From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIranian Steel Market Faces Crisis: Escalating Tensions Disrupt Plant Activity

The Iranian steel market faces increasing uncertainty due to escalating geopolitical tensions. Recent developments reported in “Iran suggests upcoming nuclear talks with US are off,” “Trump wants Iran’s ‘unconditional surrender’: Update,” “Market risks grow as Trump threatens Iran: Update” and “Trump talk of Iran attacks spreads market risks” coincide with notable changes in steel plant activity, suggesting potential disruptions. While a direct causal link isn’t always demonstrable, the overall climate of instability likely contributes to operational adjustments.

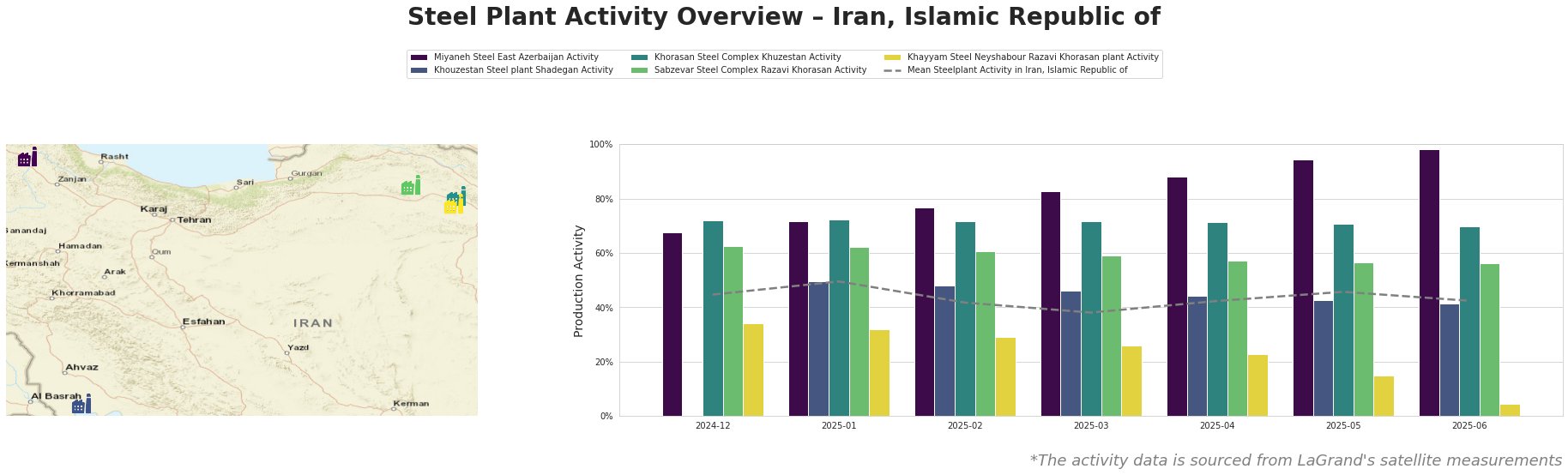

The average steel plant activity in Iran decreased from 45% in December 2024 to 42% in June 2025. The table below shows the monthly activity levels for the observed plants:

While Miyaneh Steel East Azerbaijan’s activity significantly increased from 68% to 98% during the observed timeframe, Khayyam Steel Neyshabour Razavi Khorasan plant saw a sharp decline, dropping from 34% to just 4%. Khouzestan Steel plant Shadegan, Khorasan Steel Complex Khuzestan, and Sabzevar Steel Complex Razavi Khorasan activity levels have remained relatively stable.

Miyaneh Steel East Azerbaijan, with a capacity of 800 ttpa of crude steel produced via DRI and EAF, shows a consistent increase in activity, reaching 98% in June 2025. This contrasts with the overall negative market sentiment, and no direct link to the provided news articles can be established.

Khouzestan Steel plant Shadegan, a major producer with a capacity of 3600 ttpa of crude steel using DRI and EAF technologies, has experienced a slight decline in activity, stabilizing at 41% in June 2025. Given its significant production volume of semi-finished products (bloom, slab, billets), any disruptions here could impact downstream supply. The news articles “Market risks grow as Trump threatens Iran: Update” and “Trump talk of Iran attacks spreads market risks” discuss rising marine insurance and freight costs which could negatively affect exports from plants like Khouzestan Steel.

Khorasan Steel Complex Khuzestan, producing 1500 ttpa of crude steel (DRI, EAF) and a variety of products including rebar and billets, shows a small downward trend, settling at 70% activity in June 2025. As with Khouzestan Steel, increased shipping costs due to geopolitical risks, as described in “Market risks grow as Trump threatens Iran: Update,” could be impacting its export potential.

Sabzevar Steel Complex Razavi Khorasan, with 800 ttpa capacity using EAF, maintained a stable activity level around 56-62% throughout the period. No direct link between its activity and the provided news articles is apparent.

Khayyam Steel Neyshabour Razavi Khorasan plant, a smaller producer with 500 ttpa capacity using EAF, shows a dramatic drop in activity to just 4% in June 2025. This significant decline, while coinciding with heightened tensions described in “Trump wants Iran’s ‘unconditional surrender’: Update“, cannot be definitively linked to the news articles.

Given the overall negative market sentiment and the potential for escalating conflict described in “Trump talk of Iran attacks spreads market risks,” steel buyers should:

- Prioritize securing existing contracts: Ensure fulfillment of current orders, particularly from Khouzestan Steel plant Shadegan and Khorasan Steel Complex Khuzestan, given their significant production capacity and the rising risks to maritime shipping.

- Assess alternative sourcing: Explore options outside of Iran, Islamic Republic of, as a contingency plan, particularly for products previously sourced from Khayyam Steel Neyshabour Razavi Khorasan plant due to its near-halted production.

- Monitor marine insurance and freight rates closely: Be prepared for further increases in transportation costs, impacting the overall cost of steel imports from Iran, Islamic Republic of as discussed in “Market risks grow as Trump threatens Iran: Update“.

- Closely monitor geopolitical developments: The news article “Trump wants Iran’s ‘unconditional surrender’: Update” particularly warrants continuous monitoring for any developments.