From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Vietnam Imports Dip, China Ore Demand Slows, but Activity Holds Steady

Asia’s steel market presents a mixed picture. While “China’s iron ore imports decrease by 5.2 percent in January-May” suggests a potential slowdown in Chinese demand, observed steel plant activity levels in the region have remained relatively stable. “Vietnam’s steel imports down 6.2 percent in May from April” indicates a softening in Vietnamese demand. However, the satellite data shows a less clear effect on the overall steel production.

Here’s a breakdown of recent activity:

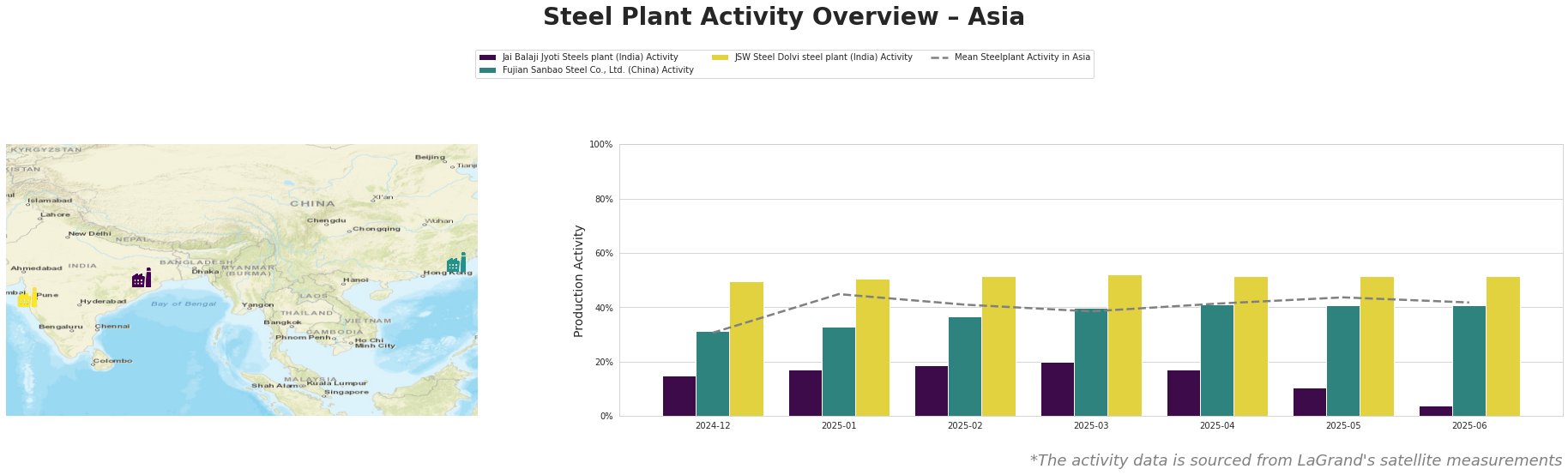

Overall, the mean steel plant activity in Asia has fluctuated, peaking at 45.0 in January 2025 and settling at 42.0 by June 2025. This suggests a degree of resilience despite the negative import figures reported in news articles.

Jai Balaji Jyoti Steels, an EAF-based plant in Odisha, India, producing 92,000 tonnes per annum of crude steel using DRI technology, shows a significant decline in activity, dropping from 17.0 in January 2025 to 4.0 by June 2025. This sharp decrease does not appear to be directly linked to any of the provided news articles, and its cause remains unclear.

Fujian Sanbao Steel Co., Ltd., a BF/BOF-based plant in Fujian, China, with a capacity of 4.62 million tonnes per annum of crude steel, has maintained a consistent activity level, fluctuating narrowly between 31.0 and 41.0 throughout the observed period. Despite “China’s iron ore imports decrease by 5.2 percent in January-May,” this plant’s activity shows no significant impact.

JSW Steel Dolvi, an integrated BF and DRI-based plant in Maharashtra, India, producing 5 million tonnes per annum of crude steel, shows the most stable activity, holding steady at approximately 52.0. This steady performance occurs despite “Vietnam’s steel imports down 6.2 percent in May from April”; there is no clear connection between these events.

Given the significant drop in activity at Jai Balaji Jyoti Steels, procurement professionals should monitor this plant and its suppliers for potential disruptions in the supply of billets, bars, and wire rods. Consider diversifying supply sources for these products in case the reduced activity persists. The steady output at Fujian Sanbao Steel and JSW Steel Dolvi suggests they are reliable suppliers, but it is still important to monitor the overall market trends and news for any potential impacts.