From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Trade Tensions Persist Amid Mixed Plant Activity

Asia’s steel market faces continued uncertainty due to ongoing US-China trade dynamics, even as steel plant activity shows varied trends. The “US stock futures dip on lack of details from China trade talk, CPI in focus” and “Stock market today: Dow, S&P 500, Nasdaq futures slide ahead of fresh inflation data, as Trump renews tariff threat” articles highlight persistent concerns surrounding trade relations, potentially impacting demand for steel. No direct link between the news articles and the recent changes in plant activity levels could be observed.

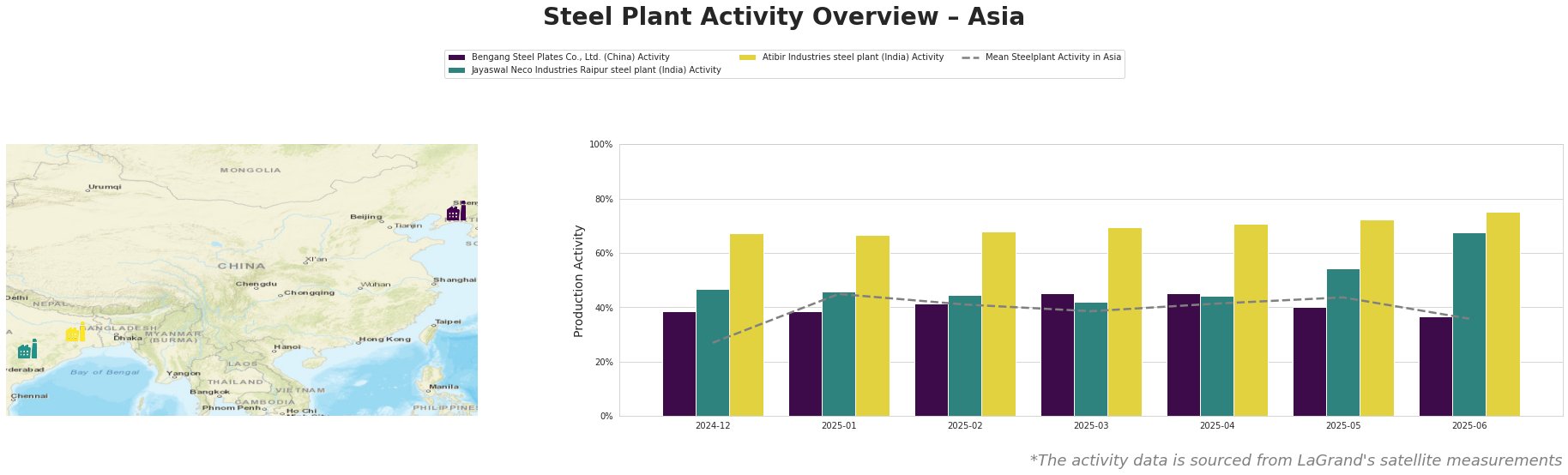

Here’s an overview of recent activity:

Overall, average steel plant activity in Asia has fluctuated, reaching a high of 45% in January 2025 and then declining to 36% in June 2025. Bengang Steel Plates Co., Ltd. showed relative stability before dropping to 37% in June. Jayaswal Neco Industries Raipur steel plant experienced a significant increase to 68% in June 2025. Atibir Industries steel plant has demonstrated consistent growth, reaching 75% in June 2025.

Bengang Steel Plates Co., Ltd., located in Liaoning, China, is an integrated steel plant utilizing BF, BOF, and EAF technologies with a crude steel capacity of 12.8 million tonnes per annum (ttpa), focusing on finished rolled products like automotive and pipeline steel. Activity levels were relatively stable until June 2025, when they dropped to 37%, a drop from 45% in April 2025. Given that “US stock futures dip on lack of details from China trade talk, CPI in focus” and “Stock market today: Dow, S&P 500, Nasdaq futures slide ahead of fresh inflation data, as Trump renews tariff threat” articles highlight ongoing US-China trade uncertainties, it is possible that concerns about trade tensions have started to impact this plant. The news articles address overall trade dynamics. However, no direct connection between the news articles and the recent change in plant activity levels could be observed.

Jayaswal Neco Industries Raipur steel plant, situated in Chhattisgarh, India, is an integrated plant with both BF and DRI processes, producing crude, semi-finished, and finished rolled products with a crude steel capacity of 1.2 million ttpa. The plant’s activity significantly increased to 68% in June 2025 from 54% in May 2025. While several articles discuss trade and economic factors, none offer a direct explanation for this specific plant’s increased activity. No direct connection between the news articles and the recent change in plant activity levels could be observed.

Atibir Industries steel plant, located in Jharkhand, India, operates as an integrated BF plant with a BOF process, producing crude, semi-finished, and finished rolled products with a crude steel capacity of 0.6 million ttpa. This plant has shown consistent growth in activity, reaching 75% in June 2025. While the rise in oil prices noted in “Morning Bid: Oil pops, dollar drops” could indirectly influence operational costs, no direct link can be established between the news articles and this specific plant’s activity.

Given the trade uncertainties and potential supply fluctuations, steel buyers should monitor Bengang Steel Plates Co., Ltd.’s output closely. Procurement professionals relying on Bengang for automotive or pipeline steel should explore alternative suppliers to mitigate potential disruptions. The rise in Jayaswal Neco Industries Raipur steel plant activity could provide a sourcing alternative, but buyers should carefully evaluate product specifications and quality to ensure compatibility.