From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Strengthens: Production Rises in Spain, Poland, and Italy Despite Import Surge and Austrian Downturn

Europe’s steel market presents a mixed landscape. Rising production in key regions contrasts with import dynamics and challenges in Austria. Specifically, Spain, Poland, and Italy are showing positive production trends, as reported in “Spain increased steel production by 6.1% y/y in January-April“, “Poland increased steel production by 3.9% y/y in January-April” and “Steel production in Italy continues to grow“, respectively. These positive trends occur despite, and in contrast to “Austria reduced steel production by 6% y/y in January-April” due to high production costs, and occur despite a surge in Ukrainian imports driven by “Ukraine increased imports of long products by 81.1% y/y in January-April“, and a wider decline in overall EU steel production. No direct connection could be established between these news articles and the activity of the individual steel plants.

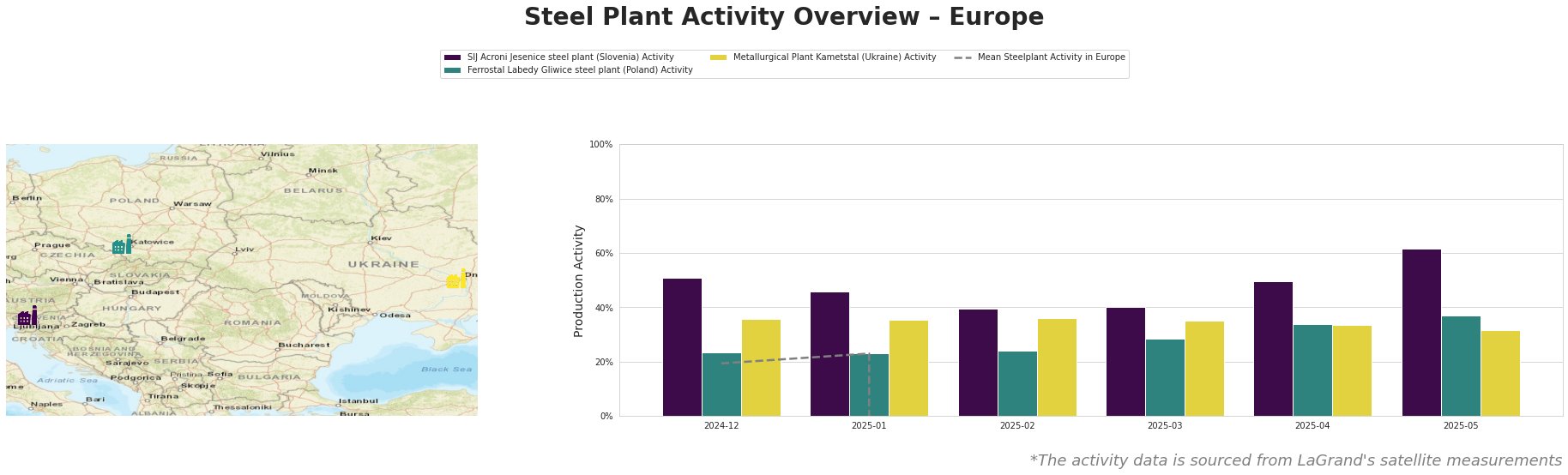

Note: The mean steel plant activity data includes outliers, which causes these negative mean activity values. Use with caution.

The SIJ Acroni Jesenice steel plant in Slovenia, an electric arc furnace (EAF) facility with a crude steel capacity of 726,000 tonnes, has shown a consistently high activity level relative to the European average. The satellite data reveals a steady increase in activity from 51.0% in December 2024 to a peak of 62.0% in May 2025. This suggests robust operational performance. No direct connection could be established between these observed trends and any of the provided news articles.

The Ferrostal Labedy Gliwice steel plant in Poland, an EAF facility with a 500,000 tonnes crude steel capacity, produces ingots and hot-rolled products. Its activity levels have been consistently below the Slovenian plant. Satellite data shows a gradual increase in activity from 23.0% in December 2024 and January 2025 to 37.0% in May 2025. This increase in activity at Ferrostal Labedy Gliwice is in line with the “Poland increased steel production by 3.9% y/y in January-April” article, suggesting a possible contribution to the nation’s overall production increase, possibly from the full capacity restart of Huta Częstochowa.

The Metallurgical Plant Kametstal in Ukraine, an integrated (BF/BOF) steel plant with a crude steel capacity of 4.2 million tonnes, shows a moderately high activity level. Its activity has decreased in recent months, from 36.0% in December 2024 to 32.0% in May 2025. While overall Ukrainian industrial production is down (“Industrial production in Ukraine fell by 6.1% y/y in January-April“), metallurgy and finished steel product production increased. The observed decrease in activity at the Kametstal plant does not align directly with the increase in the metallurgy sector reported in the article, nor does it directly reflect the surge in long product imports (“Ukraine increased imports of long products by 81.1% y/y in January-April“).

Based on the news and satellite data:

-

Supply Disruptions: The decrease in activity at Metallurgical Plant Kametstal, combined with increased Ukrainian imports of long products and general decrease in industrial production in Ukraine, suggests potential supply chain vulnerabilities for long products sourced from Ukraine. Increased production costs in Austria may limit availability of specific high-quality steels from Voestalpine.

-

Procurement Actions:

- Diversify Sourcing for Long Products: Steel buyers who rely on Ukrainian sources for long products should proactively diversify their supply base, particularly considering the “Ukraine increased imports of long products by 81.1% y/y in January-April” news, which indicates a shift in the Ukrainian steel market. Turkish suppliers may be a viable alternative, given their dominant position in Ukrainian imports.

- Monitor Austrian Steel Prices: Given the challenges faced by Austrian steelmakers (“Austria reduced steel production by 6% y/y in January-April“), closely monitor pricing trends for Austrian steel products and consider securing contracts where favorable, but be aware of potential production cuts and ensure alternative suppliers are available.

- Strengthen Relationships with Polish Suppliers: The increase in steel production in Poland, as mentioned in “Poland increased steel production by 3.9% y/y in January-April” and the increased activity at Ferrostal Labedy Gliwice steel plant indicates strengthening domestic supply. Consider strengthening relationships with Polish steel suppliers.

- Focus on Spanish and Italian Markets: Consider markets such as Spain and Italy due to their current growth trends in steel production, as indicated in “Spain increased steel production by 6.1% y/y in January-April” and “Steel production in Italy continues to grow.”