From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Resilient Despite Production Dips: Cautious Optimism for Buyers

Europe’s steel market shows resilience amid industrial production declines, but sector-specific challenges persist. Recent activity data reflects the complex interplay of factors outlined in news articles such as “Industrial production in the EU declined by 1.8% m/m in April” and “Euro area industrial output down 2.4 percent in April from March“. While these reports highlight overall production decreases, the impact on specific steel plants varies. Observed trends are further influenced by the expectations of a modest recovery in the EU tube market, as noted in “Weak EU tube market may see modest recovery“.

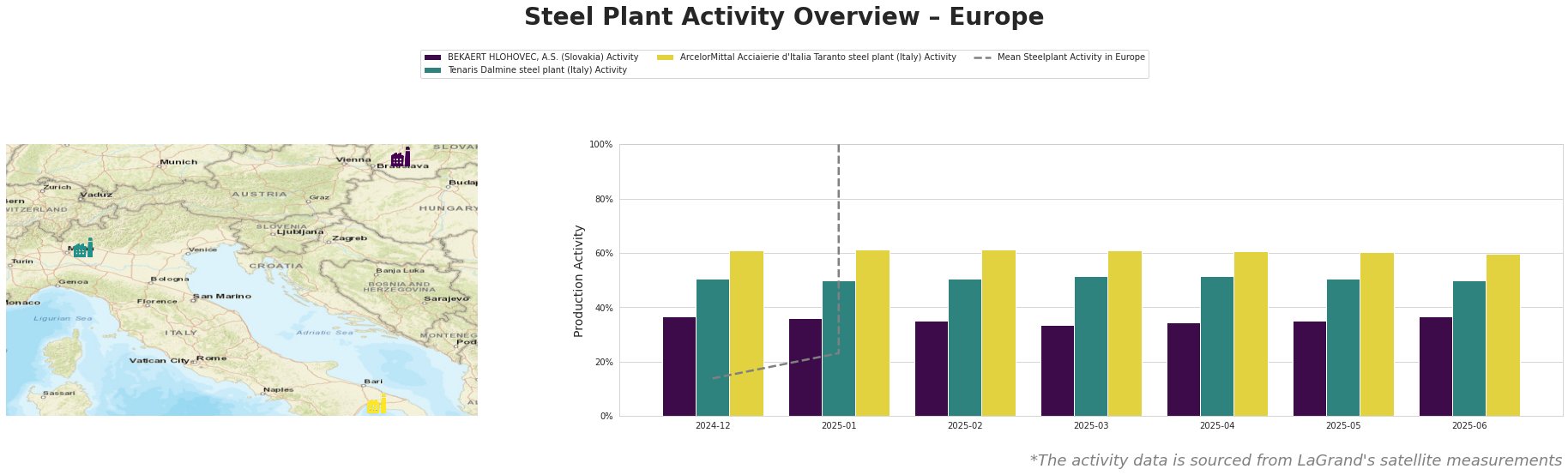

The “Mean Steelplant Activity in Europe” shows extreme variations in activity levels between February and June 2025, possibly due to measurement discrepancies; therefore, these numbers must be considered outliers. Examining individual plant activity, BEKAERT HLOHOVEC, A.S. (Slovakia) Activity remained relatively stable, fluctuating narrowly between 34% and 37%. Tenaris Dalmine steel plant (Italy) Activity showed a slight increase to 52% in March and April before reverting to 50% in May and June. ArcelorMittal Acciaierie d’Italia Taranto steel plant (Italy) Activity maintained a high level, hovering around 61% until May, decreasing slightly to 60% in June.

BEKAERT HLOHOVEC, A.S., an EAF-based producer focused on wire rod for the automotive and construction sectors, shows consistent activity, suggesting stable demand in these sectors, despite the broader industrial production declines reported in “Industrial production in the EU declined by 1.8% m/m in April“. No direct connection can be established between the activity level and any mentioned news item.

Tenaris Dalmine steel plant, an EAF-based producer with a 700kt crude steel capacity, specializing in tubes for the energy sector, saw a minor activity increase in March and April. This plant’s focus on tubes may reflect the dynamics described in “Weak EU tube market may see modest recovery,” particularly if its products are less exposed to the declining oil and gas sector and more oriented towards the relatively stable automotive and engineering sectors.

ArcelorMittal Acciaierie d’Italia Taranto steel plant, an integrated BF-BOF producer with a significant 11,500kt crude steel capacity, experienced a slight activity decrease in June. The plant’s product diversification across automotive, construction, and energy sectors likely buffers it from sector-specific downturns. The slight decrease in June might reflect the general industrial production decline described in “Euro area industrial output down 2.4 percent in April from March“, but more data would be required for a concrete assessment.

The reported overall decline in EU industrial production, coupled with the anticipated modest recovery in the tube market, suggests a mixed outlook. The stable activity at BEKAERT HLOHOVEC, A.S. may indicate relative strength in the automotive and construction sectors.

-

For steel buyers focused on tube products: Closely monitor Tenaris Dalmine’s output and pricing, as their activity levels can indicate supply availability, with attention given to sectors outside oil and gas. Given the anticipation for a modest recovery, secure contracts early to avoid potential price increases as demand stabilizes, as mentioned in “Weak EU tube market may see modest recovery.”

-

For buyers sourcing from ArcelorMittal Acciaierie d’Italia Taranto: Be aware of potential marginal adjustments in production levels due to broader industrial output fluctuations. Negotiate contracts that allow for volume flexibility, acknowledging possible short-term supply adjustments.