From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Uncertainty Amid US Tariff Volatility and Production Shifts

The Asian steel market confronts increased uncertainty as US tariff policies fluctuate, potentially impacting trade flows. The legal battles surrounding US tariffs, as detailed in “US-Zollpolitik gebremst – Das bedeutetet der Gerichtsentscheid für Trumps Zollpolitik“, “Donald Trumps Zölle plötzlich wieder in Kraft: US-Berufungsgericht hebt Urteil auf“, and “Washington: Hin und Her um Trumps Zölle vor Gericht – was bedeutet das?“, create instability. However, there is no observed direct impact on Asian steel plant activity levels based on the provided satellite data.

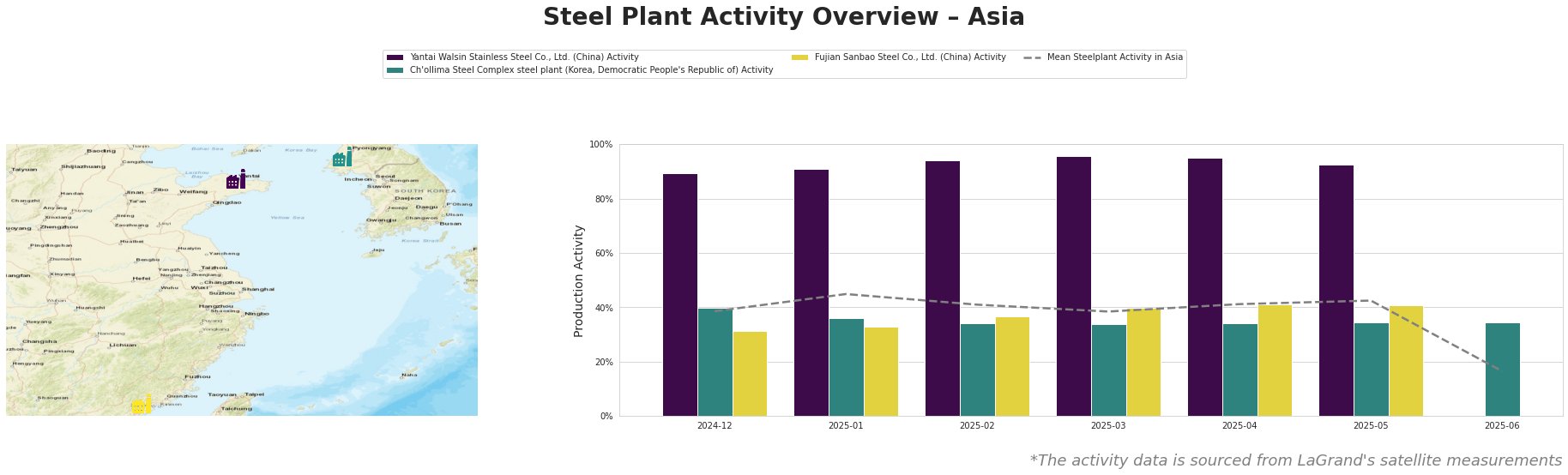

The average steel plant activity in Asia saw a significant drop in June 2025 to 16.0%, following a relatively stable period from December 2024 to May 2025.

Yantai Walsin Stainless Steel Co., Ltd., a Chinese steel plant with a 1,400 TTPA capacity focused on EAF production of stainless steel products, has consistently operated at high activity levels. Its activity remained above 89% from December 2024 to May 2025, peaking at 96% in March 2025. The high activity suggests stable production despite the external uncertainties mentioned in “US-Zollpolitik gebremst – Das bedeutetet der Gerichtsentscheid für Trumps Zollpolitik“. Activity was unmeasured in June 2025. No direct link between the news articles and activity levels can be established.

The Ch’ollima Steel Complex in North Korea, with a 760 TTPA capacity, maintained relatively stable activity, fluctuating between 34% and 40% from December 2024 to May 2025. The activity was last measured at 35% in June 2025. Its levels consistently remained below the average steel plant activity across Asia. No direct connection between the news articles on US tariffs and the plant’s activity could be established.

Fujian Sanbao Steel Co., Ltd., an integrated steel plant in China with a 4,620 TTPA capacity using both BF and BOF processes, exhibited a gradual increase in activity from 31% in December 2024 to 41% in April and May 2025. The activity was unmeasured in June 2025. This increase occurred while US tariff policies faced legal challenges as described in “Wie geht es nach dem vorläufigen Urteil zu Trumps Zöllen weiter?“. There is no discernible connection between the US tariff news and the observed plant activity.

Given the increased volatility due to US tariff policy uncertainty, as emphasized in “Wie geht es nach dem vorläufigen Urteil zu Trumps Zöllen weiter?“, and the significant drop in average Asian steel plant activity in June 2025, steel buyers should:

- Closely monitor the US Supreme Court’s potential involvement in the tariff disputes. As highlighted in “US-Zollpolitik gebremst – Das bedeutetet der Gerichtsentscheid für Trumps Zollpolitik“, the legal landscape remains dynamic.

- Prioritize suppliers with stable production, such as Yantai Walsin Stainless Steel, to mitigate potential supply disruptions.

- Assess inventory levels and consider short-term hedging strategies to buffer against potential price fluctuations arising from trade policy shifts.

- Contact Fujian Sanbao Steel to confirm it’s sudden lack of reported data.