From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Export Growth Signals Opportunity Amidst Fluctuating Plant Activity

Asia’s steel market displays strong export growth, as highlighted by the news articles “Global steel exports grew by 3.3% y/y in 2024” and “Global steel exports reach 449 million tons: demand is growing,” indicating a recovery in international economic activity. However, satellite-observed activity at key steel plants reveals varied operational trends. No direct link between EU steel import dynamics described in “EUROFER: EU’s finished steel imports decrease in Q1” and Asian steel plant activity changes could be established.

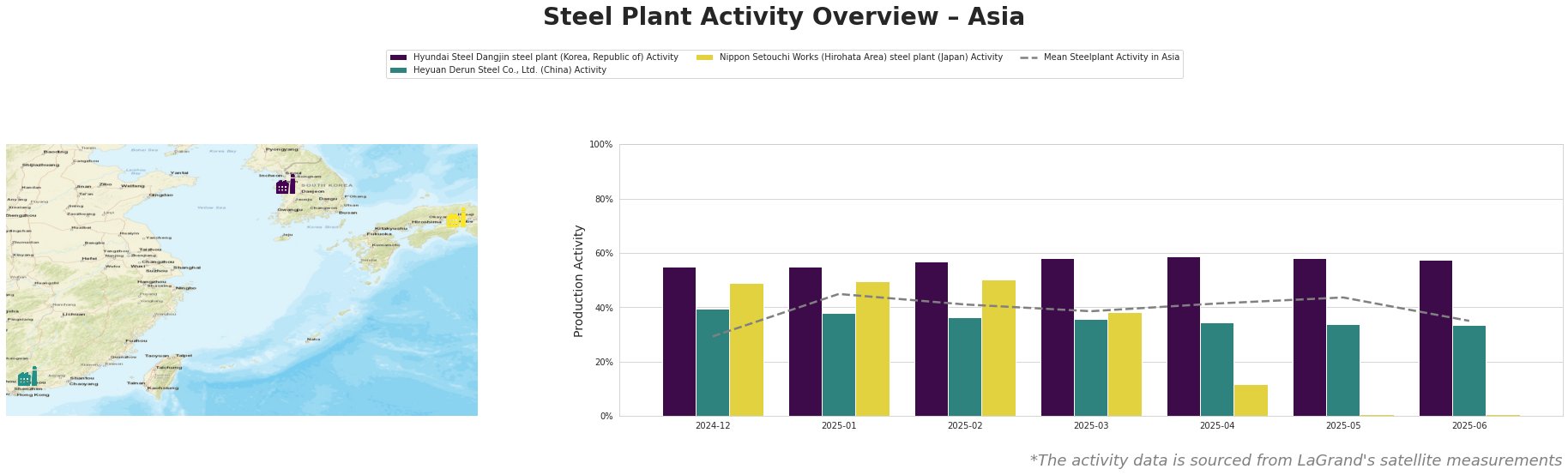

The mean steel plant activity in Asia shows a fluctuating trend, peaking in January 2025 at 45.0 and then decreasing to 35.0 by June 2025. Hyundai Steel Dangjin consistently operates above the Asian mean, maintaining a relatively stable activity level, peaking at 59.0 in April 2025. Heyuan Derun Steel Co., Ltd. shows a slight decline in activity, remaining below the Asian mean. Nippon Setouchi Works experienced a sharp decline in activity from March 2025 onward, plummeting to 1.0 by May and June 2025.

Hyundai Steel Dangjin, an integrated steel plant in South Korea with a crude steel capacity of 16.6 million tons, focuses on both semi-finished and finished rolled products, including hot-rolled sheet and rebar, serving the automotive and construction sectors. Activity levels at Hyundai Steel Dangjin remained consistently high, peaking at 59.0 in April 2025. This stable performance contrasts with the overall fluctuation in Asian steel plant activity. There is no direct connection between this plant’s activity and the provided news articles.

Heyuan Derun Steel Co., Ltd., an EAF-based steel plant in Guangdong, China, with a crude steel capacity of 1.2 million tons, produces finished rolled products such as hot-rolled rebar. The plant’s activity has seen a slight decline from 40.0 in December 2024 to 34.0 by April 2025, remaining consistently below the average Asian activity level. There is no direct correlation established with the news regarding overall export increases in “Global steel exports grew by 3.3% y/y in 2024” or “Global steel exports reach 449 million tons: demand is growing.”

Nippon Setouchi Works (Hirohata Area), a BOF-based steel plant in Japan with a crude steel capacity of 2.816 million tons, primarily produces sheets. A significant drop in activity is observed, decreasing sharply from 49.0 in December 2024 to 1.0 by May 2025. This sharp decline does not align with the general increase in global exports as per the article “Global steel exports grew by 3.3% y/y in 2024“, suggesting possible localized operational or market-specific factors affecting the plant.

The article “Global steel exports grew by 3.3% y/y in 2024” indicates growing demand, suggesting potential opportunities. However, the sharp decline in activity at Nippon Setouchi Works, absent of any news correlation, signals a possible supply disruption in the sheets market, specifically within Japan.

Procurement Actions:

- Steel Buyers: Given the observed sharp decline in activity at Nippon Setouchi Works and its potential impact on the sheet supply, steel buyers who rely on this plant should proactively diversify their supply base to mitigate risks. Consider exploring alternative suppliers in South Korea, leveraging the stable production at Hyundai Steel Dangjin.

- Market Analysts: Closely monitor the reasons behind the production drop at Nippon Setouchi Works. Investigate potential operational issues, maintenance shutdowns, or shifts in market strategy. Any further decline could significantly impact sheet steel availability in the region and beyond.