From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: Weak Demand and Price Pressures Persist Amid Stable Plant Activity

Asia’s steel market faces continued headwinds due to weak demand and persistent price pressures, particularly impacting the European market. Key factors include Russian dumping, fluctuating HRC prices, and the potential impact of the upcoming carbon border adjustment mechanism. The “Slab prices in Europe fell by $10-20/t in May” and “The European HRC market is fluctuating amid domestic price pressures” articles highlight these challenges. No direct link between these articles and the satellite-observed plant activity can be established.

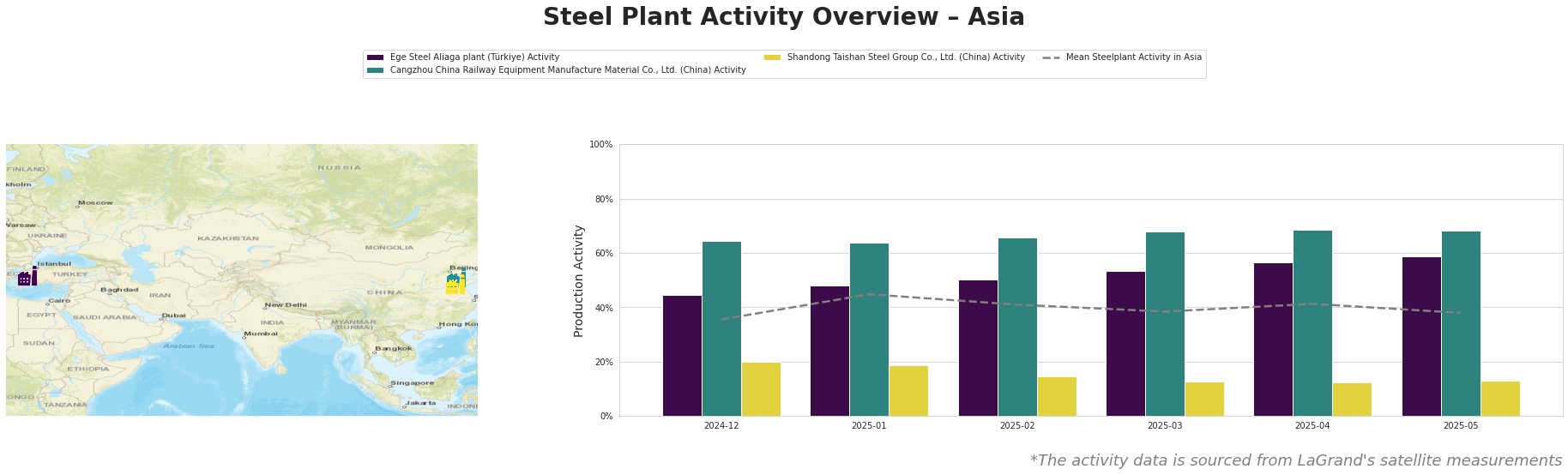

Overall, the mean steel plant activity in Asia has fluctuated, peaking at 45% in January 2025 and then trending downwards to 38% in March 2025 and then bouncing back to 41% in April, before trending downwards again to 38% in May 2025.

Ege Steel Aliaga plant: This Turkish plant, with a 2 million tonne EAF-based capacity focusing on rebar and wire rod, saw a steady increase in activity from 44% in December 2024 to 59% in May 2025. The “Longs suppliers in Romania keep offers stable, local demand still limited” article indicates weak demand in Romania, where Turkish rebar is offered. While Ege Steel’s activity has increased, Romanian traders show minimal interest in Turkish imports. It is important to note, however, that the market reported in this article, whilst proximate, is not the direct sales market for this plant.

Cangzhou China Railway Equipment Manufacture Material Co., Ltd.: This integrated BF/BOF steel plant in Hebei, China, producing primarily hot-rolled coils, maintained a consistently high activity level, fluctuating narrowly between 64% and 68% from December 2024 to May 2025. No direct relationship to the provided news articles can be established.

Shandong Taishan Steel Group Co., Ltd.: This Chinese plant, utilizing both BF/BOF and EAF processes with a capacity of 5 million tonnes of crude steel, experienced fluctuating low activity. Starting at 20% in December 2024 and trending downward to 12% by April 2025, the plant then increased production marginally to 13% in May 2025. This activity is significantly lower than the average for Asian steel plants. No direct relationship to the provided news articles can be established.

Evaluated Market Implications:

The European HRC market is under pressure from imports, particularly from Indonesia, as reported in “The European HRC market is fluctuating amid domestic price pressures”. Given the weak European demand and the pressure from Indonesian imports, as well as the increase in activity at the Ege Steel Aliaga plant, steel buyers should:

- For buyers in Southern Europe: Closely monitor import offers from Turkey, especially for rebar and wire rod. Negotiate aggressively, leveraging the information about weak Romanian demand and potential oversupply.

- For buyers in Northern Europe: Review current HRC purchasing strategies, considering both domestic and import prices. Given the Carbon Border Adjustment Mechanism (CBAM) deadline, prioritize suppliers with lower carbon intensity to avoid potential future tariffs.