From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Chinese Exports Surge Amidst Weaker Iron Ore Imports; Indian Production Remains Strong

Asia’s steel market presents a mixed picture, with strong export growth from China contrasting with decreasing iron ore imports across the region. According to the news article “China’s iron ore imports decrease by 5.2 percent in January-May,” Chinese iron ore imports have declined, indicating potential shifts in sourcing strategies or domestic production adjustments. “China increased steel exports by 9.9% y/y in May” highlights the increasing export pressure from China. The provided satellite data cannot be directly linked to these news articles, and therefore the extent of the impact cannot be determined.

Measured Activity Overview:

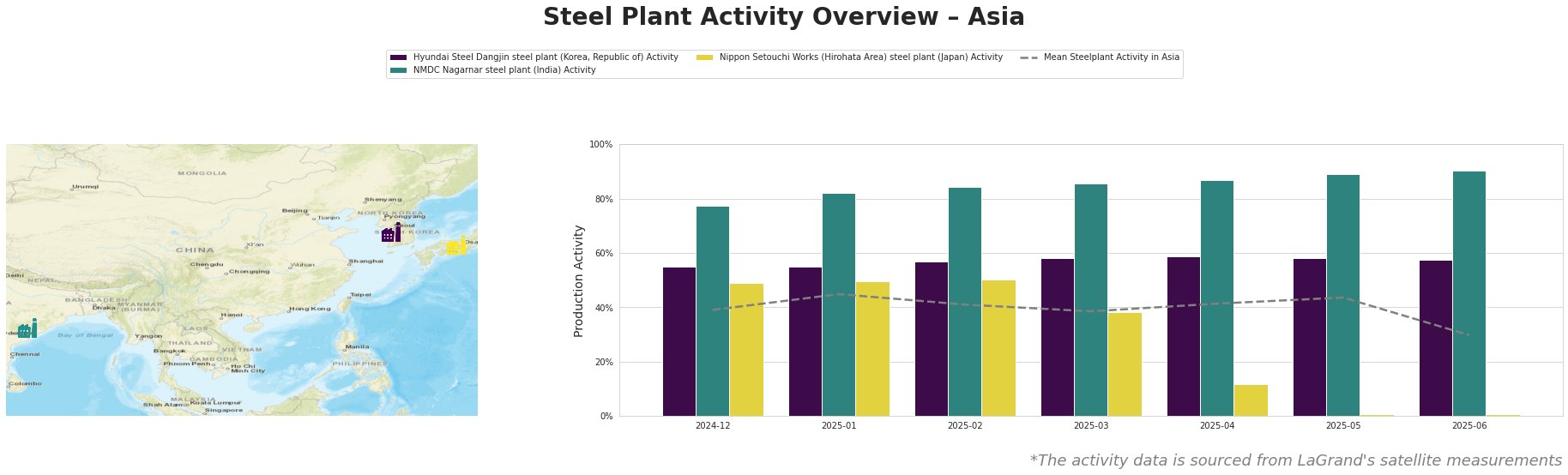

The mean steel plant activity in Asia fluctuated between 39% and 45% from December 2024 to May 2025, before dropping significantly to 30% in June 2025. The NMDC Nagarnar steel plant consistently exhibited the highest activity levels, reaching 90% in June 2025. In contrast, the Nippon Setouchi Works experienced a sharp decline in activity, plummeting to just 1% in May and June 2025.

Hyundai Steel Dangjin steel plant: This integrated steel plant in South Korea, with a capacity of 16.6 million tons of crude steel and a focus on flat products for the automotive and construction sectors, showed relatively stable activity. Activity has steadily increased from 55% at the end of 2024 to 59% in April 2025. However, the plant’s activity decreased slightly to 57% by June 2025. Given the news article “Global steel exports grew by 3.3% y/y in 2024“, the stability of Hyundai Steel’s activity, despite flat steel import declines in Europe reported in “EUROFER: EU’s finished steel imports decrease in Q1,” indicates its focus on regional markets or product specialization.

NMDC Nagarnar steel plant: Located in Chhattisgarh, India, this plant has a 3 million ton crude steel capacity focused on hot-rolled coils, sheets, and plates. Its activity has steadily climbed from 77% in December 2024 to a high of 90% in June 2025, consistently exceeding the Asian average. No direct connection can be established between the strong Indian steel production and the explicitly named news articles, especially those focused on China, Europe, and the US.

Nippon Setouchi Works (Hirohata Area) steel plant: This Japanese plant, with a capacity of 2.8 million tons of crude steel, primarily produces sheets. The activity has collapsed from 49% in December 2024 to just 1% in May and June 2025. There’s no immediate connection between this sharp decline and the provided news articles. The decline could be related to factors not covered in the news, such as maintenance shutdowns, domestic demand shifts, or specific market challenges in Japan.

Evaluated Market Implications:

The significant increase in Chinese steel exports reported in “China increased steel exports by 9.9% y/y in May” combined with decreasing iron ore imports mentioned in “China’s iron ore imports decrease by 5.2 percent in January-May” suggests a potential cost advantage for Chinese steel producers due to factors like government subsidies or access to cheaper iron ore sources (which could be sourced locally instead of imported). This situation could intensify competitive pressure on other Asian steel producers.

Recommended Procurement Actions:

-

For steel buyers: Given the surge in Chinese steel exports and potential price advantages, buyers should actively explore opportunities to diversify their sourcing and consider Chinese suppliers for standard steel grades where quality is assured. Closely monitor price trends for hot-rolled coils, sheets, and plates, as these are key export products for China.

-

For market analysts: Closely monitor the relationship between Chinese steel export volumes, domestic production costs, and iron ore import data. Look for signs of further policy interventions or trade disputes that could impact steel prices and availability in the region. Pay attention to the detailed product mix of Chinese exports, as this will reveal which specific segments are most affected.