From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: Middle East Tensions and Declining Chinese Output Signal Procurement Risks

Asia’s steel market confronts increasing uncertainty due to escalating geopolitical tensions and fluctuating production levels. The overall negative sentiment is reinforced by events discussed in “Israel strikes Iran gas plants in first energy attacks” and “Israel, Iran exchange strikes: Update“. While a direct link between these events and steel plant activity isn’t immediately apparent, the broader market implications necessitate a cautious approach. Specifically, a decrease in activity at Xinyu Iron and Steel Group Co., Ltd. in China coincides with concerns raised in “Stock market today: Dow, S&P 500, Nasdaq futures slide ahead of fresh inflation data, as Trump renews tariff threat” regarding US-China trade relations.

Measured Activity Overview

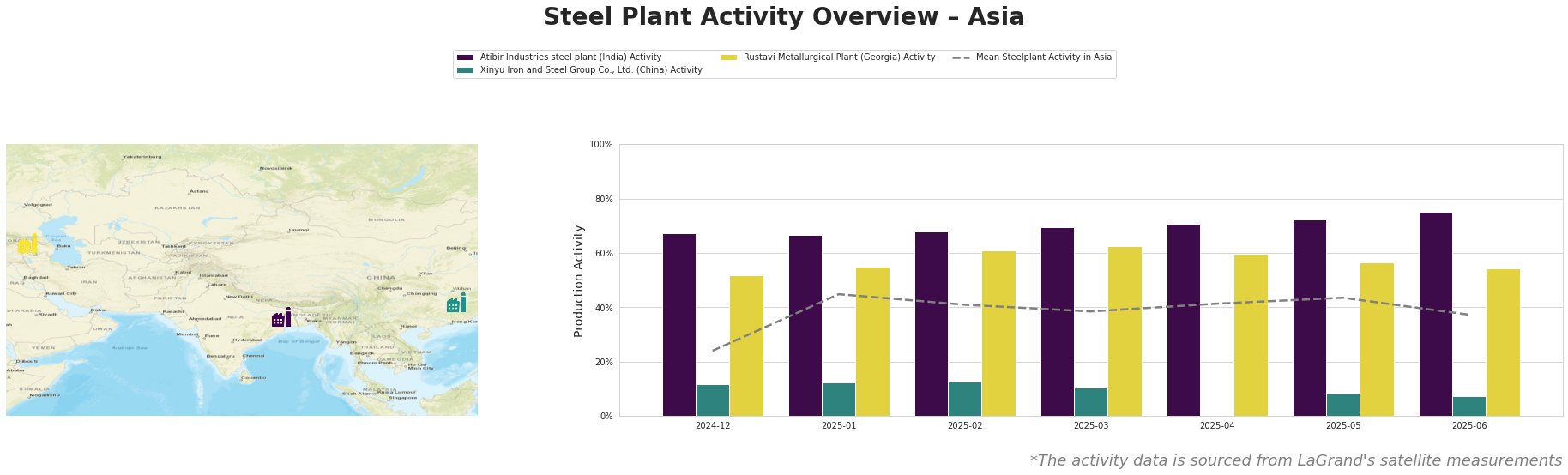

The mean steel plant activity across Asia shows a decline to 37% in June 2025, after reaching a high of 45% in January 2025. Atibir Industries in India consistently operates above the Asian mean, reaching 75% activity in June 2025. Xinyu Iron and Steel Group Co., Ltd. has consistently operated below the mean, and its activity declined to 7% in June 2025. Rustavi Metallurgical Plant in Georgia showed activity levels consistently above the mean, but also experienced a drop to 54% in June 2025.

Plant Information

Atibir Industries steel plant: Located in Jharkhand, India, Atibir Industries is an integrated steel plant with a 600 ttpa crude steel capacity, primarily using blast furnace (BF) and BOF technology. The plant has steadily increased its activity, reaching 75% in June 2025, significantly above the Asian mean. While the news articles highlight broader market concerns, no specific connection could be established to explain the steady increase in activity observed at Atibir Industries.

Xinyu Iron and Steel Group Co., Ltd.: Situated in Jiangxi, China, this plant boasts a 10,000 ttpa crude steel capacity, utilizing BF, BOF, and EAF technologies. Activity has declined to 7% in June 2025, well below the regional average. This decline might be related to the uncertainties surrounding US-China trade relations, as described in “Stock market today: Dow, S&P 500, Nasdaq futures slide ahead of fresh inflation data, as Trump renews tariff threat“, impacting the demand for finished rolled products such as medium, cold and hot rolled thin, thick, and extra thick plates catering to energy, building, infrastructure, and transport sectors.

Rustavi Metallurgical Plant: Located in Kvemo Kartli, Georgia, Rustavi operates as an integrated steel plant with a 120 ttpa crude steel capacity, utilizing BF, BOF, EAF, and OHF technologies. The plant produces a range of products, including pig iron, rebar, and seamless pipes. While remaining above the mean, Rustavi’s activity dropped to 54% in June 2025, a notable decline. However, no specific news event in the provided articles can be directly linked to this decrease.

Evaluated Market Implications

The observed decline in activity at Xinyu Iron and Steel Group Co., Ltd. coupled with uncertainties from the potential US-China trade war, as mentioned in “Stock market today: Dow, S&P 500, Nasdaq futures slide ahead of fresh inflation data, as Trump renews tariff threat“, suggests potential supply disruptions in steel products, especially those destined for energy, building, infrastructure, and transport sectors.

Recommended Procurement Actions: Steel buyers should actively diversify their supply sources beyond Chinese producers to mitigate risks associated with trade uncertainties. Given the high activity at Atibir Industries, consider increasing procurement from this source, focusing on pig iron and rolled products. Closely monitor developments related to US-China trade relations and their potential impact on steel demand and pricing.