From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineTrump’s Tariff U-Turn: North American Steel Market Braces for Disruption

The North American steel market faces heightened uncertainty following legal challenges to existing tariffs and potential increases, impacting supply and pricing. This report links plant activity to news events to offer insights for steel buyers and analysts. Recent court decisions regarding tariffs imposed by former President Trump, as detailed in “US-Gericht erklärt fast alle Zölle Trumps für rechtswidrig,” “Knallhart‑Urteil gegen Trump: Gesetz für Zölle missbraucht! So reagieren die US‑Börsen,” “Berufungsgericht setzt Trumps Zölle wieder in Kraft,” and “Trumps US-Zölle im FAZ-Liveticker: Berufungsgericht in den USA hebt Stopp für Trumps Zölle wieder auf | FAZ,” create volatility. Further instability stems from the potential doubling of tariffs, as reported in “Trump says he will double steel tariffs to 50 percent,” impacting trade flows and potentially increasing input costs for steel manufacturers. While “Trump Says He’s Supporting Nippon Steel-U.S. Steel ‘Partnership’” suggests support for the Nippon Steel-U.S. Steel deal, uncertainty remains regarding trade policies.

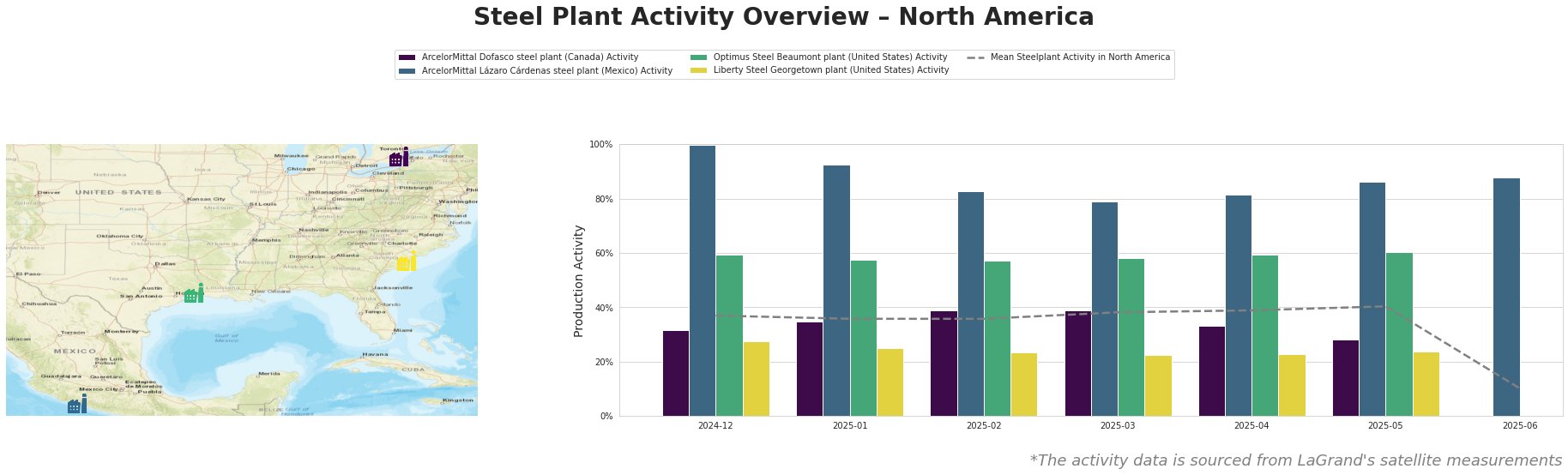

Across North America, the mean steel plant activity saw a steady increase from 37% in December 2024 to 40% in May 2025, before experiencing a sharp drop to 10% in June 2025.

ArcelorMittal Dofasco, an integrated steel plant in Canada, shows fluctuating activity levels. Starting at 32% in December 2024, it peaked at 39% in February and March 2025, before decreasing to 28% by May 2025, and is missing data in June 2025. Given the lack of directly related news articles about ArcelorMittal Dofasco, establishing a cause for this drop based on provided data is impossible.

The ArcelorMittal Lázaro Cárdenas steel plant in Mexico, primarily utilizing DRI and EAF technology, operated at near full capacity (100%) in December 2024, then gradually declined to 79% in March 2025, before rebounding to 86% in May 2025 and 88% in June 2025. This plant consistently outperformed the North American average. No direct connection to news articles could be established.

Optimus Steel Beaumont plant in the United States shows relatively stable activity, ranging from 57% to 60% between January and May 2025. No data is available for June 2025. No direct connection to news articles could be established.

The Liberty Steel Georgetown plant in the United States exhibited the lowest activity levels among the observed plants. Activity remained relatively consistent at around 22-27% between December 2024 and May 2025. No data is available for June 2025. No direct connection to news articles could be established.

The recent volatility in trade policy, compounded by Trump’s stated intention in “Trump says he will double steel tariffs to 50 percent” to significantly increase tariffs, introduces substantial risk of supply disruption and price increases. Specifically, the potential doubling of tariffs impacts the competitiveness of imported steel, potentially increasing costs for manufacturers relying on imported steel, and straining trade relations, particularly with North American countries.

Evaluated Market Implications:

The ArcelorMittal Dofasco steel plant shows a significant decrease in activity in May and is missing data in June. This may indicate a supply issue. However, without more data, it’s impossible to determine the cause. Procurement managers who rely on product from the ArcelorMittal Dofasco steel plant are advised to look for alternative suppliers.

Recommended Procurement Actions:

- Diversify supply base: Given the potential for increased tariffs and supply disruptions, steel buyers should actively diversify their supply base to include domestic and non-tariff-affected international sources.

- Negotiate contracts with price flexibility: Secure contracts that allow for price adjustments based on tariff changes to mitigate risk.

- Monitor legal and policy developments: Closely track court decisions and policy announcements related to trade to anticipate market shifts.

- Assess inventory levels: Evaluate current inventory levels and consider increasing them strategically to buffer against potential supply disruptions.

- Evaluate alternative materials: Investigate the feasibility of using alternative materials where possible to reduce reliance on steel.