From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Production Surge Despite Price Dips Signals Procurement Opportunities

Asia’s steel market presents a mixed picture. While overall production capacity is expanding, prices are experiencing downward pressure, particularly in China. According to “China’s crude steel production and stocks rose 3.2% in early June“, steel production increased early in the month. However, this rise coincides with reports of declining prices as per “NBS: Local Chinese rebar prices down 1.0 percent in early June” and “MOC: Average steel prices in China decline slightly in Jun 2-8“, indicating potential oversupply despite efforts to curb output (“China reduced steel production by 6.9% y/y in May“). A correlation between recent price declines and specific plant activity shifts cannot be directly established from the given information.

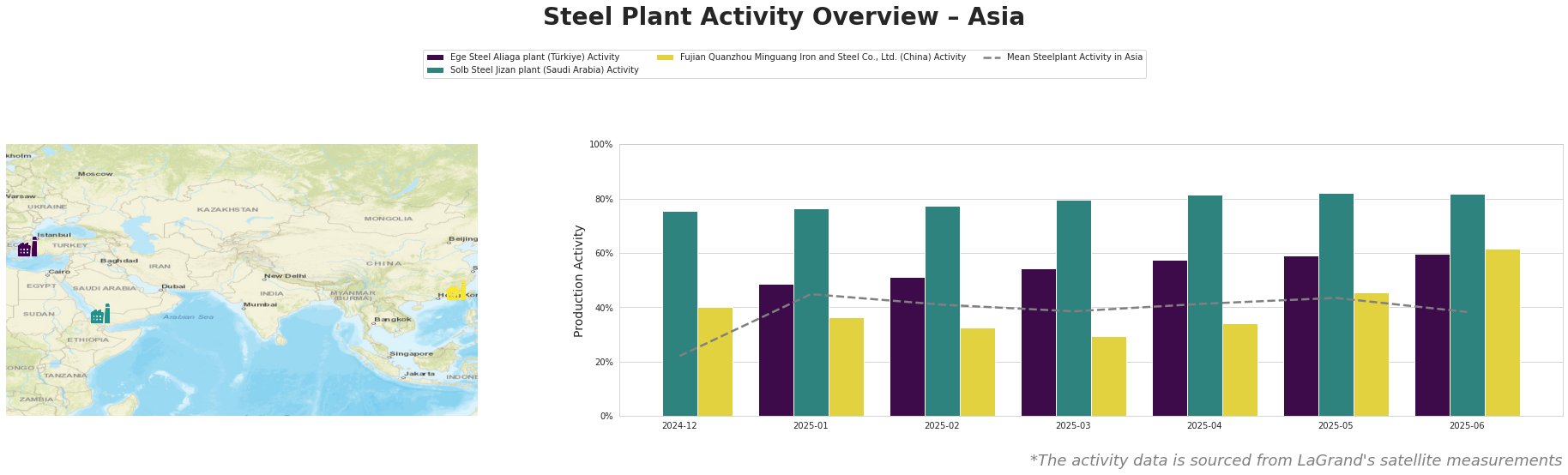

Overall plant activity in Asia, based on the selected plants, shows a fluctuating trend, with a decrease to 38% in June after a peak of 45% in January. Both Ege Steel Aliaga and Solb Steel Jizan are consistently operating above the mean Asian activity level. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. has been operating below the mean in the first half of the year, but shows a significant increase in June, reaching 62%. No direct connection to the reported price decreases in “NBS: Local Chinese rebar prices down 1.0 percent in early June” can be established.

Ege Steel Aliaga plant, located in İzmir, Türkiye, boasts a 2000 ttpa EAF-based crude steel capacity. Specializing in rebar and wire rod production via electric arc furnaces, it operates with a workforce of nearly 1000 employees. The plant’s activity has shown a consistent upward trend from January to June, reaching 60% activity. This growth does not appear to correlate with the news articles regarding Chinese price declines, indicating a potentially more localized or demand-driven dynamic.

Solb Steel Jizan plant, situated in the Jizan Region of Saudi Arabia, features a 1200 ttpa capacity, also utilizing EAF technology. With a larger workforce of 2000, it produces billet, rebar, rebar in coil, and wire rod. Activity at this plant has remained consistently high at 76% to 82% between December 2024 and June 2025, significantly exceeding the Asian average. This sustained high production level, like Ege Steel, appears unaffected by the trends detailed in the Chinese market news.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd. in China, has a larger integrated production setup with a 2550 ttpa crude steel capacity based on BOF technology supported by blast furnaces. It produces round bar, high-speed bar, coiled rebar, and wire rod. Its activity was consistently below the mean Asian level from January to May, but saw a sharp increase to 62% in June. Despite the increase in activity, “China’s rebar output down 1.6 percent in January-May” details decreased rebar output, suggesting the increased activity could be directed towards other products or replenishing depleted stocks of other steel products, like hot-rolled coil (HRC), cold-rolled coil (CRC), and medium steel plate, where inventories saw increased, according to “Stocks of main finished steel products in China down 1.0% in early June“.

The rise in Chinese crude steel production (“China’s crude steel production and stocks rose 3.2% in early June”), combined with declining prices (“NBS: Local Chinese rebar prices down 1.0 percent in early June”, “MOC: Average steel prices in China decline slightly in Jun 2-8”) suggests a potential supply glut, especially considering that finished steel inventories decreased only slightly (“Stocks of main finished steel products in China down 1.0% in early June”). For steel buyers:

* Focus on short-term contracts for rebar in China: Given the reported price decreases and increased production, buyers of Chinese rebar should negotiate short-term contracts to take advantage of potential further price declines.

* Diversify sourcing: Considering “China reduced steel production by 6.9% y/y in May” and the volatility in the Chinese market, explore alternative suppliers outside of China to mitigate risks associated with production cuts or trade policy changes. Increased activity at Ege Steel Aliaga in Turkey and Solb Steel Jizan in Saudi Arabia, suggest that these regions may be alternative sourcing options.

* Monitor HRC, CRC, and medium steel plate inventory levels in China: The increase in Chinese inventories of these products (“Stocks of main finished steel products in China down 1.0% in early June”) indicates a potential oversupply. Track these inventory levels closely for potential price drops and opportunities for cost-effective procurement.