From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Indian Output Surges Amidst Import Safeguards, China Production Soars

Asia’s steel market presents a mixed landscape. Rising steel output in India, influenced by government safeguards (“India’s Crude Steel Output Rises in May Amid by safeguard“), coincides with increased activity at key steel plants. While EU trade adjustments (“EU plans to reintroduce country-specific quotas on certain steel products“) do not directly impact the Asian market based on the provided information, India’s protectionist measures may lead to reduced imports (“India may halve steel imports in 2025 due to safeguard measures“). The satellite-observed activity level changes reflect these trends, with no directly attributable effects of the EU measures.

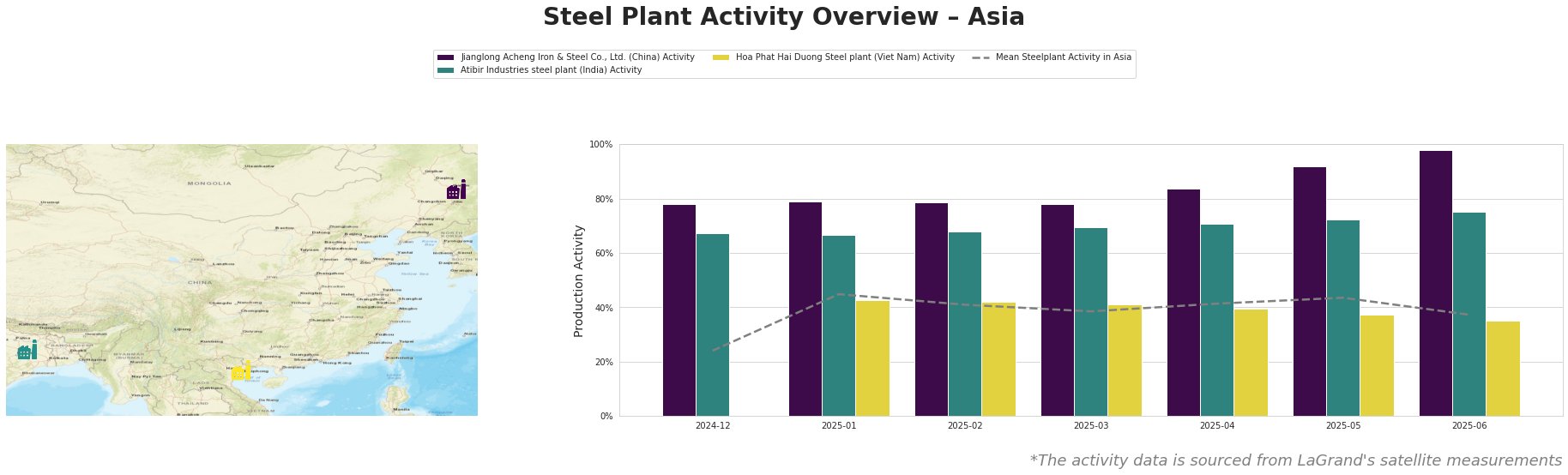

The mean steel plant activity in Asia fluctuated, peaking at 45% in January 2025 and then decreasing to 37% by June 2025. Jianglong Acheng Iron & Steel Co., Ltd. in China consistently operated above the mean, reaching a high of 98% activity in June 2025. Atibir Industries steel plant in India also maintained activity levels significantly above the Asian average, rising steadily to 75% in June 2025. Hoa Phat Hai Duong Steel plant in Vietnam showed consistently lower activity than the average, dropping to 35% in June 2025.

Jianglong Acheng Iron & Steel Co., Ltd., located in Heilongjiang, China, is an integrated BF-BOF steel plant with a crude steel capacity of 1.1 million tonnes and a responsible steel certification. Primarily producing finished rolled products, including hot-rolled and coated steel, for the automotive, energy, and machinery sectors, the plant exhibited consistently high activity. The plant’s activity increased steadily from 78% in December 2024 to 98% in June 2025, indicating strong production. No direct connection can be established between this activity and the provided news articles.

Atibir Industries steel plant in Jharkhand, India, is an integrated BF-BOF steel plant producing crude, semi-finished, and finished rolled steel with a crude steel capacity of 600,000 tonnes and responsible steel certification. The plant’s activity rose steadily from 67% in December 2024 to 75% in June 2025. This increase aligns with “India’s Crude Steel Output Rises in May Amid by safeguard”, as the Indian government’s safeguard measures appear to be driving increased domestic steel production.

Hoa Phat Hai Duong Steel plant in Hai Duong, Vietnam, is an integrated BF-BOF steel plant with a crude steel capacity of 2.5 million tonnes and responsible steel certification, producing finished rolled products like construction steel and hot-rolled coil. Unlike the other two, the plant’s activity decreased from 43% in January 2025 to 35% in June 2025, consistently operating below the Asian average. No direct connection can be established between this activity decrease and the provided news articles.

Given India’s rising domestic steel production and potential import reductions driven by protective measures (“India may halve steel imports in 2025 due to safeguard measures”, “India’s Crude Steel Output Rises in May Amid by safeguard”), steel buyers should anticipate potential supply constraints from imported steel into India. Steel buyers relying on imports into India should consider:

- Diversifying sourcing: Proactively explore alternative steel suppliers outside of India to mitigate potential disruptions.

- Securing contracts: Establish long-term contracts with domestic Indian steel producers to ensure a stable supply amidst import restrictions, especially from plants like Atibir Industries that show significant increases in production activity.

- Monitoring DGTR’s decision: Closely monitor the Directorate General of Trade Remedies (DGTR) investigation regarding increasing the safeguard duty beyond 12%, as a decision in August could further impact import costs.