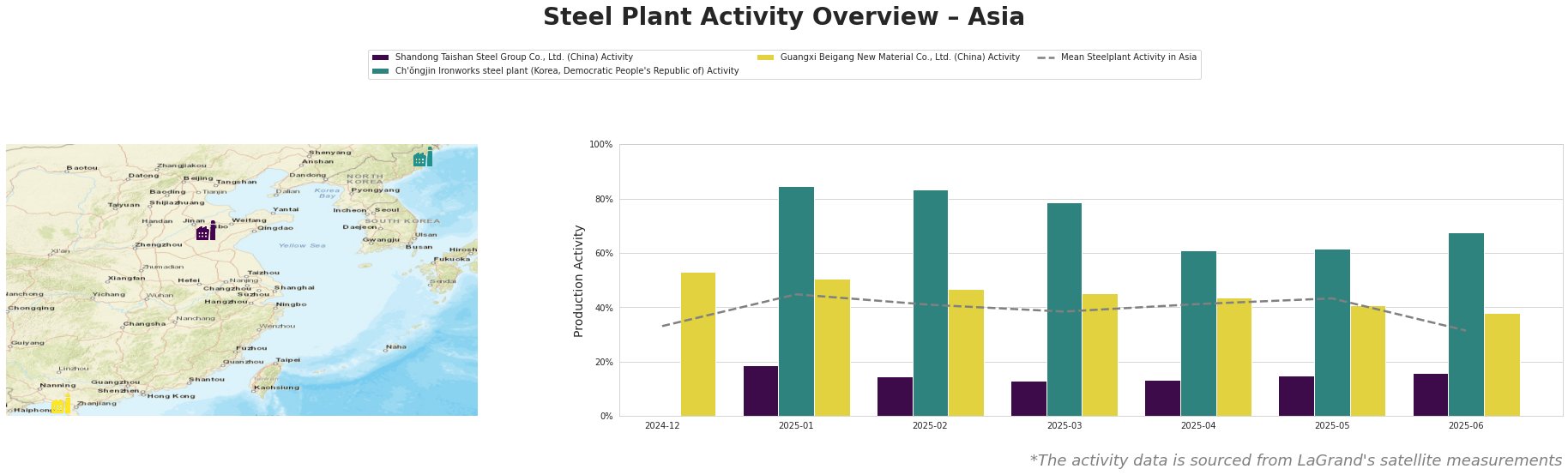

The mean steel plant activity in Asia shows a decrease to 31.0% in June 2025 after peaking at 45.0% in January 2025. Activity at Shandong Taishan Steel Group Co., Ltd., a major integrated BF producer of hot and cold-rolled coil, has remained consistently low, fluctuating between 13% and 19% since January 2025. There is no explicit evidence in the provided articles to directly link these activity levels to the European market situation. Ch’ŏngjin Ironworks, a DRI-based plant producing slab and plate, exhibits relatively high activity but experienced a drop from 85% in January 2025 to 68% in June 2025. However, no direct connection to the cited news articles can be established. Guangxi Beigang New Material Co., Ltd., an integrated BF and EAF-based producer of hot-rolled coil and other products, experienced a decrease from 53% in December 2024 to 38% in June 2025. No direct relationship to the European market situation is apparent from the provided articles.

Shandong Taishan Steel Group Co., Ltd., with a crude steel capacity of 5000 ttpa and integrated BF-BOF production route, has shown consistently low activity levels between 13% and 19% since January 2025. Despite holding a ResponsibleSteel Certification, the production volumes do not seem to be directly influenced by recent market dynamics reported for Europe based on provided articles. Ch’ŏngjin Ironworks, with a crude steel capacity of 2000 ttpa and a DRI-BOF/EAF production route, showed the highest activity levels but experienced a drop of -17% between January and June 2025. The produced slab and plate volumes don’t seem to be directly influenced by recent market dynamics reported for Europe based on provided articles. Guangxi Beigang New Material Co., Ltd., producing hot-rolled coil and other products using BF-EAF route (crude steel capacity: 3400 ttpa), saw its activity drop of -15% between December 2024 and June 2025. Similar to the other plants, there is no link to the European market situation evident from the provided articles.

Given the declining HRC prices in Europe due to competitive imports as mentioned in “European HRC prices decline on weak demand, import interest stays low despite more price cuts,” steel buyers should closely monitor import offers from Indonesia and Turkey. The article notes offers ranging from €470-490/mt CFR from Indonesia and €480-530/mt CFR from Turkey. While Asian plant activity remains relatively stable, the impact of these competitive import prices on Asian export strategies should be assessed. It is recommended that analysts investigate whether increased exports from Asia to Europe could compensate for reduced domestic demand in Europe and how this would then influence activity levels at specific plants.